[ad_1]

courtneyk

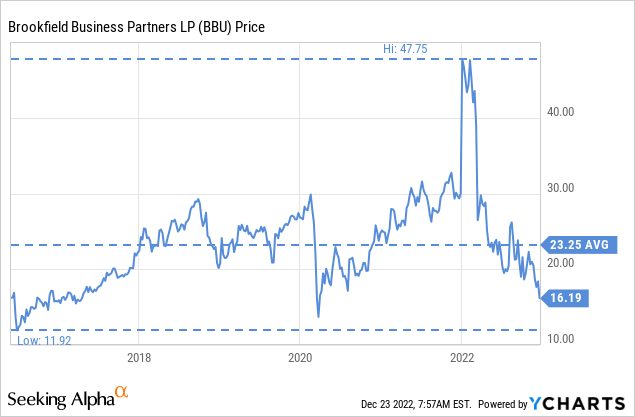

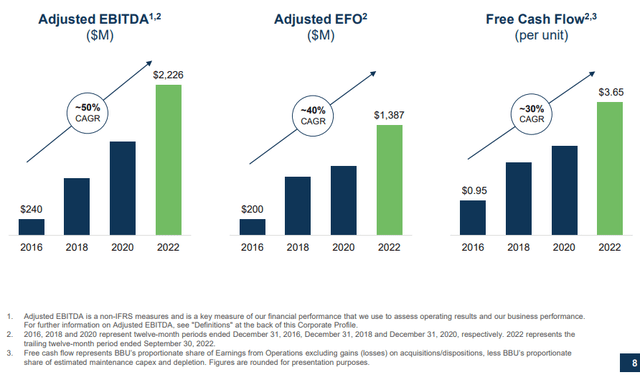

We were surprised at how low Brookfield’s business partner rates are (NYSE:BBU) got parts. While the company operates in a challenging environment, it has made significant progress in growth over the past five years. EBITDA from the group of businesses, and free cash flow per share are significantly higher. Of course, rising inflation and interest rates are big investor concerns, but those headwinds seem manageable and more than discounted at these rates.

Inflation remains a concern during the last earnings call, the company reported. For example, most of their shipping cost structures, including raw materials, transportation, logistics, labor, and energy, remain high and above pre-Covid levels. The good news is that many of these areas are seeing a return to the trend line over time. The company has done a good job of raising prices to recover from inflation and maintain margins.

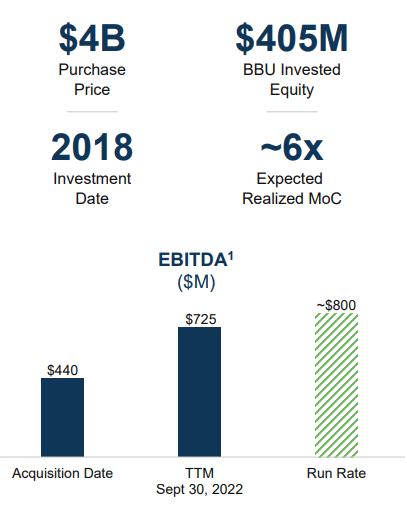

One of the company’s biggest wins came in October, when the company reached an agreement to sell Westinghouse to a strategic alliance led by Cameco Corporation ( CCJ ) and Brookfield Renewable Partners ( BEP ) for $8 billion. This is expected to bring net proceeds to BBU of approximately $1.8 billion and a 6-fold multiple on investment when combined with all distributions the company has received to date. The company expects to close the sale in the second half of next year.

BBU investor presentation

A large part of BBU’s investment theory revolves around improving business performance and EBITDA. Income growth is typically not a big part of the equation. Based on EBITDA growth, we say that the company is doing well overall, although not all of its investments have been widely successful. Importantly, on average, EBITDA continues to grow, and especially free cash flow per share.

