[ad_1]

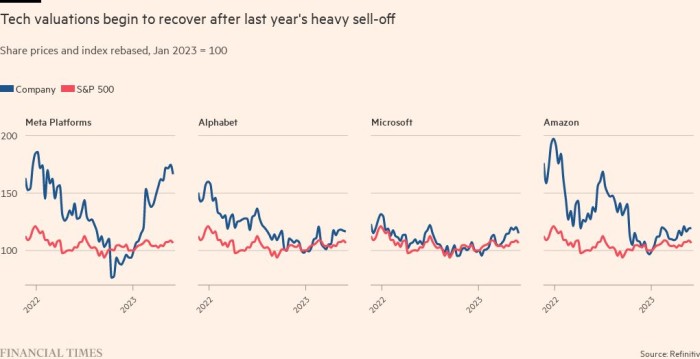

By the standards of Big Tech’s recent outbreak, the beginning of 2023 was not a time for the history books.

First-quarter growth reported this week by Alphabet, Amazon, Meta and Microsoft was between 3 and 9 percent, boosting big tech’s combined revenue by 41 percent as demand for digital services surged.

But with their recent fortunes at a low level, the companies still offer surprises. Instead of seeing their businesses fall back from depressed fourth-quarter levels as widely expected, Big Tech’s growth rate has rebounded.

Along with severe cost-cutting stemming in part from a wave of layoffs, revenues rebounded and maintained the industry’s profit margins.

The strong financial performance has boosted confidence on Wall Street at an important time. Investors are bracing themselves for the tech industry’s next financial shift: a big increase in spending on the development of generative artificial intelligence.

“We’re seeing huge numbers of caps in large tech companies,” said Angelo Zino, senior industry analyst at CFRA Research. But we expect AI to deliver additional revenue increases over the next couple of years.

This week’s strong performance shows that, despite being tied to economically significant costs such as advertising and IT, the tech industry’s biggest players have weathered the recent economic turmoil remarkably well.

“The big tech companies have been incredibly resilient, much better than predicted,” said Jim Tierney, head of US growth investments at AllianzBernstein.

The latest figures include strong signs that growth in cloud computing – a key business for Amazon, Microsoft and Google – is coming to an end, he added – “a positive thing overall.” [tech] Ecosystem” is when you see orders for the giant cloud companies.

On Thursday, Amazon was the latest to deliver strong first-quarter numbers along with earnings and revenue forecasts.

AWS, its cloud computing division, saw a sharp drop in revenue growth of 37 percent at the start of last year. But 16 percent in the final quarter was still better than feared, raising hopes the downturn may be coming to an end.

However, the most up-to-the-minute information provided by Amazon suggests it’s not out of the woods yet. AWS growth slowed to 11 percent in April as customers looked for ways to save money in a tough economy, the company said on a call with analysts.

The news sent the stock price suddenly into reverse, more than erasing a 12 percent gain after the release of first-quarter figures.

Despite this, Amazon’s strong first quarter appeared to confirm that Big Tech is off to a positive start this year. Microsoft set the stage two days ago, reporting good results for its own cloud division and hinting the market is already rebounding.

CEO Satya Nadella warned earlier this year that Microsoft’s cloud operations could experience a year of slower growth as customers try to “upgrade” their cloud contracts, seeking efficiencies to save money.

His turn may have come sooner than expected. Chief Financial Officer Amy Hood said on Microsoft’s earnings call this week that “at some point, workloads just can’t get any better.”

Signs that things are looking up put “a little bit on our guidance” for the current quarter, she added – raising hopes of stronger growth and sending Microsoft shares up 10 percent over the next two days.

Big Tech’s core business – digital advertising – has also performed better than feared this year after an unexpected return to growth after three quarters of contraction.

Coupled with heavy spending cuts, the news sent Meta shares up 15 percent, extending a strong rally for all major tech companies this year.

This week has seen plenty of questions from investors about generative AI, and while the technology behind OpenAI’s ChatGPT may not yet be financially significant, Wall Street is fixated on the new technology.

Nigel Green, CEO and founder of wealth management firm Dever Group, said: “Investors have been mulling over the AI specifications presented by the big tech titans this earnings season, perhaps more than any other issue.

What they saw left a generally positive impression. Amazon boss Andy Jacey said that while overall capital spending has fallen this year, his company is still ramping up data center spending, partly in anticipation of a jump in demand driven by AI.

“Few people appreciate how much new cloud business will emerge from the flood of machine learning over the next several years,” Jassy said.

Microsoft and Meta went even further by putting AI at the center of their investor call center, anticipating that the technology would boost performance in their businesses.

Mark Zuckerberg didn’t put a figure on the impact of the company’s AI investments, but the Meta chief pointed to signs that the technology is already having an impact. They included a 24 percent increase in engagement on Instagram, which the company relies heavily on AI for primarily Reels, a TikTok-like video service.

Such early signs have boosted confidence on Wall Street that as Big Tech pours investment into the next wave of AI, it will find plenty of ways to cash in on its expensive new game.

“Microsoft’s pricing power will jump once AI is embedded in its services,” Zino said. “I think Meta AI in particular has done a good job of explaining how it works today and how it can improve content. That’s in contrast to Metaverse, which is still a very distant prospect.”

If there was a shadow on the AI horizon, it was at Google, whose core search business is widely seen as the most vulnerable to the rise of generative AI. Parent Alphabet was among the companies warning of higher capital costs stemming from AI, with costs starting to rise in the second quarter and rising gradually thereafter.

CEO Sundar Pichai has tried to reassure Google that it will come up with new ways to contain the high costs of running AI-powered services and make money from them.

The lack of specifics, however, failed to calm concerns, and Alphabet’s shares fell the day after it reported a return to growth in its search advertising business.

[ad_2]

Source link