[ad_1]

Gonzalo Marroquin / Getty Images Entertainment

Our view

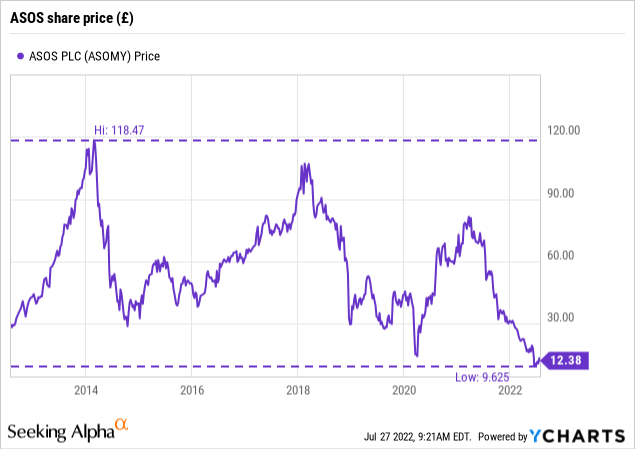

ASOS (OTCPK:ASOMY) is a UK-based e-commerce player that focuses on fashion and cosmetics and targets the youth segment (20-somethings) globally. Interestingly, the company has fallen out of fashion when it comes to investors with its share price. It is down more than 80 percent from its peak in 2021.

There have been several recent headwinds that have given investors reason to be cautious. These include lower revenue growth, supply chain issues and lower full-year profit expectations. Add to that widespread economic uncertainty and a relatively high operating cost base, and we can see why investors are concerned.

While there are real signs of a more challenging business environment ahead, we think the issues will ultimately be short- to medium-term issues and we think the current selloff is unfair.

In our view, business fundamentals continue to support the long-term investment case. Our reasons for this include:

- Improvement of non-financial KPIs customers, orders and average order values in recent years;

- Despite signs of a slowdown in the US, double-digit revenue growth continued as it tracked global expansion as a key driver of growth.

- Leveraging brand recognition and customer reach by acquiring Topshop brands and partnering with Nordstrom ( JWN ) in the US. And

- A liquid balance sheet and low leverage that provides flexibility to see out tough business times.

While we see tough trading conditions as a real possibility in the coming months or years, we think the risk/reward trade at current prices presents a compelling opportunity for patient, long-term investors.

Investment context

Since 2010, ASOS investors have seen the value of their investment decline by more than 50% from tip-to-traffic on three occasions. The latest decline began in late 2021 and early 2022, with prices falling by more than 80% to around £8. Shares have recovered around 30 per cent since then, but at around £10 per share, they remain at non-2021 levels.

Company analysis

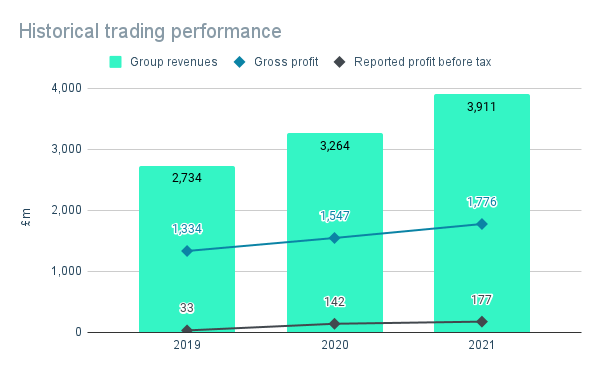

Growing revenues and profits

Author. Information from company reports

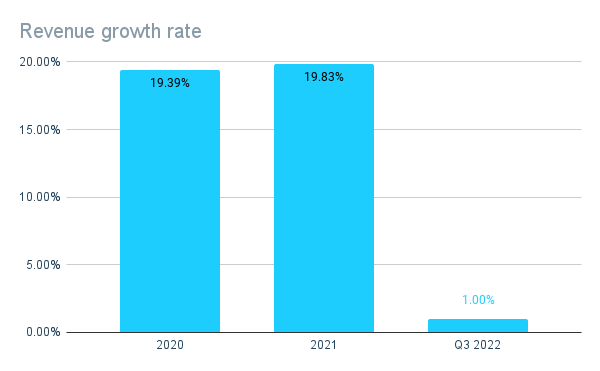

A volatile stock price is not reflected in a company’s trading performance. In fact, the company has shown strong business performance in recent years, with double-digit revenue growth and stable profit margins consistently driving profits.

The 20-year-old’s strong performance came in the face of unprecedented challenges from Covid-19. Despite the uncertainty of demand and supply disruptions, the company grew its revenue by 20 percent and posted a gross margin of over 47 percent. Profit before tax (“PBT”) more than tripled to £142 million, although this included a net benefit of £45 million related to Covid-19, due to restrictions on product returns due to the pandemic.

