[ad_1]

Take and change

Beware of the silent ones. Election in 2010 It did not do any US national TV advertising in 2021 and Virgin Voyages was absent for seven months last year. However, both brands rose to leadership status in 2022.

Dennis the Jackal

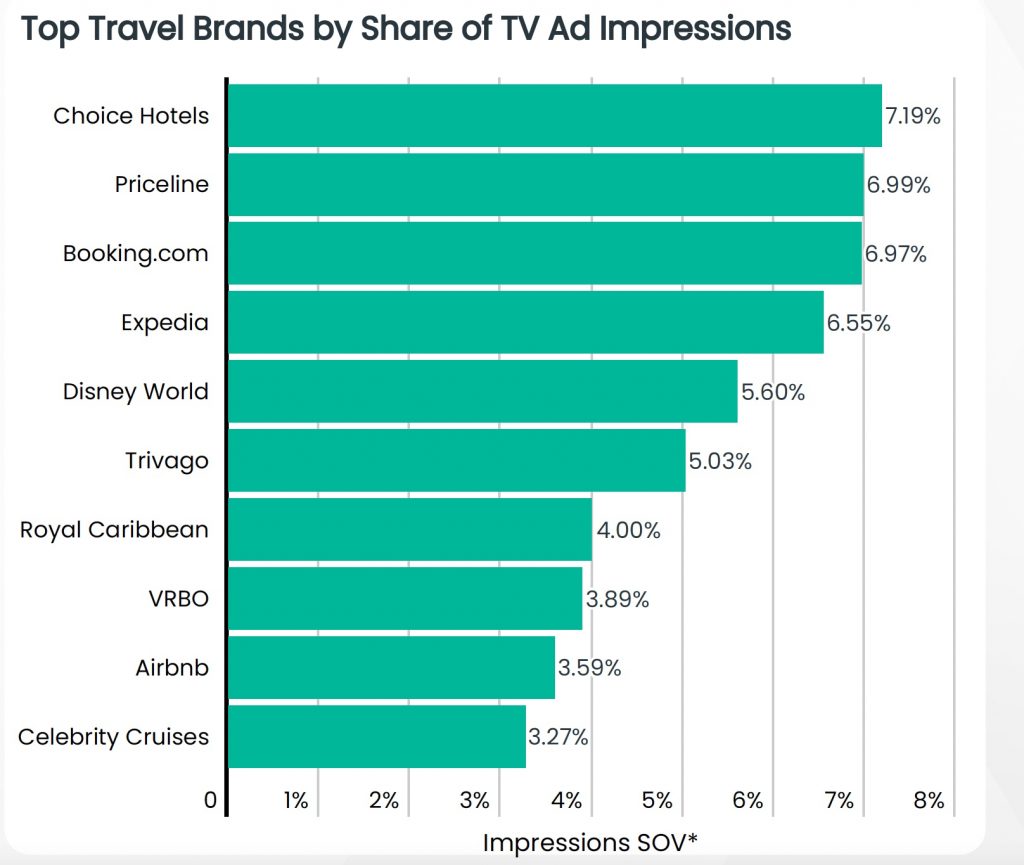

In the year You couldn’t find national TV advertising for Choice Hotels in the U.S. for all of 2021 and the first three-and-a-half months of 2022, but the Maryland-based franchisor surpassed all travel brands — not just hotels — to capture the top share of voice for the first seven months of the year.

That’s the word from TV measurement and analytics firm iSpot.tv, which says Choice Hotels Travel Brands commands a 7.19 percent share of voice in TV ads.

Rounding out the polls, according to iSpot.TV, were Connecticut-based online travel agency Priceline (6.99 percent) and Amsterdam-headquartered sister company Booking.com (6.97 percent).

From January 1 to July 31, travel industry TV and impressions increased 61.1 percent year over year, while national TV advertising more than doubled. [130.3 percent] About $608.6 million,” says iSpot.tv.

In the year Here are the top 10 travel brands most viewed on U.S. national TV in the first seven months of 2022, measured by viewership, according to iSpot.tv.

Here are iSpot.tv’s estimates of travel ad spending among the top 10 travel brands as measured by TV ads in the first seven months of 2022:

- Choice Hotels: $23.0 million

- Price: 22.5 million dollars

- Booking.com: 39.9 million dollars

- Expedia: $48.1 million

- Disney World: $27.9 million (this is media value because Disney is not paying full price on the networks).

- Trivago: $19.0 million

- Royal Caribbean: $41.3 million

- Vrbo: $31.1 million

- Airbnb: $52.0 million

- Celebrity Cruises: $11.6 million

As you can see, iSpot.tv estimated that Airbnb was the top spender out of 10 at $52 million, but ranked ninth in terms of awareness in the first seven months of 2022.

