[ad_1]

For founders who have only been in the startup scene for a few years, the last few months of chaotic fundraising cycles, high valuations and tech company layoffs can feel like the sky is falling.

When he loves unicorns Gopuff It lays off more than 10% of its employees within six months, or companies that say they’re ready to go public, like an HR tech company. PhenomKeep quiet about those plans, it’s easy to worry.

Philadelphia in particular has seen several years for venture capital in the past. It did well even in the uncertain first pandemic quarter, and 2021 turned out to be the city’s best year ever, with $8 billion in VC deals. But that wild growth is slowing.

In the second quarter of the year, the US saw a slowdown in national investment. Funding, in particular, has lagged, and IPOs continue to be “virtually nonexistent for VC-backed companies in 2022.” Q2 2022 PitchBook – NVCA Venture Monitor found.

Since the beginning of 2022, many things have changed for emerging technology companies. Who does it affect? And should you worry?

What’s happening in the venture capital market.

In general, the VC market—including how companies determine round sizes and prices—tracks the public market pretty well. For founders looking for growth capital on a regular basis, this is tough news as a possible recession is headed our way. While the U.S. isn’t official right now, supply chain issues, rising inflation and the cost of doing business combined with the war in Russia and Ukraine make it a challenging time for business owners.

In the year As early as 2022, investors were dealing with potentially volatile valuations, with software startups devaluing by 100 times their annual earnings, PitchBook reported in January.

Pulling a gopuff. (Courtesy photo)

We were at a time when investors were caught up in fast, big deals, like Red and Blue Venture Founder Brett Toche He said during an investor panel in May. It was normal to meet with a company and it was expected that a decision would be made on the agreement within a day or two. Investment due diligence was going out the window.

“I hate hype and chasing trends,” he said. “Am I caught? Yes. But we evaluate each deal on its own merits.”

But we’re entering a cooling period of VC and market slowdown in the last few months. Companies that have grown in the past year may or may not have a “down round” where they raise at a lower price than the previous round. Greg Seltzera junior attorney and partner at Ballard SparHe told me.

Startups can use low-round average anti-dilution protection to reduce the cost of converting preferred stock into common stock for existing investors, Seltzer says, “not for startup mortality, but for early funders.” “

We’ve been here before.

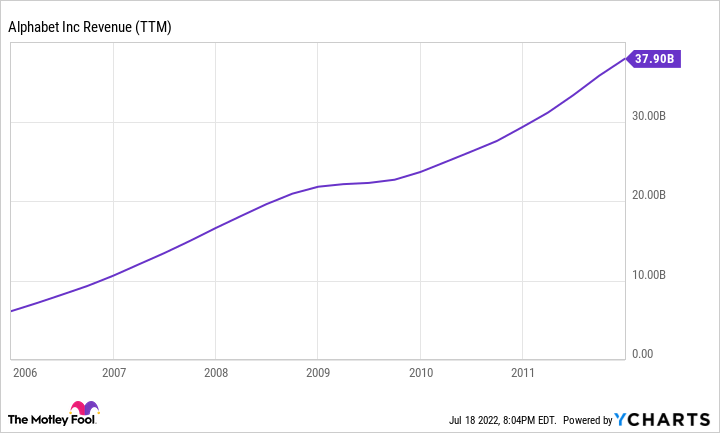

Abe KwonA partner in Trauman Papers The Emerging Company and Venture Capital Practice, however, says that while this period may be viewed, it has often passed. In the year Companies that tried to raise money during the 2008 financial crisis went through their own boom cycle, similar to the dot-com era of the early 2000s. Since then there has been a pretty steady increase in reviews and deal rates.

Abe Kwon. (Courtesy photo)

Repeat founder. Rick Nucci It has now worked on various marketplaces in its fundraising cycle. When it starts Bumi In the year In the early 2000s, broader economic indicators combined with fundraising in the Philly area — not known for its technological prowess at the time — created a difficult time for early-stage funding.

“At the time, we were valuing these companies on strange things,” Nucci said. “Eventually the industry improved, but all of the early 2000s were very difficult.”

This was a lost time for Philly Tech’s long-time ecosystem developer. Mike Krupit He told me this spring.

