[ad_1]

Yuuji/iStock via Getty Images

An often-delayed AR/VR device with Apple Inc. (NASDAQ:AAPL) will finally appear to launch in the next few weeks. The tech giant is expected to finally release the mixed reality headset globally Developers Conference (“WWDC”) in a few weeks after some attention from executives. Mine Investment thesis Apple stock remains the biggest bearer, selling to perfection, and a product that can justify this current price is headed to the finish line.

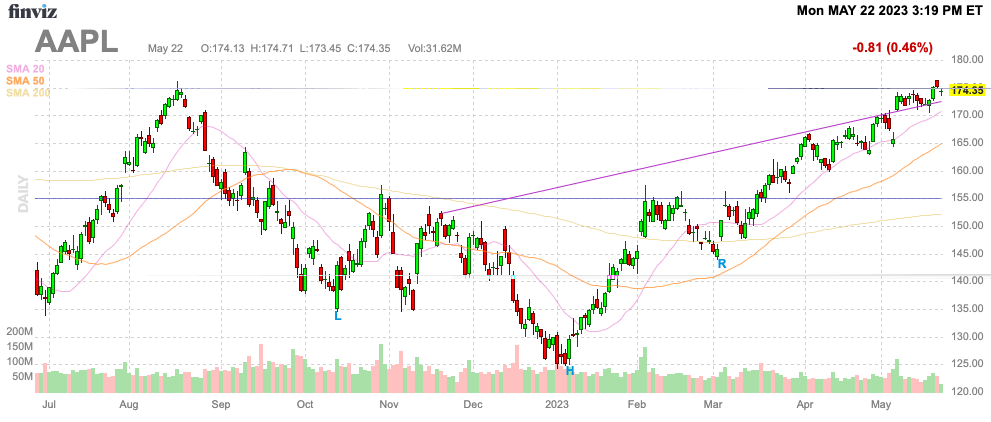

Source: Finviz

Tim Cook’s old product

Apple CEO Tim Cook will die on November 1 at 63. When the next big product category comes out, the executive may not be in charge of the tech giant — potentially the Apple Car in 2026 or beyond — but he’ll make the AR/VR device part of it. Heritage.

The CEO had the first rank The goal of smart glasses is that users can wear them all day long just like glasses. The device performs daily tasks like sending emails, playing games, etc. Bloomberg Tech reported Tim Cook and other executives were heavily involved in the product as the device shifted more toward AR devices than competitors like the Quest Pro. Meta Forums, Inc. (META).

Production has been regularly delayed over the past few years, a fault that appears to be tied to a lack of leadership from Cook and other executives such as senior vice president of hardware technologies Johnny Srouji. Mr. Srouji did not want to divert high-performance chip development assets away from the iPhone. The AR/VR device has been in development since at least 2015, with expected product announcements that are less innovative than devices currently on the market.

according to Bloomberg TechThe headset forecast is now back to 1 million units, down from the original plan for 3 million units. The ultimate goal is for the AR/VR device to match the iPad and Apple Watch with $25 billion in annual sales, but the estimated $3,000 device now won’t even generate $3 billion in sales by FY25.

While the device won’t be announced until June 5 at WWDC, the launch could be as early as 25 years old. Our Dead Money article predicted how critical new product sales would fail to meet bearish forecasts in March 2022, and this is now playing out.

Some of the interesting data points are Apple’s plan to sell its products at cost only, so the tech giant doesn’t even make any profit on these devices. To make matters worse, the battery pack resides in the user’s pocket with a power cord in a less attractive design shift than Tim Cook’s original concepts.

Influential Apple analyst Ming-Chi Kuo He warned of a delay until WWDC, which has a portion of 2023, is sold out. The tech giant has been wisely pushing back the release of the product due to concerns over market feedback, the reality device with a battery pack.

The big problem here is that Apple is missing out on its next device roadmap and ultimately smart glasses that fit Tim Cook’s original goal. A lack of clear involvement by executives in the product development of AR/VR devices appears to be a major contributor to product delays, with smart glasses development almost at a standstill.

On the flip side, our previous research highlighted a well-developed device roadmap from MetaPlatforms. In addition, CEO Mark Zuckerberg has a vision for the Metaverse and is investing billions every quarter, while Apple is only spending $1 billion on future products.

Michael Gartenberg, a former Apple marketing executive, may have made the case for the product’s release this way (emphasis added).

One of them Great technology flops I guess there’s always… a lot of internal pressure for the next big thing.

The former executive offered the following expanded view Insider:

Apple makes high-cost devices that sell for millions with strong profit margins, not ‘experiments’ that are unveiled to the public and sold to deep-pocketed developers or enthusiasts. This is a broken model that Google tried with Glass and Microsoft tried with HoloLens.

All signs point to Mr. Gartenberg being right, and Apple needs to explain why this AR/VR product was released after so many delays.

No price is given for failure.

Our negative outlook on Apple stock is disconnecting it from the stock market. Apple is struggling with product development, such as AR/VR and the future Apple Car, which are needed to drive revenue growth in the coming years.

Loop Capital exited by downgrading Apple to a hold based on risk concerns over iPhone shipments. The tech giant had already predicted a ~2% decline in FQ3’23 sales, and now analyst Ananda Baruh sees risks for the next two quarters.

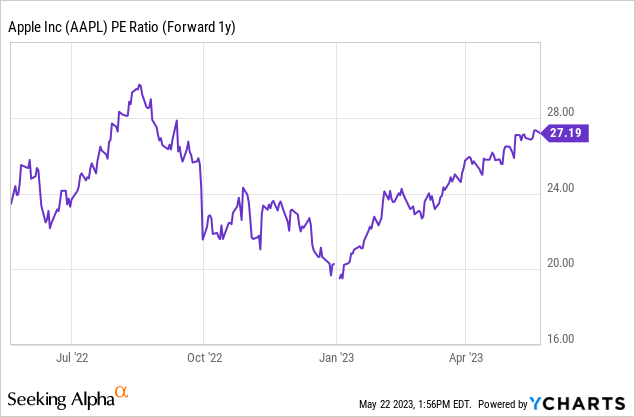

What is crazy is the decision to leave the price target at $180. Apple is trading near all-time highs and is valued at 27x forward EPS estimates, which is not a valuation that should have growth questions.

The analyst community is content to let the stock take care of itself without bullish views. The average analyst price target is now just $179, giving up a minimal 3% upside.

take away

The key investor takeaway is that investors have no reason to be so bullish on Apple Inc. stock. The company could launch an AR/VR device in a few weeks and deliver a flop, which could change the outlook for AAPL stock going forward.

Apple investors should use the stock trading as another opportunity to unload the stock at an all-time high.

[ad_2]

Source link