[ad_1]

Cushman & Wakefield released today “Tech Cities: The Global Intersection of Talent and Real Estate,” a new report that examines the drivers of top location strategies for technology owners, identifies the top global technology markets and the impact of technology companies on office real estate. In the report, the firm ranked Phoenix as the top tech city in America based on several factors.

Globally, technology is a bigger part of the economy — and business real estate — than ever before. Global tech employment has increased dramatically over the past decade. Information and communications employment in the 15 largest global economies has increased to nearly 23 million workers, and is projected to grow by 17 percent, adding an additional 12 million workers over the next 10 years.

Read more25 Tech Startups to Watch in Metro Phoenix

David C., Head of Global Employer Insights at Cushman & Wakefield. “Despite the recent volatility in the economy, the demand for technology skills is not slowing down anytime soon. As a result, the evolution of cities remains critical for tech talent and technology owners as well as commercial real estate decision makers.

In the year Demand for tech skills is on the rise after dipping in the mid-2020s. Globally, job postings for technology jobs (ie, computer programmers, IT network professionals and analysts and data scientists) increased more than 50% in the first year of the pandemic. There are now 2.7 million more office workers in the world’s 10 largest economies than when the pandemic began.

Cushman & Wakefield selected more than 115 diverse tech cities around the world to evaluate the availability and cost of talent, office real estate and business environments. The top tech hubs in each global region are identified by gathering 14 factors, weighing each as a market choice criterion for tech companies, and then validating it with industry experts and rigorous model testing.

For North America, the San Francisco Bay Area ranked as the top tech city, followed by Toronto, New York, Seattle, Los Angeles, Atlanta, Washington DC, Dallas-Fort Worth, Boston and Montreal.

Talent is a critical resource for technology owners to evaluate potential positions. The San Francisco Bay Area leads North America with approximately 280,000 tech jobs, followed by New York with 259,000 and Washington, D.C. with 216,000.

“Finding and retaining top talent is top-of-mind for tech companies, especially given the tight labor market and technical skills that some tech companies demand,” Smith said.

Markets like Toronto and the San Francisco Bay Area are likely to continue to be tech hotbeds. Markets with medium-sized labor pools can have impressive talent balances, such as Montreal.

