[ad_1]

jetcityimage/iStock Editorial via Getty Images

Introduction: Why is AT&T stock falling?

AT&T Inc.NYSE: T) shares fell 7.6 percent on Thursday (July 21) after the company released Q2 2022 results, and fell another 2.9 percent as of 11:50 a.m. EST on Friday.

We initiated a Hold rating on AT&T in July 2021, stating our view that shares should be removed. Since then, AT&T shares have lost 10.6% in the year (adjusted for $5.92 Day-1 Warner Bros. Discovery ( WBD ) shares).

|

Library Capital Rating History vs. AT&T Share Price (Last Year)  Seeking Alpha (21-July-22). |

Q2 results showed the poor quality of AT&T’s businesses in the face of macro challenges. EBITDA was essentially flat. 2022 FCF outlook reduced to $14 billion from $16 billion. The operating segment was weakly priced despite high inflation and the growth capital rate for FCF. It contributed to the decline. Business Wireline is now expected to see a low-double-digit EBITDA decline in 2022 and is not expected to stabilize until H2 2024. Consumer Wireline had better pricing growth, but broadband customer net loss rose to 25k.

AT&T stock currently trades at a 7.5x P/E, a 10.1% Free Cash Flow (“FCF”) yield, and a 6.0% dividend yield, but we don’t believe it’s cheap enough to offset AT&T’s structural risks. Get rid of it.

A careful summary of the AT&T rating

Our long-term caution on AT&T stems from what we call structural problems in the business:

- Mobility It operates in a commodity market, has low revenue and high EBITDA growth rates, and is facing threats from US cable-owned mobile virtual network operators (“MVNOs”).

- Business Wire It is in structural decline due to the loss of legacy services and US Cable’s market share among SMB customers.

- Consumer wire Partially upgraded to fiber and still losing US cable subscribers. After effective depreciation, EBITDA hit a low point in 2021, when AT&T added HBO Max to its Internet bundle.

As a reminder, after being spun off from WarnerMedia in April, the new AT&T will generate approximately 70% of its EBITDA from Mobility, 21% from Business Wireline and 9% from Consumer Wireline.

|

AT&T Pro form Revenues and EBITDA by Segment (2021)  AT&T Company Documents. NB Negative EBITDA figures in a company etc. are not shown. |

In addition, AT&T holds a 70% economic interest in DirecTV (with the other 30% held by private equity firm TPG) and receives annual subsidies (an estimated $4bn in 2022 and an expected $3bn in 2023).

2022 Cut Free Cash Flow Outlook

Highlights from Q2 2022 saw full-year FCF outlook cut from $16bn to $14bn, representing a larger decline than 2021, when pro forma FCF was $19.2bn.

|

AT&T 2022 Outlook (updated with predecessor)  AT&T Results Presentation (Q2 2022). |

The 2022 wireline services revenue growth outlook was raised to 4.5-5.0% from 3%+, but there were no benefits to earnings. Expected EBITDA was reduced at Business Wireline, replaced by an expected increase in activity, while Consumer Wireline was “on track.” (We discuss each section in more detail below.)

AT&T did not provide an updated outlook for 2023.

FCF was just $1.4bn in Q2 2022, down from $2.8bn in Q1 and $5.2bn in the prior-year quarter and below expectations. Cash flow was $7.7 billion in Q2, up from $7.6 billion in Q1 and $10.2 billion last quarter.

|

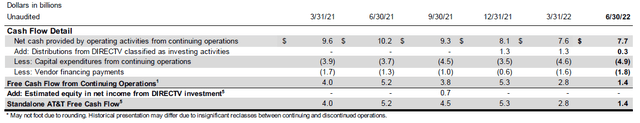

AT&T CAsh per quarter (last 6 quarters)  AT&T Results Release (Q2 2022). |

Management has given several reasons for the deterioration in cash flow, including:

- An era of “success-based investments” driven by customer growth

- CapEx front-loading for growth initiatives in H1

- AT&T was unable to fully compensate for long collection cycles and inflationary costs

- Weak macroeconomic environment prospects in H2 2022

In AT&T jargon, “performance-based investments” mean customer device subsidies and other incentives. We can see the results of these and long-term collection cycles in AT&T’s H1 cash flow:

|

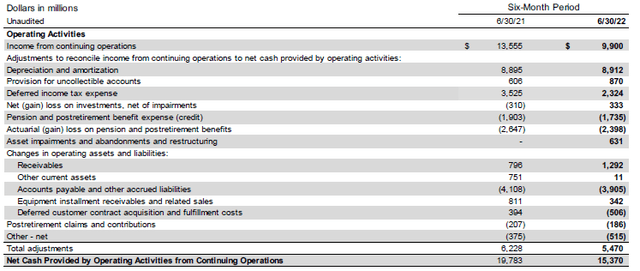

AT&T ohCash Flow (H1 2022 vs. Previous Year))  AT&T Results Release (Q2 2022). |

Working capital represents cash flow of $2.77bn in H1 2022, more than double the previous year ($1.36bn), with “delayed customer contract acquisition and fulfillment costs” exacerbated by $900m.

