[ad_1]

In the right situation, platform trading can bring huge profits to investors. Companies like acting as an intermediary between buyers and sellers Airbnb (Father B 2.74%) And Ebay (EBAY 1.01%) Earn high profits without taking the risks associated with traditional rivals in the e-commerce and hotel industries.

But which stock is better to buy today? eBay and Airbnb both updated investors on their growth plans for 2023, so let’s compare the two against that broader sales backdrop.

Airbnb is a growth stock

Both companies are in growing industries, but Airbnb appeals to more growth-oriented investors. That’s partly because the home and room rentals platform was built earlier in its expansion history. Sales rose 31 percent in the most recent quarter, for example, compared with a slight decline for eBay.

That difference will be even stronger in 2023. eBay is reporting flat sales in the first quarter, while Airbnb saw revenue rise between 18% and 23% after adjusting for currency changes. The marketplace platform is still experiencing a growth slowdown compared to pre-pandemic levels as the buyer pool shrinks.

Looking ahead, Airbnb is likely to open up additional revenue streams over time as it makes it easier for people to earn money hosting guests. “We have some big ideas for where to take Airbnb next,” executives told investors in late February. eBay can realistically target multi-margin growth.

eBay is very dangerous.

If you’re risk-averse, there are now good reasons to choose eBay stock over Airbnb. The marketplace platform is not prone to template failure. While consumers continue to buy clothes, toys and electronics, demand for travel is likely to fall in a severe recession.

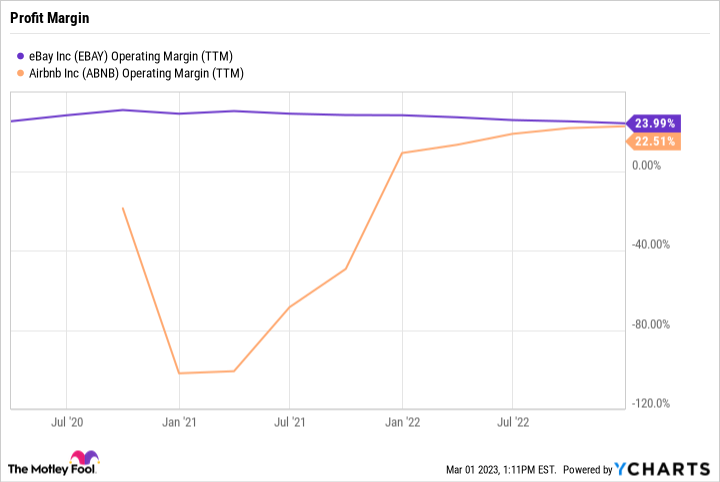

EBAY Operating Margin (TTM) data by YCharts. TTM = trilling 12 months.

eBay pays a modest dividend that helps it bounce back during stock market downturns. The business has a long history of encompassing a wide range of retail environments, which is not the case with Airbnb.

Finally, the stock is more cautious. You can buy on eBay for less than 3 times the sales, compared to over 10 times the sales for Airbnb.

Buy better

That high valuation means the biggest risk you’re taking on buying Airbnb is paying for a high-performing business. The company may disappoint investors in the next few years, perhaps by showing poor growth or struggling to raise its payout. With an eBay purchase, you’re experiencing a very slow return on sales in exchange for worrying about the company not living up to expectations.

In this way, eBay is a more focused investment for value-oriented investors who value stability and financial returns. Airbnb, on the other hand, is a classic growth stock that offers promise with elevated risk.

However, both businesses demonstrate the financial power of the platform sales model. And both are profitable and generate enough cash flow today. Those factors should support market returns for Airbnb and eBay shareholders who want to hold shares through 2023 and beyond.

Demitri Kalogeropoulos has no position in the mentioned shares. He has a spot in the Motley Fool and recommends Airbnb. The Motley Fool recommends eBay and recommends the following options: Short April 2023 $52.50 eBay calls. The Motley Fool has a disclosure policy.

[ad_2]

Source link