[ad_1]

Can AI automate corporate decision-making? It’s an exceptionally broad and challenging task – assuming it’s possible. But that’s exactly what startup Arena says it will do, fueled by its lead round of funding ($32 million). First Capital and Goldcrest Capital from Founders Fund, Flexport and a colorful cast of characters, including retired general David Petraeus, Peter Thiel and Y Combinator CEO Michael Seibel.

New York-based Arena It is the brainchild of Pratap Ranade and Engin Ural who co-founded the company in 2020. The duo set out to build a platform that uses predictive algorithms to help businesses formulate strategies for managing “uncertain” environments – such as a global pandemic.

Ranade, who attended Stanford and Columbia, was previously an associate partner at McKinsey and founded Kimono Labs, a web-scraping startup acquired by Palantir in 2016. Before joining Palantir as an engineer, Ural was an application developer at Goldman Sachs. Meet Ranade.

Arena services are wrapped in a lot of hyperbolic language, but are relatively straightforward in their implementation. One of the startup’s tools uses AI techniques to simulate the economy, testing millions of product cost structures to arrive at an optimal model for the company. It’s similarly reminiscent of the AI Economist, a Salesforce-developed research environment that runs millions of simulations to come up with plausible fiscal policy.

Beyond pricing, Arena can simulate things like inventory management. When giving advice to clients, Ranade says he blames “gaps” on clients (eg, execs) in the economic environment, such as “headwinds from congested supply chains.”

Image Credits: Arena

“Without Arena, enterprises typically approach these kinds of decisions in a few ways: hire a large team of people to make these decisions, buy decision-support software to help people on the job make data-driven decisions, or do nothing and continue to be pushed through traditional processes,” Ranade told TechCrunch. “Each of these approaches has its merits, but they fall far short of the full promise of AI: truly intelligent machines augmenting human capabilities on our behalf,” he said in an email.

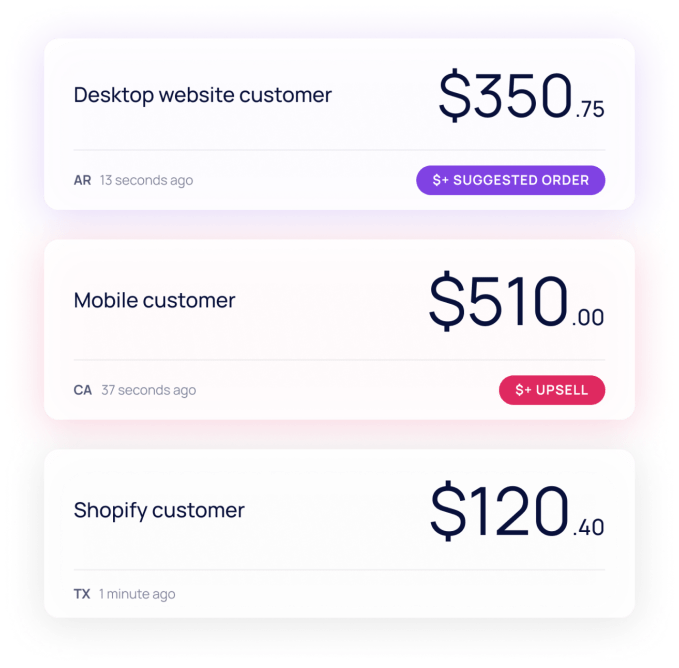

Arena’s customers feed the platform with features such as SKU-level sales, pricing, inventory at the location level and shopper behavior during e-commerce sales. Arena augments that data with the context of what Ranade calls a “demand graph,” which provides broader, real-time market signals. Together, these inputs are used to create the simulations mentioned above, which in turn generate models for prices, commodities and markets that are then fine-tuned to global data.

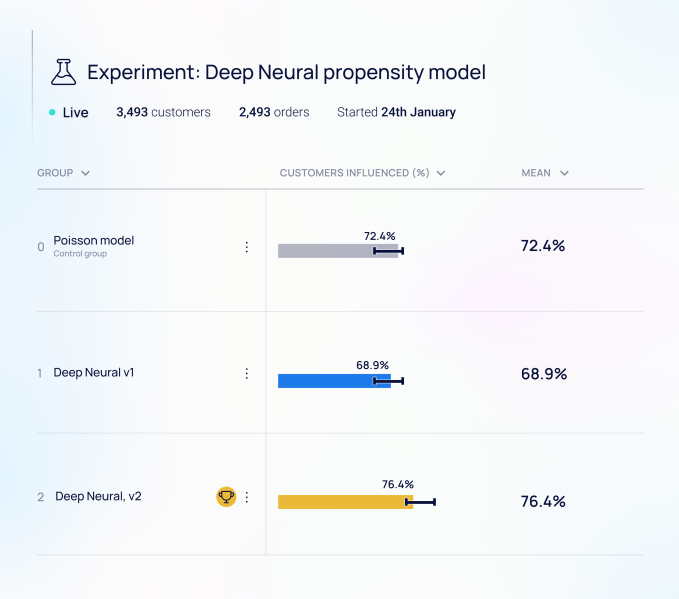

Today, when more sophisticated, data-driven business-to-business companies run promotions, data scientists analyze past data to determine the best type of promotion to run for a specific product in a specific market. They then load the promotion into their enterprise resource planning system, and analyze the performance weeks later,” said Ranade. “At Arena, this entire process is automated… Under the hood, Arena’s AI actively adapts to changing pricing trends and adjusts to customer behavior, making adjustments as it learns in real time to drive bottom line impact.

Ranade presents the amazing Arena customer claims – including “Choose” Anheuser-Busch InBev and other Fortune 500 brands in e-commerce, automotive, manufacturing and financial services. Thanks to technology, they are able to lower the costs of goods and services and make their supply chains more robust. It’s not clear how true that is. But for what it’s worth, Ranade says Arena is currently making “millions” of decisions across both digital and physical channels.

“We’ve found Arena to be a step change in value because we’re not only introducing a new way of decision-making to the organization, but also complementing the existing infrastructure of the C-suite and their organizations,” said Ranade. . “The outbreak was really a vindication for us. Our technology is designed to handle shocks – cases where past data does not represent the future. The outbreak has demonstrated that our technology can deliver significant and measurable results for our customers, especially in highly dynamic decision environments.

Image Credits: Arena

Arena’s Series A closing today marks the company’s first external raise, Ranade told TechCrunch. The business has grown “viable” up to this point. But Ranade and Ural believed that taking the venture route would allow them to expand into Arena’s core technology as they grow into industries like manufacturing, renewable energy and financial services.

To compete in the growing data analytics products market, it will definitely need a large war chest. O9 Solutions, which applies analytics to supply chain and inventory planning and management, paid the company $2.7 billion in a recent $295 million round of funding. Untracked, Pecan.ai and Noogata compete directly with Arena by offering tools designed to predict metrics such as customer lifetime value, churn and retention, sales and on-time delivery.

xCash is free flowing when it comes to enterprise analytics — the global big data and business analytics segment could be worth nearly $700 billion by 2030, depending on which analyst you believe. But the challenge for vendors like Arena is convincing customers. Keep your promises. A recent NewVantage Partners survey found that many established companies continue to struggle to become “data-driven,” with less than a third saying they have a “well-defined” data strategy. For many – especially small and medium businesses – the return on investment is unclear.

Arena’s headcount stands at 50 people today, with 90% of the engineering, data science and product development staff in the startup’s downtown office. Ranade did not respond to a question on whether Arna plans to hire in the next year.

[ad_2]

Source link