Worsening cash flow on flat EBITDA indicates that AT&T’s growth is capital intensive, a sign of poor business quality.

AT&T EBITDA was flat in Q2.

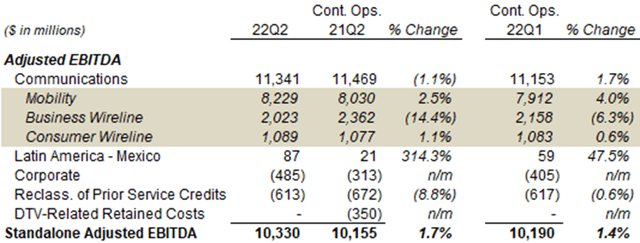

For Q2 2022, AT&T reported standalone EBITDA of $10.3bn, 1.7% higher year-over-year and 1.4% higher sequentially:

|

AT&T EBITDA per segment (Q2 2022 with previous periods)  AT&T Results Supplement (Q1 2022). NB Q1 2022 Other one-off charges include the absence of FirstNet and CAF II charges. |

However, the comparisons are skewed by several one-off items. The year-over-year comparison was $100m lower in DirecTV-related reserve costs of $350m in the prior-year quarter due to the return of Connect America Fund (“CAF”) II in Q2 2022; Excluding this, EBITDA was down 0.7% year-on-year. Similarly, the sequential comparison benefited from 3G shutdown costs peaking in Q1. These could be as high as $300 million but have not been specified; Excluding this, EBITDA could be flat or even down from Q1.

We review each AT&T business in detail below.

Mobility: Poor cost and capital-intensive

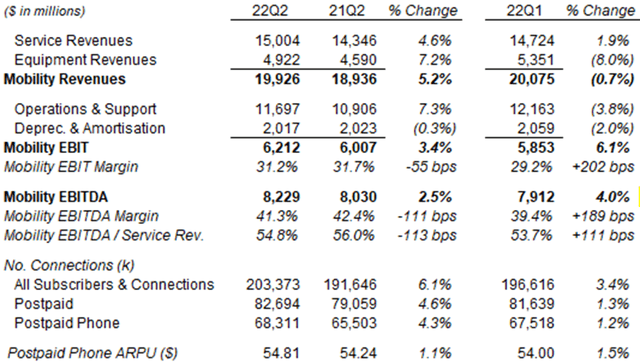

The operating segment reported year-on-year EBITDA growth of 2.5% or 3.8% excluding CAF II charges of less than $100m this quarter.

|

AT&T Mobility P&L and KPIs (Q2 2022 with previous periods)  AT&T Results Supplement (Q2 2022). |

Revenues grew 5.2% year-over-year, driven largely by subscriber growth. EBITDA margin decreased 1.1 ppt year-on-year to 41.3 percent. Despite inflation, postpaid average revenue per user (“ARPU”) increased 1.1% year-over-year and 1.5% sequentially, thanks to customer upgrades and improvements in roaming. Pricing measures were taken in June, so the effects won’t be felt until H2.

Active subscriber growth has benefited from more than 300k net adds from FirstNet. It may also benefit from the decision to front-load CapEx in H1 (mid-band coverage initially reaching the target of 70m POPs two quarters early by the end of the year) and continued “success-based investments” (ie subsidies and incentives). . The latter two factors were negative for AT&T’s cash flow as discussed above.

We continue to view activity as a commodity business that struggles in the macro headwinds.

Business Wire: Denial re-accelerated

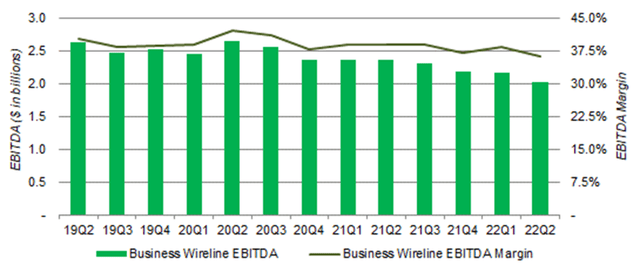

Business Wireline EBITDA fell 4.9% sequentially and fell 7.0% year-over-year in Q2, re-accelerating the decline (from a 1.6% sequential decline in Q1).

|

AT&T Business Wireline EBITDA (as of 2019)  AT&T Company Documents. |

Management attributed the Q2 decline to continued pressure on public sector spending and rising costs in wholesale network access fees (which AT&T apparently failed to pass on to customers).

Commercial wireline EBITDA is now expected to be in the “low-double-digits” in 2022 (it was “mid-single-digits”) and only stabilize in H2 2024 (“as we exit 2023… stabilizes into 2024”).

We continue to see commercial wireline as a structurally-challenged business and further decline in profitability.