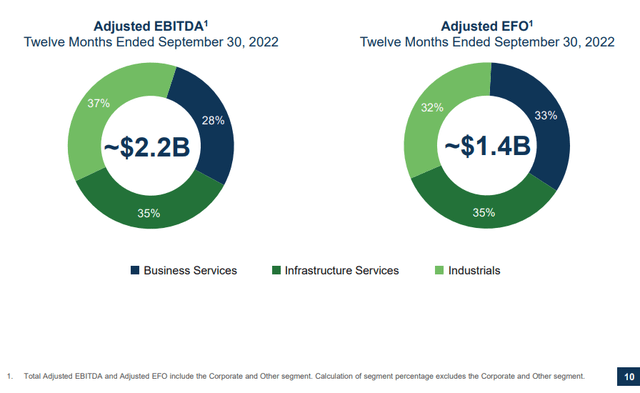

Entering a recession-prone environment, the company is focused on not losing at least some market share, but products or services may still experience a decline in orders. Adjusted EBITDA is a good balance between business services, infrastructure services and industrials to mitigate this risk. For investors who want to learn more about the company’s various businesses, we recommend reading our article sharing the highlights of BBU’s Investor Day.

BBU investor presentation

Q3 2022 results

BBU reported strong financial results in the third quarter, with adjusted EBITDA rising to $627 million from $443 million last year. The company ended the quarter with pro forma corporate liquidity of $2.8 billion. This takes into account recently closed acquisitions and the proposed syndication from the sale of Westinghouse Investments.

balance sheet

A major concern for BBU investors is the balance sheet, especially given the rising price environment. While we believe the debt burden is currently manageable for the company, especially since most of it is non-performing, we would be more comfortable if the weighted average maturity were longer and the percentage of fixed loans was higher. The company currently has a weighted average debt maturity of 4.5 years, with the majority of non-performing loans held at the corporate level. The company says it uses an appropriate level of leverage, focusing on service and sustainability. About 40% of non-performing loans are fixed or fixed, with an average cost of ownership of 6.3%. As the debt is refinanced, we expect the average cost of borrowing to rise in the current environment.

Use

During the last earnings call, an analyst asked about the company’s strategy to reduce profits. The answer was that debt to EBITDA should come down over time with improved earnings. CFO Jaspreet Dehl further elaborated on how the company thinks about its benefits in the business. A particularly interesting data point shared was that the company estimated interest rates to increase by 75 basis points on revenue of ~$65 million.

So when we think about the benefits in the business, we think about it from the perspective of each operating company, and each business is different. There are some businesses where we always operate at a very low leverage level given the basic profile of the business and there are other more stable, contracted, in some cases inflation-linked businesses. Ability to service high debt. We have been closely monitoring the impact of interest rates on debt servicing in each of our portfolio companies. The business is generating a lot of free cash flow today, so it gives us a lot of flexibility to manage that as it comes. And based on the current profile and our debt, the impact of about 75 basis points is about $60 million, $65 million is the impact on EFO, and the run rate is a very small percentage. So we think the portfolio is well structured to manage well. There will be some businesses that come in to refinance that we will have to deal with, but we are not concerned at this point, that is not manageable.

Price

While rate hikes, inflation and inflation are valid investor concerns, we believe the outlook is bearish for these issues and more. According to the company, they generated ~$800 million in free cash flow over the past twelve months. This is after interest, taxes, necessary maintenance CapEx and depreciation. As a result, at current prices, shares are trading at 5 times higher free cash flow. That’s extremely cheap, and the main reason we believe parts will do well next year, especially in 2023 when it becomes clearer when the Fed will end its discretionary hiking campaign.

BBU investor presentation

Accidents

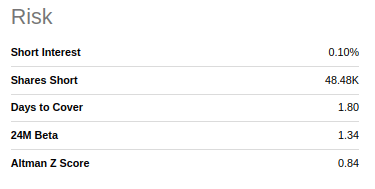

As we have already discussed, the main risk to investing in BBU is balance sheet and high leverage. While it seems manageable at the moment, this could change quickly if the economy deteriorates significantly. This is reflected in a low Altman Z-score below the 3.0 threshold.

Seeking Alpha

Summary

We believe BBU is a top pick for 2023 given how cheap the units have gotten. Trading at ~5x free cash flow, there is plenty of upside potential. A boost to the valuation recovery will come when the Fed signals the end of its interest rate hiking campaign. We believe this should happen sometime next year. In other words, while inflation, deflation and a weak balance sheet are concerns, the BBU’s valuation is extremely low and could recover quickly once investors are convinced the Fed has finished raising rates.

Editor’s note: This article is featured as part of the Search for Alpha’s Best 2023 Pick competition, which runs through December 25. This contest is open to all users and contributors. Click here Learn more and submit your article today!

Editor’s Note: This article discusses one or more securities that are not traded on a major US exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Source link