[ad_1]

The European Fintech Tech has collected $ 800 million at a very attractive discount.

Clair, who lives in Sweden and is known as a “buy now, pay later” service provider, has been rumored to be looking for new money at least since last month. Preliminary reports indicate that this is in the $ 15 billion range, a significant drop from $ 45.6 billion a year ago. Then earlier this month, clues indicated that the estimate could be close to $ 6.5 billion – and as things have happened, the amount is very good.

Clarna estimates that behind the new investment is $ 6.7 billion, down 85% on June 2021.

The tour included new and existing investors, including Sequoia, Silver Lake, Commonwealth of Australia Bank, United Arab Emirates Sovereign Fund Mubadala Investment Company and Canadian Pension Investment Board (CPP Investments).

Positive rotation

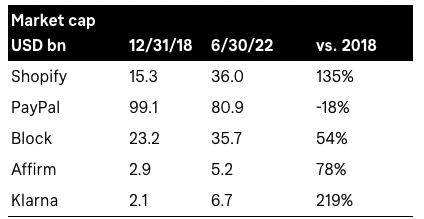

He wants to put something on the ad, Clalar highlights the “worst fall in 50 years” in his press release, and tries to paint a better picture of what today’s review looks like in 2018 – and makes good use of it. – Well-known publicly traded Fintex for comparison. It’s no wonder that Clare and I look so beautiful in this hand-picked database.

Clarity and review comparisons from 2018. Image thanks Clalarna

While the hypothesis here may take a short-term view, Clare and his guess may have fallen off the cliff, but he is not doing very well on the big plan – the big picture is really important, right?

But while many companies have found a “correction” following the epidemic of insanity, it is worth looking at Clalarna’s reviews from each year between 2018 and 2022 for a little more insight into things. A.D. In 2019, Clare was valued at $ 5.5 billion, then $ 10.6 billion in 2020, and $ 31 billion in March 2021, just a few months before hitting a record high of $ 45.6 billion.

So Clarena has not yet dropped from the previous review, it is still significantly lower in value in 2020, and only slightly increased in the 2019 review. But hey, compared to 2018, things are very good.

All that, maybe. Something To Clare and the whirlwind. His estimation is a reflection of what investors think and what they don’t think. It is a must. Reflect what customers think, and it is far from the only company to deal with such a review failure. About a year and a half after the big IPO, Clare and Rival also endured turbulent times, with shares declining last year – and now valued at the same rate as Clarina after the market. Last year, it reached a maximum of $ 47 billion.

Seoul’s partner, Michael Moritz, said Clarena’s estimate was “the way investors have suddenly voted in the past.”

In a statement, Moritz said: “It is remarkable that Clarna’s business, its position in various markets and its popularity among consumers and traders have been stronger than ever since Sekoya invested in 2010. “Finally, after investors withdraw their funds, the shares of Clarina and other primary companies will receive due attention.”

[ad_2]

Source link