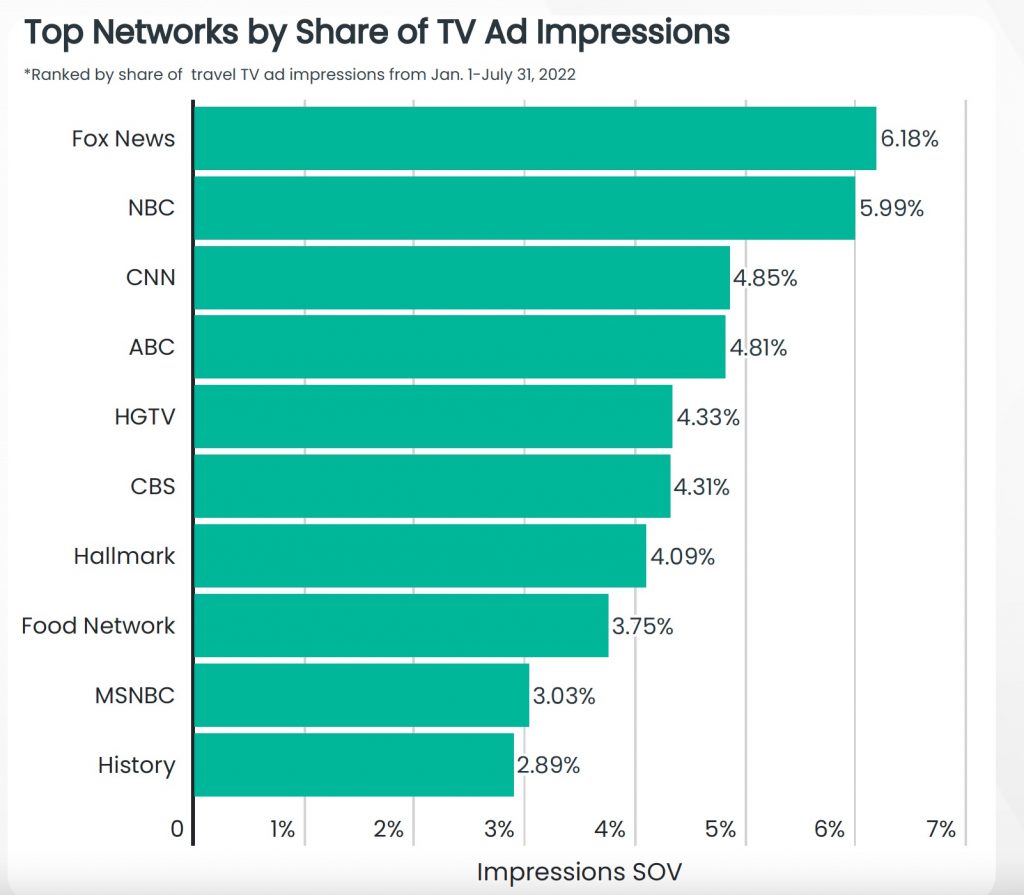

“Advertisers take different approaches to TV depending on their goals and the programmatic value they want to focus on, so ad impressions and spend don’t always match,” said Tyler Bobin, senior analyst at iSpot.TV. “For example, a large portion of Airbnb is during premium programming, with the top programs being men’s college basketball (6.79 percent of ad impressions), NFL (4.7 percent), NBA (4.6 percent); American Idol (2.9 percent) this is us (2.4 percent) and Bachelor (2.3 percent)

Major broadcast networks sometimes air these programs in prime time and come at a higher cost, Bobin said, but the goal is to “reach a large, engaged audience that is less likely to be interrupted by advertising.”

Polling had the highest share of voice among travel brands in the first seven months of the year, with its “Always a Reason to Book” ad accounting for 47.7 percent of Polling TV advertising as of April 20, when Polling entered the ad with the first U.S. national TV ad from 2020 through July 31, 2022.

Among those to emerge in the first seven months of 2022 are online travel websites and cruise lines.

Booking Holdings’ brands, Priceline (18.3 percent) and Booking.com (18.25 percent), essentially a dead heat, dominated national TV ad impressions in the U.S. in the first seven months of 2022 in the online travel agency sector. According to iSpot.tv estimates. Booking Holdings views Booking.com as a leading brand, and has been working hard for several years to increase its share of US travel bookings.

Booking.com focused on prime-time airtime, which accounted for one-third (31 percent) of all ad impressions at the time, according to iSpot.tv.

