[ad_1]

Array Technologies (Arrange) shares jumped 10% in the extended trading session on Tuesday after the company’s second-quarter numbers beat estimates. Array provides tracking solutions and services for solar projects.

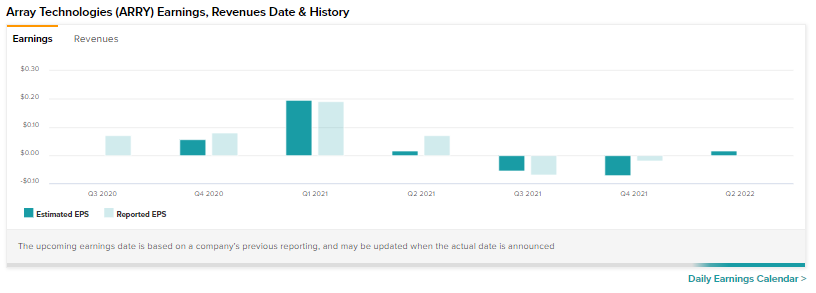

Adjusted revenue from the STI Norland acquisition rose 116.2% year-over-year to $424.9 million, beating estimates by ~$88 million. Excluding the territorial impact, Array still posted organic growth of 79% due to improved volumes and average selling price. EPS of $0.09 also, comfortably beat consensus by $0.07.

Kevin Hostetler, CEO of Array, said: “This significant growth not only enhances Array’s product and service offerings, but also our ability to provide flexible solutions to our customers’ changing demand landscape, as well as our continued focus on operational excellence. He said.

Remarkably, along with top-line growth, the company achieved a third consecutive quarter of improvement in gross margin (11%) on the back of a better contract price mix.

Importantly, at the end of June, Array’s total completed contracts and order wins were $1.9 billion, representing a 110% jump from year-ago levels. Additionally, aided by improved metrics, Array sees revenue land between $1.3 billion and $1.5 billion for the full year of 2022. EPS is expected to be between $0.25 and $0.35 during this period.

Is Array Technologies a good investment?

Shares of the deal are now up 55.1% in the past month, and JP Morgan analyst Marc Strauss expects that run to continue. The analyst reiterated his buy rating on the stock, increasing his price target from $28 to $33. This represents 80.43% potential upside.

Street, meanwhile, has a moderate consensus rating of Buy and an average price target of $18.18.

While Wall Street is cautiously optimistic, bloggers are good at bargains. A deeper dive into our data at TipRanks shows that 100% of bloggers who follow Array have a strong sentiment on the stock, compared to a sector average of 65%.

Major macro positives are building for the deal.

After experiencing losses in the last two quarters, Array’s strategic moves are starting to pay off, aided by better pricing. Importantly, the recent executive order targeting domestic clean energy remains a major positive development. As a result, Array expects ~$240 million worth of projects to move forward.

Additionally, the expected fall in inflation may provide clarity to the incentive structure for the solar sector.

Read full description

[ad_2]

Source link