[ad_1]

Feb 7 (Reuters) – Retail investors are piling into smaller companies building artificial intelligence tools as competition heats up between Google-parent Alphabet and Microsoft for leadership in the next big growth driver.

ChatGPT’s viral success has shifted the focus of AI on Wall Street, reminiscent of the blockchain hype of a few years ago when stocks of companies linked to the technology soared.

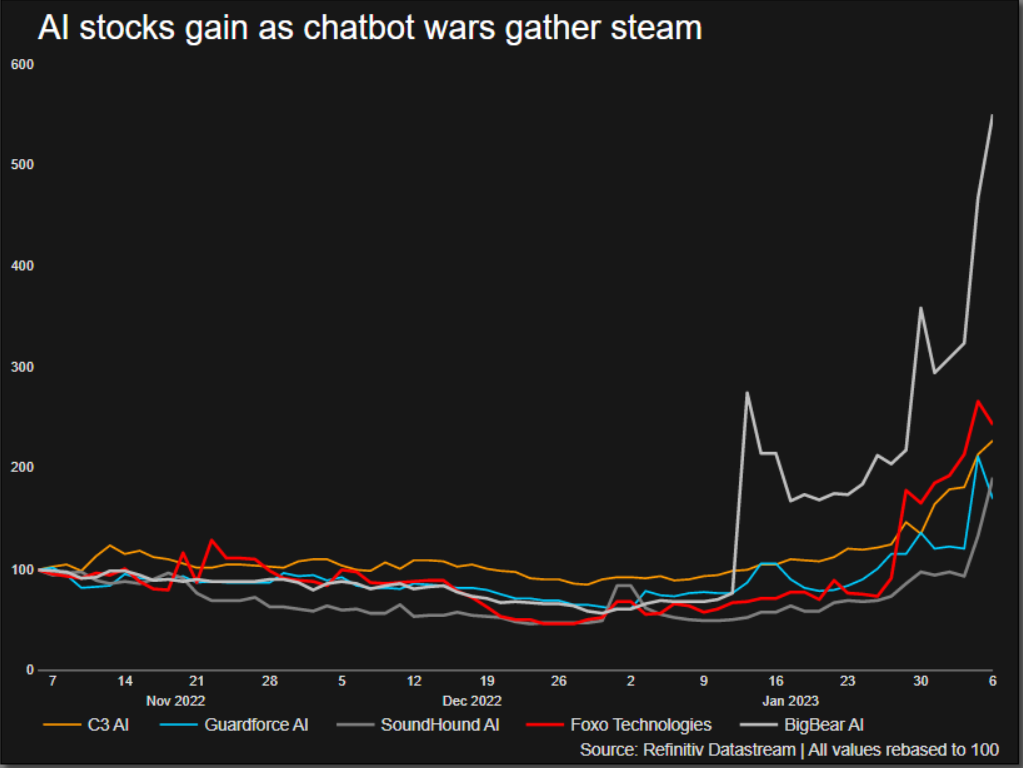

$3 billion AI software company C3.ai ( AI.N ) was the fifth to actively trade on Fidelity’s platform for retail investors on Monday, recording $31.4 million in daily retail revenue, according to Vanda Research. The stock slipped 4.5% on Tuesday, but is up 140% this year.

“Small-cap companies have a bigger component of AI than their larger counterparts,” said Matthew Tuttle, CEO of Tuttle Capital Management, explaining why retail investors are focusing on smaller companies.

Latest updates

See 2 more stories

Tuttle said he shorted C3.ai shares a week ago, but was looking to switch to the long side because “that’s where the action is.”

Shares of SoundHound AI ( SOUN.O ), which provides audio AI platform services, and Thai security firm Guardforce AI ( GFAI.O ) have more than doubled this year, while analytics firm BigBear.ai has gained ninefold. .

SoundHound AI was last down 1% and BigBear.ai was down 9%, while Guardforce AI (GFAI.O) was up 7%.

Shares of ChatGPT parent Microsoft ( MSFT.O ), which backs OpenAI, gained 2% ahead of a possible later-day AI launch.

Alphabet ( GOOGL.O ) said on Monday it will launch its chatbot service Bard and more artificial intelligence for its search engine as well as developers.

Microsoft is in a strong position in the AI race with its close partnership with OpenAI and Azure’s capabilities around computing and data, said Barclays analyst Raimo Lenschau.

“If you’re going to invest in AI, you have to consider the fact that these smaller companies are competing with Goliath and that Goliath has the scale, agility and capital to own the space,” said Etoro analyst Callie Cox. Recent interest in AI.

US-listed Baidu Inc soared 15% on Tuesday after the Chinese search engine said in March it would complete internal testing of a ChatGPT-style project called “Ernie Bot”. Earlier in the day, a clutch of Chinese AI stocks also rallied.

“The market is trying to find what it wants to be the next big thing that will drive the markets in the next 10 years, and AI is that,” said Chen Zhao, global strategist at Alpine Macro.

“It may be speculative in nature, but everyone thinks it’s going to be a big deal in the future.”

Reporting by Meda Singh in Bengaluru; Additional reporting by Bansari Mayur Kamdar and Akash Sriram in Bengaluru, Editing by Sriraj Kalluvila and Anil D’Silva

Our Standards: The Thomson Reuters Trust Principles.

[ad_2]

Source link