[ad_1]

The premium between corporate debt and the U.S. Treasury has fallen to its lowest level in more than a decade, in a signal that investors are growing confident that recent rises in inflation will not hinder economic recovery.

The collapse of the difference in investment returns (known as the spread) means that buyers are asking for a much lower premium than they had previously for owning corporate debt, which is riskier than U.S. superinsurance treasuries. .

The spreads between U.S. Treasury yields and corporate bonds have narrowed markedly this year, as investors gained confidence and claimed to own even marginally higher return assets in a low-yield world.

This compression of the spread, which indicates the level of risk that investors see in corporate lending compared to the U.S. government, had been under pressure from the spectrum of higher inflation since ‘April to May.

However, a growing number of investors are approaching the Fed’s mantra that price hikes will be transient as the economy reopens after the pandemic, pushing for reduced inflation measures .

“The Fed has been controlling the transitional narrative that has provided confidence to corporate bond investors,” said Adrian Miller, chief market strategist at Concise Capital Management. “After all, investors in corporate bonds are more focused on the strong path of expected growth.”

Confidence in the economic recovery was strengthened on Wednesday Fed officials noted a shift toward the possible repeal of crisis policy measures, which embraces a more optimistic outlook for the American rebound. Fed chairman Jay Powell’s faltering tone, including comments that “price stability is half of our mandate” in the Fed, has helped allay concerns that inflation could be left out. control, forcing an abrupt response from the central bank.

The gap between U.S. Treasury yields and investor-grade corporate bond yields fell 0.02 percentage points to 0.87 percent on Wednesday, according to ICE BofA indices, their lowest level since 2007. and remained unchanged Thursday. In the case of high-yield bonds with a lower rating and therefore riskier, the spread fell 0.05 percentage points to 3.12%, low a post-crisis low set in October 2018. It widened modestly to 3.15% on Thursday.

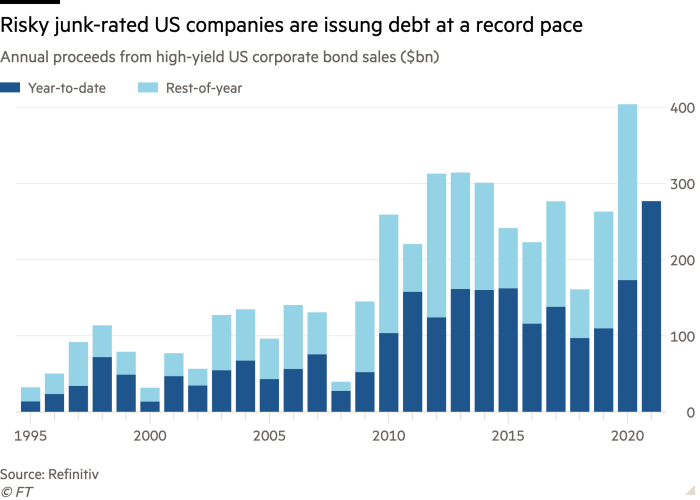

The fall in spreads has been driven by the central bank’s accommodative policies through the pandemic crisis, as well as the multi-million dollar pandemic aid package from the federal government. Financial conditions in the United States are almost the easiest to record, according to a popular index led by Goldman Sachs, which has spurred a wave of corporate debt by companies at risk of more junk.

Some 373 junk-rated companies have borrowed through the nearly $ 11 billion U.S. corporate debt market, including companies hard hit by the pandemic such as American Airlines and cruise operator Carnival. Collectively, the risky cohort has raised $ 277 billion, a record pace and has risen 60 percent from previous year’s levels, according to data provider Refinitiv.

However, falling spreads and investors ’perception of risk have not been enough to offset a global rise in yields, which have been shaken by the prospect of rising interest rates as investors adjusted. at a faster pace of tightening Fed policy.

Debt with a higher rating, safer, but with fewer differences to amortize investors against a jump in Treasury yields, tends to suffer more in high growth and interest rate environments. In contrast, high-yield bonds tend to benefit, as the booming economy makes companies less likely to break down.

“At the moment, people are not at all afraid of the price action of a higher move in yields,” said Andrzej Skiba, U.S. head of credit at BlueBay Asset Management. “Businesses are doing very well and we are seeing a significant recovery in profits.”

Yields on investment quality bonds have risen 0.3 percentage points more than 2.08% since the beginning of the year, compared with a decrease of 0.27 percentage points to 3.97% of bonds high performance.

Bank of America analysts expect the two markets to continue to converge, projecting that investment quality spreads will widen to 1.25% and high-yield bond spreads will continue to decline to 3, 00% in the coming months.

However, while optimism about the U.S. recovery abounds, continued zeal for lower-quality corporate debt has caused consternation in some quarters. Investors are concerned that precarious companies are being offered credit at interest rates that do not take into account high levels of risk.

“It is very important for us that the return we receive from a high-yield bond provides an adequate level of compensation for the credit risks of the investment. When returns are as low as this, it naturally becomes harder to tell, ”said Rhys Davies, Invesco’s high-performing portfolio manager. “It’s pretty simple: the lower the market performance, the more investors will have to navigate the market more carefully.”

[ad_2]

Source link