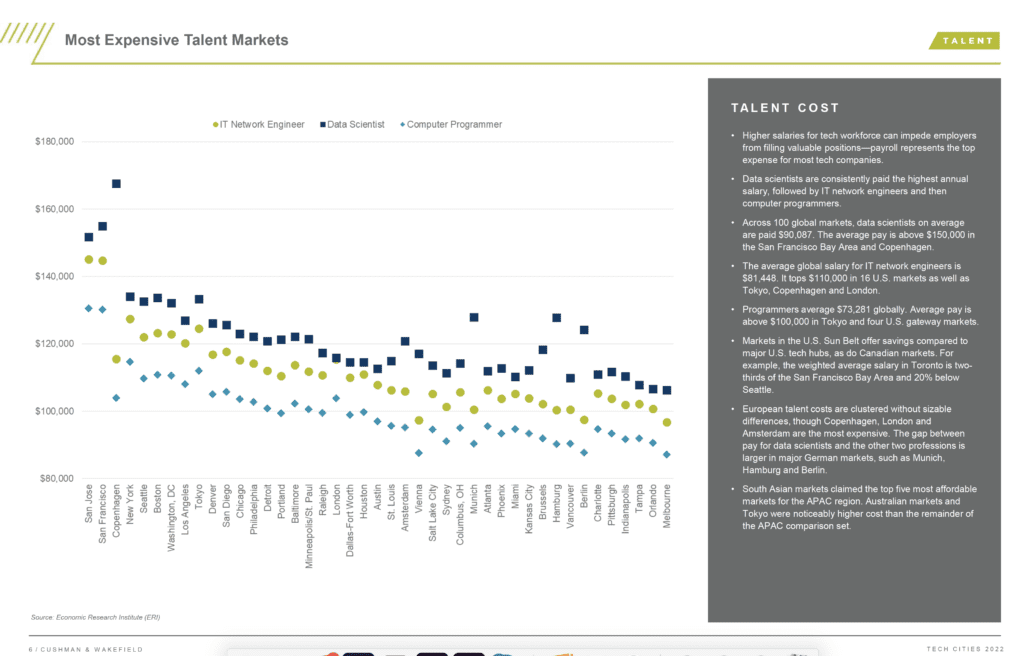

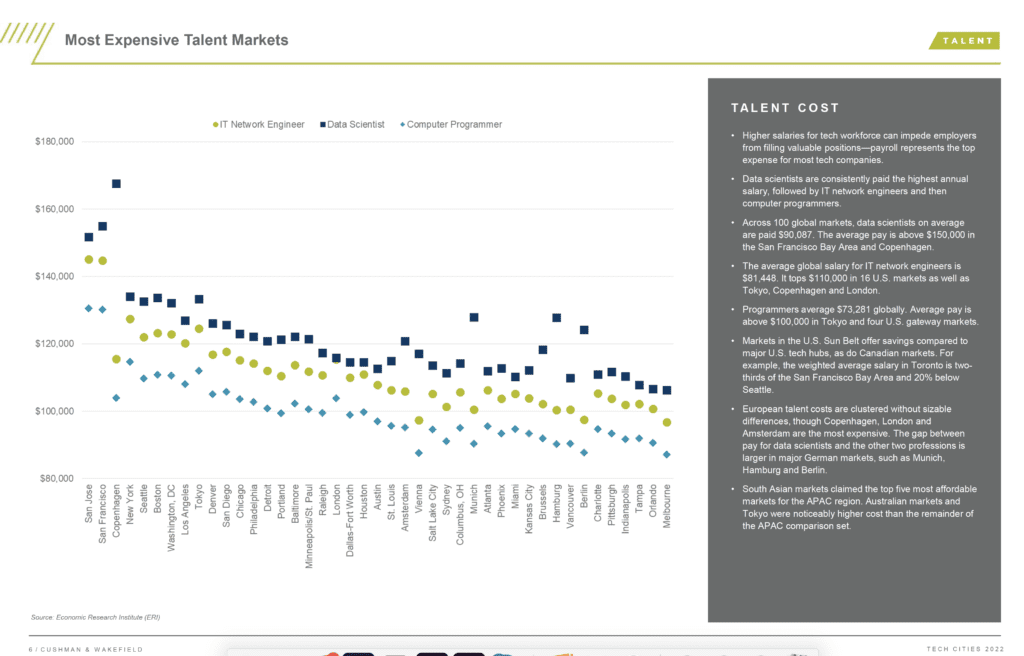

The number one value of technology companies is talent. The San Francisco Bay Area continues to make a name for itself as the most valuable market for technology talent in North America. In more than 100 global markets, data scientists have an average salary of $90,000, but in the San Francisco Bay Area, the average salary is over $150,000. Markets in the Sun Belt offer savings compared to major U.S. tech hubs, such as Canadian markets. For example, the weighted average salary in Toronto is two-thirds that of the San Francisco Bay Area and 20% that of Seattle.

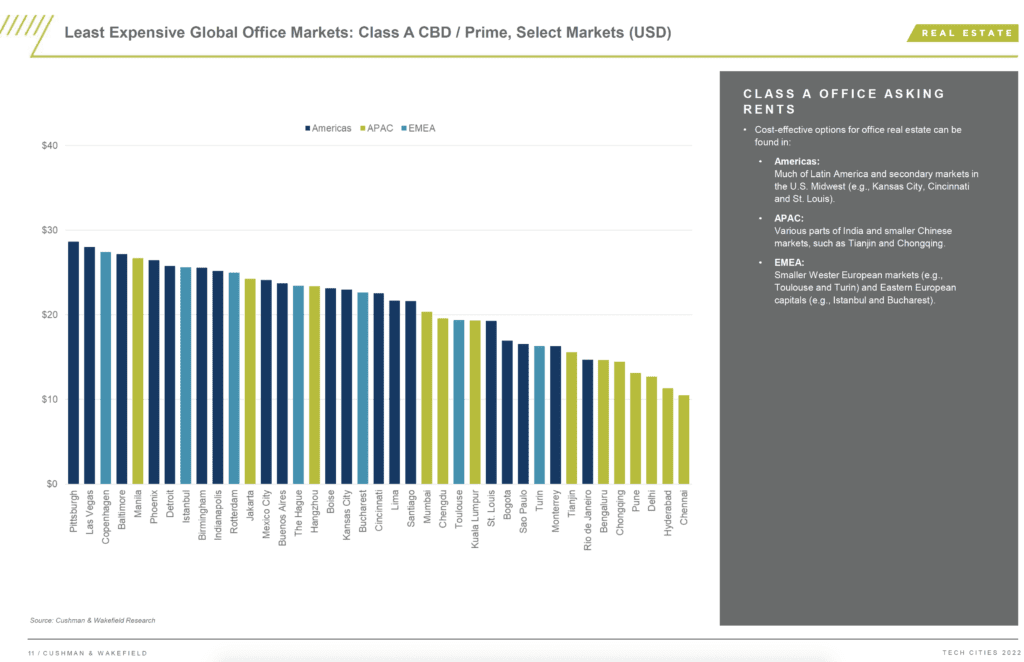

Landlords seek opportunities to save on rent and build high-quality office spaces that serve as innovation and collaboration hubs. In North America, real estate prices are highest in traditional major cities, including New York ($78 psf), San Francisco Bay Area (76 psf) and Toronto ($66 psf). Cost-effective options are available in many Latin American and secondary markets in the US Midwest, such as Kansas City ($23 psf.), Cincinnati ($23 psf.) and St. Louis ($19 psf.).

With increasing flexibility, the quality and location of office space will become more important. It is important for technology companies and workers to identify markets with a dynamic ecosystem as well as the availability of high-quality office space. Construction supplies will continue to create opportunities for technology companies to tap into new quality niches that attract and retain talent in key labor markets.

The office space under construction at 16+ msf in New York City, USA has a deep pipeline. As a percentage of current inventory, however, this represents only 6% of current inventory in Manhattan, below the share of inventory under construction in Vancouver, Austin, and Toronto, all of which have more than 9% of inventory currently under construction.

Click here to see the whole thing High tech city Report.

[ad_2]

Source link