The growth story continued in FY21, with revenues up a further c.20% and PBT reporting a 25% increase to £177 million. However, this includes a number of non-recurring costs and benefits such as ongoing Covid tailwinds and the acquisition of Topshop brands (see below). Excluding these, the company posted a PBT amount of £126 million, a 30% increase over last year.

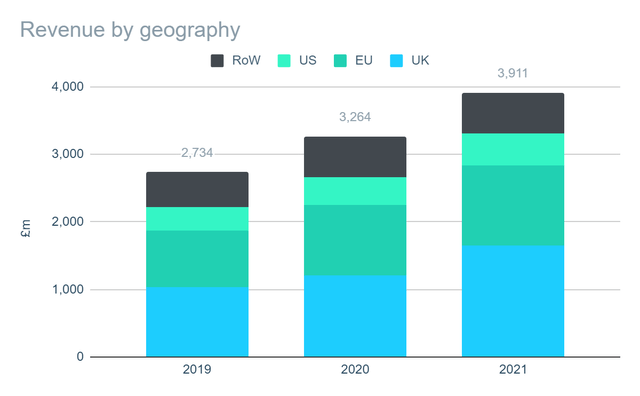

Using brand awareness

Author. Information from company reports

The company benefits from a global customer base in over 200 markets with over 26 million active customers. Despite the continued push for international growth, the UK remains a very important market share, accounting for over 40% of sales. It has also been the most significant driver of growth in recent years in absolute and percentage terms.

Management hopes that growth both domestically and abroad will be accelerated by improving the company’s brand awareness – whether through acquisitions or partnerships. In the year In February 2021, the company acquired the Topshop brands from the failed Arcadia Group for £286 million. The company hopes to capitalize on its existing brand recognition, which is particularly strong in the UK, US and Germany.

To further drive growth in North America, in 2021 the company formed a strategic partnership with United States-based multi-channel retailer Nordstrom, which has more than 350 retail stores in North America. The partnership highlights the steps the company is taking to become a wholesaler and retailer.

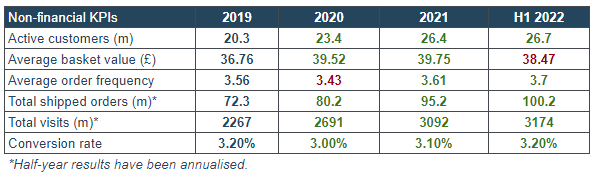

More, more, more

Author. Information from company reports

The positive progress is not limited to the company’s financial performance, the company’s non-financial KPIs (as chosen by the management) have been showing continuous improvement in recent years.

As of 2019, the company continues to attract more customers, prostitutes are willing to spend more on average, and are placing orders with increasing frequency. Even H1 2022 results show continued improvement across all metrics despite headwinds facing the company.

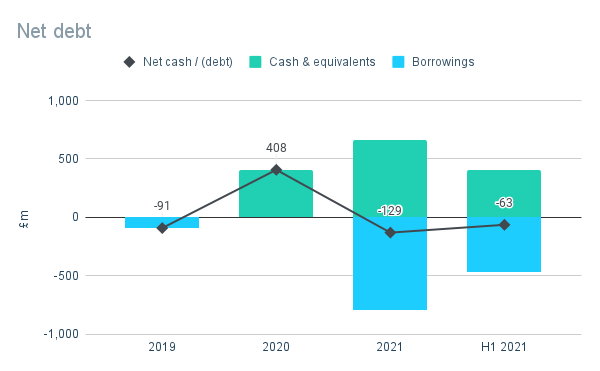

Lean and fluid balance

Author. Information from company reports

The company has consistently maintained a low level of net debt in recent years. In its half-year results for FY22, the company reported net debt of £63 million, representing leverage of 0.5x EBIT for FY21.

Although this was partly due to the company’s cash-generating activities, it also raised £239.4m of net proceeds from the start of the pandemic in April 2020 by placing ordinary shares. New shares with selected institutional investors. The proceeds were used to clear the company’s limited debt and provide additional liquidity if needed.

A year later, the company issued £500m of convertible bonds with a 0.75% coupon due in April 2026 as part of a restructuring programme. The proceeds will be used primarily to support the company’s international growth program, but will also be used to refinance the company’s acquisitions. Topshop Brands. The initial conversion price was set at £79.65 per share, more than 6x the current share price, meaning a conversion is unlikely to happen anytime soon.

The company has a revolving credit facility of £350 million in addition to £407 million in cash.

Decreasing symptoms

Author. Information from company reports

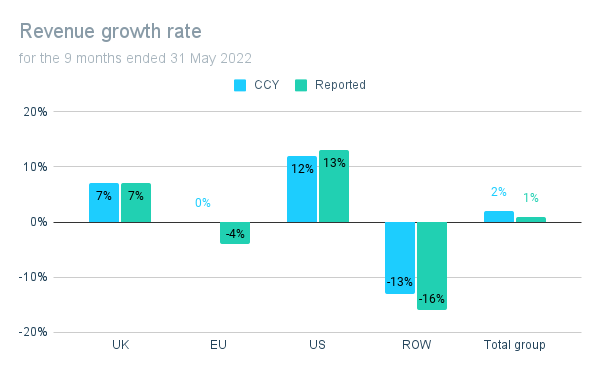

There were signs of a slowdown in the company’s Q3 trading results for the nine months ended May 31, 2022.