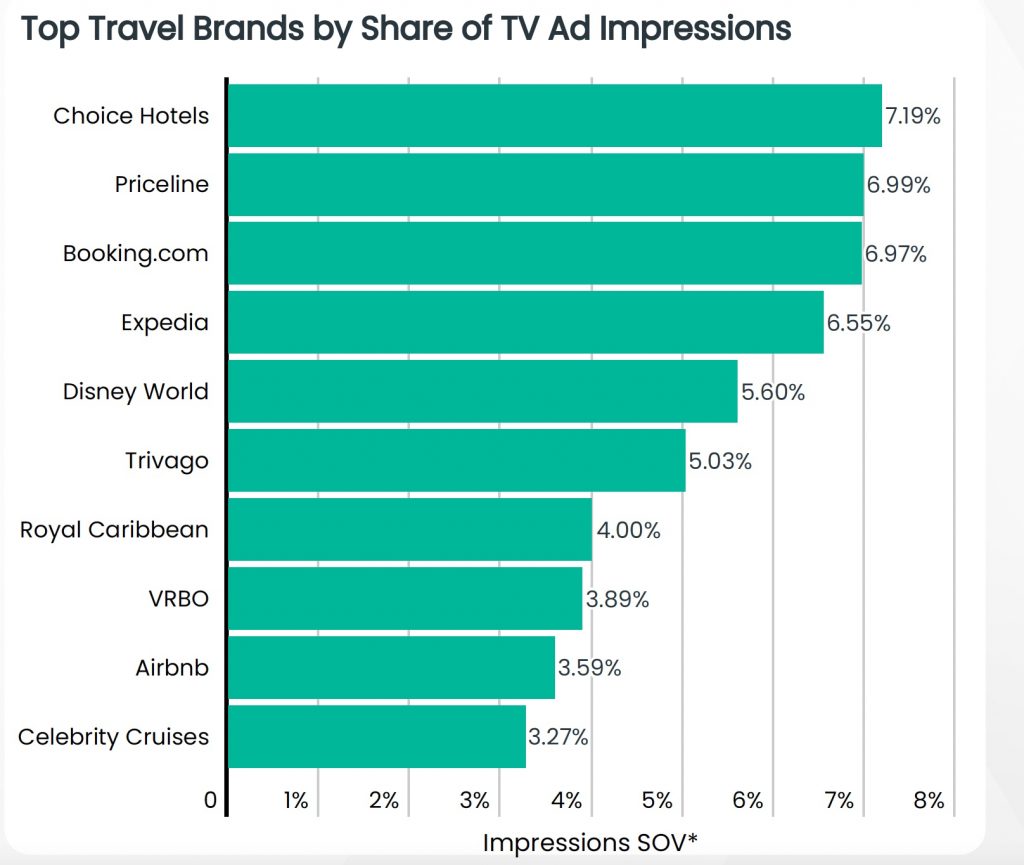

Overall, among travel industry advertisers in the US, Fox News (6.18 percent) accounted for the largest share of TV ad impressions, followed by NBC (5.99 percent) and CNN (4.85 percent).

National Basketball Association (1.44 percent), National Football League (1.37 percent) and TV series Friends (1.36 percent) were the top three programs measured by TV advertising in the first seven months of 2022, according to iSpot.TV.

In the year Cruise lines are ramping up TV advertising in the first seven months of 2022 if they’re not sailing in 2020 when the pandemic strikes, though spending has been particularly heavy in the first three months. Royal Caribbean (24.98 percent), Celebrity Cruises (20.46 percent) and Virgin Cruises (15.93 percent) were the leaders in US national TV ad impressions from Jan. 1 to July 31, 2002, iSpot.tv found.

Like Choice Hotels, Virgin Voyages ran no U.S. national television ads in the first seven months of 2021, but from Jan. 1 to July 31, 2022, it snagged the number three ad impressions, the most airtime of any cruise line. Virgin Voyages focuses on cable networks, which account for almost all (97.1 percent) of ad impressions.

Among airlines, Southwest (41.76 percent) and Delta Air Lines (32.54 percent) were the top two generators of ad impressions in the first seven months of 2022, iSpot.TV estimates, and Turkish Airlines was a distant third (5.17 percent). .

Turkish Airlines focused its ads on air during sports programming — with more than half of its ad impressions during the Feb. 13 Super Bowl in both English and Spanish-language broadcasts.

Southwestern’s US national television advertising is focused on syndicated programming rather than new shows and events, according to iSpot.TV.

Most admired ads

In the first seven months of the year, the most popular US national television commercials from travel companies, such as Ace Metrics creative review surveys, Walt Disney World’s “Feel the Magic”, Royal Caribbean’s Vacation – Year of Yes, and Shoe 40 Years Celebration – Drinks.

[ad_2]

Source link