[ad_1]

The electric vehicle and storage manufacturer shared insights about its MegaPak energy storage business and MegaPak XL, a stationary battery storage product that Tesla claims has the highest energy density on the market.

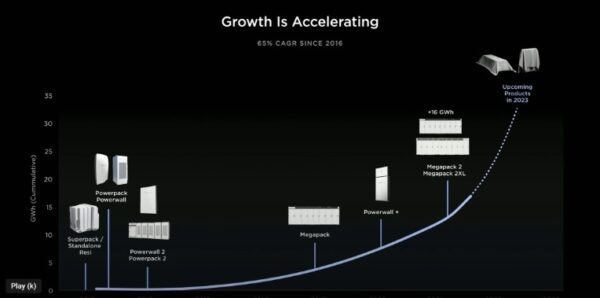

At Tesla’s recent Investor Day at its Gigafactory in Austin, Texas, the electric vehicle (EV) and battery storage maker revealed some interesting information about its megapack energy storage project. Tesla’s energy business was one of many parts of this three-and-a-half-hour investment day on March 1. Towards the end of the conference, he provided some new insights into the rapidly expanding megapack business.

Giving the overview was Mike Snyder, Senior Director, Megapack at Tesla. Snyder has worked at Tesla for nine years, so the history of Tesla’s large-scale energy storage business is less than a decade. As for the car side of the business, Tesla has been ramping up its megapack manufacturing facilities in the US to meet demand for its utility-scale stationary storage product, which has been a busy first decade. The MegaPak factory in Lathrop, California is properly called a “megafactory,” although it’s a smaller relative to the four Gigafactories Tesla operates in Austin, Fremont, Berlin and Shanghai, churning out 40,000 EVs per week.

According to Snyder, more than 16 GW of megapacks have been installed worldwide, with the goal of increasing that to 100 GWh this year. He sees 100 GW of solar as an annual run rate for the next few years, so it’s a big improvement after 16 GWh in the first decade. The latest product is the sixth generation Megapack XL, packing a 3MWh lithium-ion battery. Snyder calls the Megapack XL the highest-capacity stationary battery storage product on the market, capable of packing up to 300 megawatt hours per acre of land. According to Snyder, this is twice the energy intensity of a conventional gas peak plant.

Snyder was joined on stage by Drew Baglino, Tesla’s senior vice president of powertrain and energy engineering. Both Baglino and Snyder highlighted Tesla’s power electronics prowess, saying the company “delivers more electronics every year than the solar and wind industries combined.” Cumulative output to date is 1.4 TW across Tesla’s vehicle and stationary storage products. Coupled with Tesla’s extensive in-house capabilities in software development, the Megapack can operate in “virtual machine mode,” providing artificial flexibility to the electric grid. According to Baglino, it’s no longer just about injecting clean energy into the grid, but “adding energy stability” to the mix. As megapack costs continue to decline, these utility-scale energy storage units will replace conventional fossil-fired power plants to provide both power and stability to the power grid.

On the car side, Tesla’s ambitions with the Megapack are impressive. Its long-term goal is to increase annual production to 1 TWh, which represents 25x the annual production capacity of the current factory in Lathrop. Lathrop itself has been a huge success, with Tesla converting an existing JC Penney distribution center into a state-of-the-art manufacturing facility for Megapacks in less than twelve months. The Lathrop mega-factory was completed in September of last year.

Speed is also of the essence when building megapak projects. Snyder emphasizes the plug-and-play nature of Megapacks and how Megapacks can be easily connected together to form giant, smart power blocks that can quickly connect to power grids around the world. In the last four years, Tesla has quadrupled the speed of installation of Megapack projects, while at the same time reducing the required manpower by three times.

Tesla’s investor day covered developments on the distributed storage front, where Tesla’s Powerwall is its flagship product. Whether it’s the Megapack and front-of-the-meter storage or the Powerwall and behind-the-meter storage, we expect all of Tesla’s permanent energy storage products to match what Automattic is doing on the EV front. Both are key elements in Tesla’s vision to get to a “sustainable energy world,” to use Elon Musk’s phrase this investor day. While the 2030 goal on the EV front is to produce 20 million vehicles per year, the 2030 goal is to hit the 1 TWh mark on the energy storage front. According to Tesla, this will require an investment of 150 to 175 billion dollars, which is actually less than a third of Tesla’s current market capitalization. On the other hand, it’s about five times Tesla’s total investment ($28 billion) so far.

This content is protected by copyright and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

[ad_2]

Source link