[ad_1]

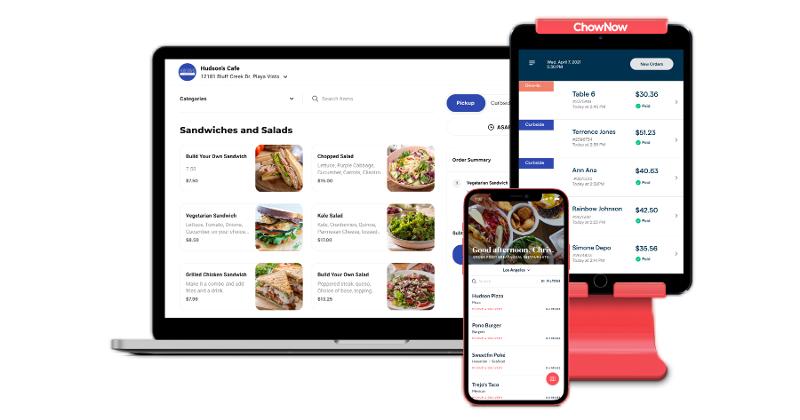

ChowNow provides an online ordering system for independent restaurants. / Photo courtesy of ChowNow

Chris Webb, co-founder and CEO of online ordering provider ChowNow, has laid off 20% of his workforce in what he likens to a storm in the financial markets.

He said the reduction would allow the company to continue operations for two years with the cash it currently has on hand. As inflation rises to levels not seen since the 1980s, and interest rates are poised to follow suit, ChowNow and other tech companies are encouraging capital markets to slow down.

“We’ve benefited from cheap capital for a decade, just like everyone else,” he said. If we go from 0% interest rates to 10% interest rates like in the 1980s, suddenly capital becomes very expensive.

After years of rapid growth, he says, “Now we’re saying, ‘Shoot, let’s make sure we don’t overspend.'” “Looks like this storm is about to hit.”

The Los Angeles-based company is the latest restaurant technology provider to cut jobs in recent weeks, joining Nextbite, Sunday, Reef and others. It’s part of a broader decline in the tech sector as the country moves out of the pandemic and into a deep recession.

But the Web is different from past economic crises, like the onset of a pandemic or the housing market crash, in that the impact on businesses is immediate and tangible. Despite the layoffs, ChowNow says it’s doing very well.

“We had our best sales month of the entire month last month. We had a few restaurant customers in June,” he said. “It’s not like our business is slowing down, and that’s true of most businesses right now.”

Public restaurant tech companies such as Toast and DoorDash have pointed to the upside as they report record earnings despite their shares falling to all-time lows.

Those public stocks were a sort of “canary in the coal mine” for ChowNow. “I think everybody understands that the cost of capital is going to be much higher and higher, and that’s what scares a lot of people,” Webb said.

ChowNow offers an online ordering system for independent restaurants as well as a commission-free marketplace where customers can explore local takeout options. Before the layoffs, it had about 500 employees.

The tech company is far from the only one facing rising inflation and interest rates that have made investors more judgmental about how they deploy capital.

“The downturn in the market means that, unfortunately, like many other companies, we have to be more mindful of costs as we head into a lingering recession,” Alex Kanter, Nextbite’s CEO and founder, wrote in a LinkedIn post on Tuesday. The virtual brands company laid off an undisclosed number of employees this week after cutting its workforce by about 10 percent at the start of the year. The headcount rose to more than 300 last year on the back of a $120 million investment led by SoftBank.

On Sunday, a company that provides QR code-based payment technology to restaurants is said to be going out of business and withdrawing from some markets. With $124 million in venture capital, it was booming. The company did not respond to a request for comment as of press time.

Technology cuts are accelerating as market conditions worsen. as one Analysis by CrunchBaseAt least 143 companies have laid off more than 24,000 people this year, with at least 75 starting the cuts in June.

No company seems to be immune. Earlier this week, tech titan Microsoft laid off 1% of its workforce, citing restructuring.

Webb says ChowNow’s decision to reduce its workforce will allow it to survive the “worst case scenario.”

“Let’s plan for the storm to last for two years,” he said. If it’s not that bad, we’ll try to hire a lot of people that we’ve unfortunately let go this week.

Members help our journalism succeed. Become a Restaurant Business member today and unlock exclusive benefits, including unlimited access to all of our content. Register here.

[ad_2]

Source link