Nine-month revenues increased 1% over the same period last year, a significant slowdown compared to the 20% annual sales growth rates achieved in recent years. While overall sales were up, management reported that net sales were impacted by the increased revenue as the benefits related to Covid-19 finally reversed.

Author. Information from company reports

Despite the headlines, things are not all bad and there are signs of continued progress in many areas.

The company continued to expand in the US with double-digit sales growth, which increased by 12 percent over the same period last year. This partnership with Nordstrom is supported by continued growth, with ASOS products available in more stores and online with an expanded product range.

And sales in the EU and ROW both decreased, partly due to negative currency movements and also due to the company’s decision to stop sales in Russia in connection with the situation in Ukraine. Although these issues still affect profitability, they are reduced to some extent

The whole year view is reduced

| FY22 guidance | October 2021 | June 2022 | Change |

| Income growth | 10% – 15% | 4% – 7% | Lowering |

| Profit before tax (£ million) | £110 – £140 | 20 – 60 pounds | Lowering |

As part of a Q3 marketing update, management lowered its guidance for the year, citing uncertain consumer buying behavior and continued high return rates. Revenue growth is expected to be less than half of initial guidance of 4%-7%, reducing PBT expectations to £20 million to £60 million.

Net debt is expected to increase to £75 million-£125 million by year-end due to lower profits and increased inventory levels. At this level, debt remains in a manageable range even after adding lower earnings, representing 1.5x-2.5x estimated EBIT leverage for FY22 (based on management’s lowest revenue growth estimate and an EBIT margin of 1.3 percent for the company. Earned in H1 FY22).

High medium-term targets

The company has medium-term targets of £7 billion in annual revenue and an EBIT margin of at least 4%, but the timetable for achieving these has been extended by a year to 2025/26.

Achieving these targets means doubling the business volume at 15% – 20% CAGR compared to FY21 levels. However, with a total addressable market of £430 billion across the UK, US, Europe and major RoW territories, the company’s 21-year revenue represents less than 1% market share, so there is room for growth.

Accidents

We see key risks for investors to include:

Inflation/economic conditions

The company is already reporting signs of slowing growth, they believe before Consumers have really felt the impact of inflation. A persistently high cost of living will squeeze disposable incomes and reduce demand.

Functional capacity

The company has higher operating expenses relative to sales as indicated by the 1.3% EBIT margin achieved in H1 FY22. As a result, the company’s profitability will see relatively small changes in sales and/or costs. The impact of this risk depends on the management’s ability to reduce costs if it occurs slowly.

Fast market

The company operates in a fast-paced market where consumer tastes and trends change dramatically, which risks falling out of fashion. However, the breadth of the company’s product offering, continued growth and positive trends in non-financial KPIs suggest that it can attract and retain customers.

Price

Our valuation approach focuses on determining the business’ true source of income – or “owner’s income”. While one uses non-GAAP ‘adjusted’ measures with caution, we believe that adjusted PBT represents a reasonable starting point in ASOS’s case.

In the year As of July 27, 2022, the company’s shares trade at approximately £10, giving the company a total market value of £1.03 billion. This represents a 10x price-to-earnings multiple based on FY21 results. This increases to 21x – 60x depending on management guidance for reduced profitability.

However, FY22 estimates reflect short- to medium-term headwinds that will eventually decline and we believe the company’s long-term prospects are compelling. As a result, we believe the FY21 results are more representative of the company’s true earnings power.

The company’s own medium-term plan is to achieve revenues of £7bn by 2024/25, with a minimal EBIT margin of 4%. Using this as a basis, we estimate that PBT if these are realized would be in the region of £195m, which reflects the price-to-earnings multiple of just 5x achieved and the current valuation.

If the company starts to achieve its target, we see the potential for a valuation of £1.85 billion (based on a hypothetical 10x earnings). At this rate, if these goals are achieved in FY25, growth of nearly 90% will equate to 24% of annual revenue. Even if we assume these targets take two years longer than planned, they will reward investors with a 14% compounded annual return.

Conclusion

Overall, we think the sell is oversold and assign a “Buy” rating to the current price, taking into account relative risks and strengths.

Yes, there are signs of slowing down, but it is important to look at these against the strong sales growth of previous years and consistently strong fundamentals. A broader recession is a real possibility, but the company enters this period with a healthy balance sheet that will help see it through tough times.

Investors hoping for a quick recovery should steer clear, but the fundamentals support a long-term investment case.

[ad_2]

Source link