[ad_1]

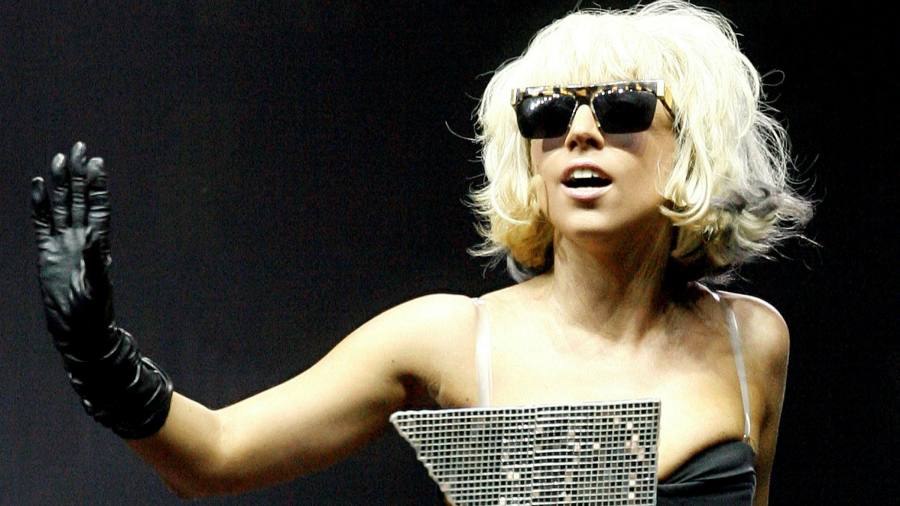

Billionaire hedge fund Bill Ackman is nearing a deal Universal Music Group this would see his blank check company acquire a 10% stake in the record label behind artists like Lady Gaga and Cyndi Lauper, people reported on the subject.

The deal with Pershing Square Tontine Holdings, a special-purpose acquisition company that broke records with its $ 4 billion listing last year, will value Universal at about $ 40 billion.

As part of the unusual plans, Vivendi still aims to distribute other remaining universal shares to investors through a public listing on the Euronext stock exchange later this year, two people reported on the situation. One person considers the Spac listing to be a proxy for valuing Universal Music prior to this initial public offering.

The negotiation comes when Vivendi seeks to withdraw money from Universal Music, its prized asset that has benefited from the revival of the music business, which attracted investors to the sector.

Ackman beat the competition from private equity firm Hellman & Friedman, which had offered to buy a 10% stake in Universal at a valuation of 30 billion euros, according to a person with direct knowledge of the matter.

Participations in AckmanThe New York Stock Exchange company fell as much as 14 percent in out-of-hours trading as investors reacted negatively to news of the transaction.

Ackman Space is working with its advisers to finalize the terms of the agreement, which could take days or weeks to close, people reported on the matter.

Last month, Vivendi said it was considering selling an additional 10% stake in Universal Music to an unnamed U.S. investor. The French media group, controlled by billionaire Vincent Bolloré, has previously sold 20% of Universal to China’s Tencent.

Ackman hinted last month that he could announce a deal in the coming weeks. The investor said he had been working on the transaction since early November, adding that he was “deeply committed” to an “iconic, phenomenal and fantastic business”. Ackman said at the time that there was a lot of complexity in the deal.

The value of music companies has increased in recent years as audio streaming services like Spotify resurrected the troubled business, sending billions of dollars in royalties payments to record labels, including Universal. In 2013, SoftBank offered to buy Universal Music for just 6.5 billion euros.

Universal, home to events such as The Beatles, Drake and Taylor Swift, is the world’s largest record label, with a market share of 30%, according to estimates by Midia Research Research.

Spaces, which raise money through a public listing and are looking for a private company to make them public, have become one of the most talked about asset classes on Wall Street. But greater regulatory control and poor performance have diminished investor interest and slowed the number of listings and the volume of transactions.

Due Diligence Newsletter

Sign up here to receive Due Diligence, leading news from the world of corporate finance, which are sent directly to your inbox every Tuesday to Friday

[ad_2]

Source link