Consumer Wire: 25k broadband net loss

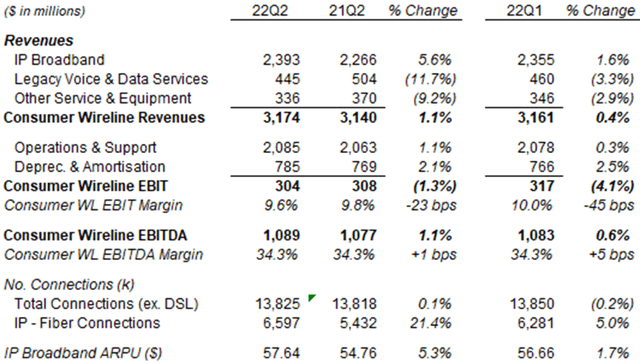

Consumer Wireline reported year-over-year growth of 1.1% in revenue and 1.1% in EBITDA:

|

AT&T Consumer Wireline P&L and KPIs (Q2 2022 vs. Prior Periods)  AT&T Results Supplement (Q2 2022). |

IP Broadband revenue growth was hampered by legacy Voice & Data Services and other product failures. In IP broadband, AT&T’s total connections were flat (up 0.1%) year-over-year, although fiber connections increased 21.4%, while ARPU growth was strong at 5.3%, “led by a mix of customers switching to fiber and recent broadband.” Pricing Actions”.

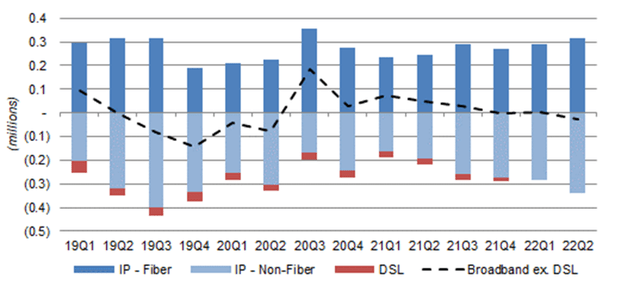

In Q2 2022, AT&T had a total broadband (excluding DSL) subscriber loss of 25k, compared to a net gain of 28k in Q1 and the prior-year quarter. Growth in fiber net additions was more than offset by increasing non-fiber losses.

|

AT&T Consumer Wireline Additions (as of 2019)  AT&T Company Documents. Nb. It does not include DSL subscribers which had an average loss of 23k in 2021. Q2 2020 net adds 104k (28k fiber) Includes “Keep Americans Connected” accounts. |

Total fiber locations reached 18.0m by the end of Q2, up from 16.2m at the start of the year. Despite the continued rollout of fiber, AT&T’s total broadband net addition (excluding DSL) is on the rise starting in Q1 2021.

We continue to expect Consumer Wireline EBITDA growth to remain modest going forward.

Spending “savings” is still “reinvesting”.

Management has claimed credit for progress in AT&T’s cost-savings program, but admitted that the total savings achieved so far have been reinvested and have not resulted in a revenue benefit.

We have strong visibility of achieving more than $4 billion of our $6 billion transformational cost savings plan by the end of this year. As we’ve shared before, we’ve reinvested these savings into growing our core communications business. However, we expect these savings to start contributing to the bottom line as we enter the middle of this year.

John Stankey (AT&T CEO, Q2 2022 Earnings Call)

The prospect of cost savings that will finally go to the bottom line in the “back half” of 2022 may also be at risk, because of inflation. Current inflation has pushed AT&T’s costs to 2022 by $1 billion more than originally expected.

AT&T dividend yield and price

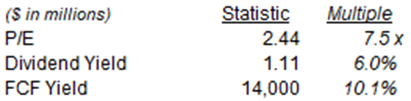

At $18.38 a share relative to the midpoint of 2022 EPS guidance ($2.42-$2.46), AT&T stock is trading at a 7.5x P/E. Based on the 2022 FCF outlook ($14bn), the FCF yield is 10.2%:

|

AT&T Price Metrics (2022E)  AT&T Company Documents. |

The dividend is $0.2775 per quarter ($1.11 annualized), representing a dividend yield of 6.0%.

While these metrics are superficially attractive, we believe they outweigh the risks posed by the long-term challenges to AT&T’s business.

Buy AT&T stock now? Summary

Shares of AT&T fell more than 10% after Q2 results on Thursday, and now trade at a 7.5x P/E and 6.0% dividend yield.

Q2 results showed the quality of the businesses to remain subdued in the face of macro challenges. EBITDA flat and 2022 free cash flow cut.

Mobility had weak valuations despite high inflation, its EBITDA margin fell and its growth required significant CapEx and working capital.

Business Wireline EBITDA is now expected to fall to low-double-digits in 2022. Consumer Wireline lost 25k broadband subscribers in Q2.

At $18.38 a share, the valuation, while superficially attractive, is outweighed by AT&T’s structural challenges. Stay away.

AT&T’s concerns outweigh its cheapness, and we reiterate our hold rating.

[ad_2]

Source link