[ad_1]

The top performing destinations in Europe in the summer of 2022

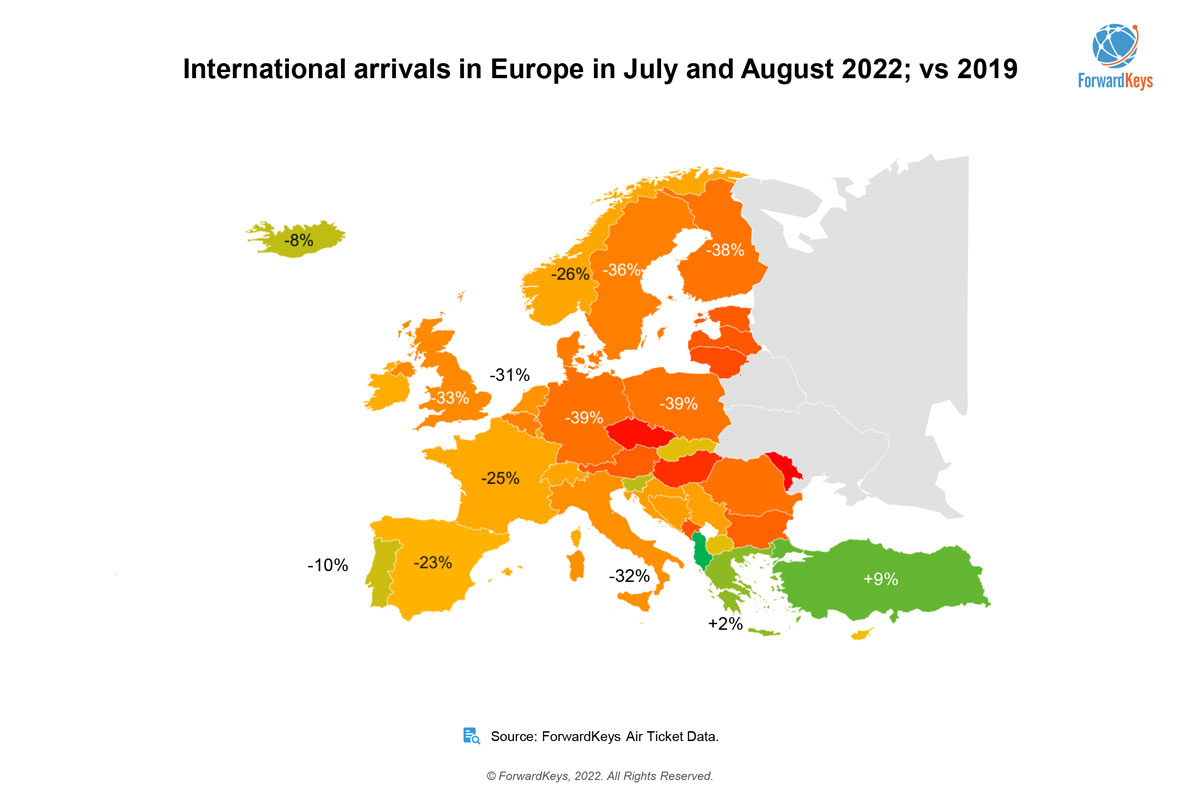

During the peak summer months of July and August, air travel to Southeast Europe significantly exceeded pre-pandemic (2019) levels. The two biggest destinations, Turkey and Greece, both surpassed pre-pandemic levels of international visitors by 9% and 2% respectively. Air travel to Albania (a relatively small destination with less than 1% market share for European flights) also increased by 28%. In the year While no other major country destinations recovered from 2019 numbers, Slovenia was down 7 percent, Iceland was down 8 percent, and Portugal was down 10 percent.

The list of best-performing city destinations was led by Istanbul, which recorded a 2 percent increase in air arrivals. It was followed by Athens, down 7%, Reykjavik and Porto, both down 8%, and Malaga, down 13%.

Factors influencing travel trends

Key factors driving Turkey’s strong performance include the depreciation of the Turkish lira and its opening to the Russian market, where direct flights to most of Europe have been banned. In the year In the summer of 2019, Russians accounted for 4 percent of all arrivals in Europe, but in 2022 this has decreased significantly. Greece has worked hard as a destination throughout the pandemic by implementing relatively visitor-friendly Covid-19 travel restrictions.

European destinations could attract more visitors during the summer months if the aviation industry could better cope with travel demand in late spring and early summer. If there had been no disruption, Forward Keys estimates that the recovery of flight bookings in Europe would have been five percentage points higher.

Travel audiences are eager to travel in summer 2022.

Analysis of departure markets shows that within Europe, Greece proved to be the strongest in July and August with trips to European destinations matching 2019 levels. They are followed by Poland at 9%, Spain at 12%, England at 13%, Denmark at 14% and Portugal at 15%. Overall, intra-European departures fell by 22 percent.

The strongest European market was the US, down 5% in 2019. It was followed by Colombia and Israel, both down 9%, South Africa, down 10%, Mexico down 12%, and Canada and Kuwait, both down 13%. Overall, markets outside of Europe were down 31 percent.

Travel Outlook 2022 and 2023; What is future demand?

While much has been said about the economic downturn and rising prices hurting hopes for a post-pandemic travel recovery, the trend remains positive. In July and August, air travel across Europe decreased by 26%, but the outlook for the next three months shows from 31.St In August, flight bookings were 21% behind the same period in 2019, with bookings for Turkey and Greece down 20% and 5% respectively. The next best booked destinations are currently Portugal, 3% behind, Iceland, 7% behind and Spain, 15% behind.

The strongest departure markets were led by the UK, where demand for outbound flights fell by 2% for the three months before the outbreak. Spain is 3% behind, the US 5%, Ireland 6% behind, and Germany 11% behind.

Olivier Ponti, VP Insights, ForwardCase, said: “Despite travel disruption and capacity reductions due to staff shortages, recovery from the pandemic continues. Now, forward bookings for leisure travel with air travel indicate continued recovery after the pandemic. And, encouragingly, business bookings are taking hold. However, we remain cautious about the outlook as the continued war in Ukraine and the impact on energy prices will have a negative impact on the European economy. That means flight bookings are currently focused on the autumn half-term peak and the Christmas period, which could lead to further flight disruptions if the aviation industry’s recent recruitment woes continue.

Tom Jenkins, chief executive of the European Tourism Association, concluded: “The insights ForwardKeys provides are invaluable to our understanding of recovery. Below the numbers, the predicted supply-side challenges remain in Europe’s tourism ecosystem after the pandemic. Operators report difficulty in positioning business and erratic service levels due to staff shortages and lack of customer knowledge. Logistical constraints and new taxes add complexity and cost at the destination level. Some hoteliers are doing well, with strong earnings on lower occupancy rates due to reduced product demand. Others struggle: Despite high occupancy, profit margins are eroded by rapidly rising costs. As unpleasant as these things are, they are challenges that arise in business returns. The industry is recovering, but avoidable problems (such as tax uncertainty) are discouraging recovery.

“ETOA membership reflects the market, and we are seeing new interest and activity across Europe. Despite inflation, demand is particularly strong from long-term markets, both for product and network opportunities. We have willing buyers struggling to secure the product they want and the Asian market is only just beginning to recover. Market conditions are challenging, but operators are still selling and proving their efficiency. Sustainable recovery requires collaboration across the sector, public and private sectors. Together with our members and partners, we are here to support this.

ETOA and Forward Keys will share more insights on the state of the European travel market in a webinar organized by ETOA on 13Th September.

[ad_2]

Source link