“The 2000s are dead. We just finished the recession and right after the dot-com crash the focus was on real estate and politics. Most of the investors in high tech in Philly were unfamiliar with the space,” Krupit said. “There was no seed capital. There was movement toward the West Coast, lots of healing and licking of wounds, but nothing remarkable.

In the year In 2008, when Nucci wanted to raise Guru TechnologiesThe seed, things improved. But he still said he’s easily talked to 50 investors, all of whom have asked him why he’s building outside of the Bay Area. That view has since changed, when the Guru closed the recently released Series C AddNucci said the company was particularly looking for companies to locate their headquarters outside of traditional tech hubs.

“This ultimately yielded some benefits. But when I was 24 and started Bumi, I was like, ‘Who is this kid?’ There were credible things like that.” Nucci said. We knew it, but it was painful.

Guru co-founders Mitch Stewart (L) and Rick Nucci at Guru’s Center City headquarters. (Courtesy photo)

So what are companies doing in this market?

Kwon says he’s spoken to several VCs over the past few months and confirmed — yes, fundraising is still very much possible now.

“There’s still a lot of competition happening. Has it slowed down a bit? Absolutely,” he said. “And the reviews seem to have gone down a bit.”

“There seems to be some feeling about it,” he said. Some people think that during the last growth cycle, valuations were so high that the market was overvalued. You see the movement now as a kind of market correction, with a bust cycle.

And while some may say last year’s fundraising and pricing was a founder market because companies can raise more while giving away less, others argue that inflated valuations could negatively impact founders in future rounds.

How are startups and growth companies doing now? They are self-supporting, cutting costs and staying put.

“This situation is not Philly-centric,” Seltzer said. Like my Philly clients, we have clients all over the country who are looking at affordable prices.

(Left to right) Ballard Spahr attorneys Terrence M. Grugan, Brianna A. Willand and Gregory L. Seltzer. (Courtesy photo)

He pointed to recent layoffs at Gopuff, which cut about 1,500 employees earlier this month to “improve operational efficiency.” A Callowhill-based company backed by international investors SoftBankis one of at least 10 companies in the company’s portfolio that have gone out of business after taking in millions in venture capital.

Layoffs are an unfortunate but common response to technically unprofitable companies facing economic struggles both internally and externally, Kwon said. It comes down to knowing your runway.

“They have income but it is covered by their expenses. “Many of the company’s profile will take VC funding thinking they can take the money at the expense of control and equity, but hopefully it will be profitable,” Kwon said. “Most experienced entrepreneurs know that they will always look at that number and raise more money before that runway ends. Unfortunately for the employees, they sometimes make the tough decision to extend the runway through layoffs.”

Seltzer said Philly’s low cost of living and operating costs have helped local companies survive the uncertain economic conditions somewhat better than in other regions, but founders are still entering major projects on a temporary or general basis. Plans to go public, start hiring, or raise a large round are done carefully.

We’ve seen Philly unicorn and HR technology company Phenom take the next step slowly. Just after raising a $100 million Series D at a $1.4 billion valuation last year, CEO I don’t understand He said he felt an IPO was inevitable. As recently as last April, he said that move could happen “soon.”

“Going public is definitely part of that journey, no doubt,” he told Technical.ly.

Part of the Philly-area Phenome Group as of January 2020. (verified photo)

When we checked earlier this week, Phenom CFO Devinder Atwal As the company continues to expand its product offering, win new customers and grow its business, the IPO is still “a logical step in that journey,” he said.

But the right timing has to be determined because “we need to manage a lot of factors, some of which are out of our control,” he said, citing global financial, geopolitical and supply chain challenges.

Go out and collect money

Kwon’s advice to the early-stage founders he works with is to not panic, panic or get caught up in Twitter threads.

“Yes, the reviews are down, and the volume and volume is down a bit, but whether that continues or not is anybody’s game,” he said. “Companies are still getting funding right now. Don’t buy into the negative paranoia.

Seltzer agreed, saying the VC community remains strong despite the low valuations.

“My VC clients remind me that they’re in the business of investing in companies, they have capital, and it’s not about their LPs sitting in a fund and achieving what they envisioned,” Seltzer said. “I’d tell founders to keep doing the Philly thing – keep loading for now, if you’re comfortable, but now it’s possible to scale up. Prices may be low, but the lights will stay on.

-30-

[ad_2]

Source link