[ad_1]

Although the investor cautionary tale spread throughout the startup world amid the economic downturn, some types of startups were a little more sensitive to market conditions. The global supply chain pandemic is one of the major industry disruptions, so it probably goes without saying that companies that deal with global supply chain issues are a good proposition for jaded capitalists.

Over the past two months, Germany-based Integrity Next has seen companies invest $109 million in ensuring ESG (environmental, social and governance) compliance across their supply chains. Texas-based Overhaul took $73 million for a supply chain security platform; San Marcos-based Everstream has secured $50 million to bring insights to predictive analytics. France’s Sesame raised $37 million to provide companies with ESG supply chain insights. And India’s Pando has invested $30 million to grow its freight management platform.

Today, it’s the early wave’s turn to show that global supply chains are still one of the hottest tickets to raise VC bucks. The Austrian startup raised €18 million ($20 million) in Series A+ funding after raising an 11 million euro ($12.3 million) round eight months ago.

For its latest cash infusion, Prewave attracted European VC heavyweight Creandum, which has previously backed the likes of Spotify, Klarna and iZettle.

Risk factors

Early wave founders Harald Nitschinger and Lisa Smith Image creditsPre-wave

In the year Founded in Vienna in 2017 by Harald Nitschinger and Lisa Smith, PreWave bills itself as a comprehensive supply chain risk platform that covers the “risk lifecycle phase” by identifying, analyzing, mitigating and reporting these risks.

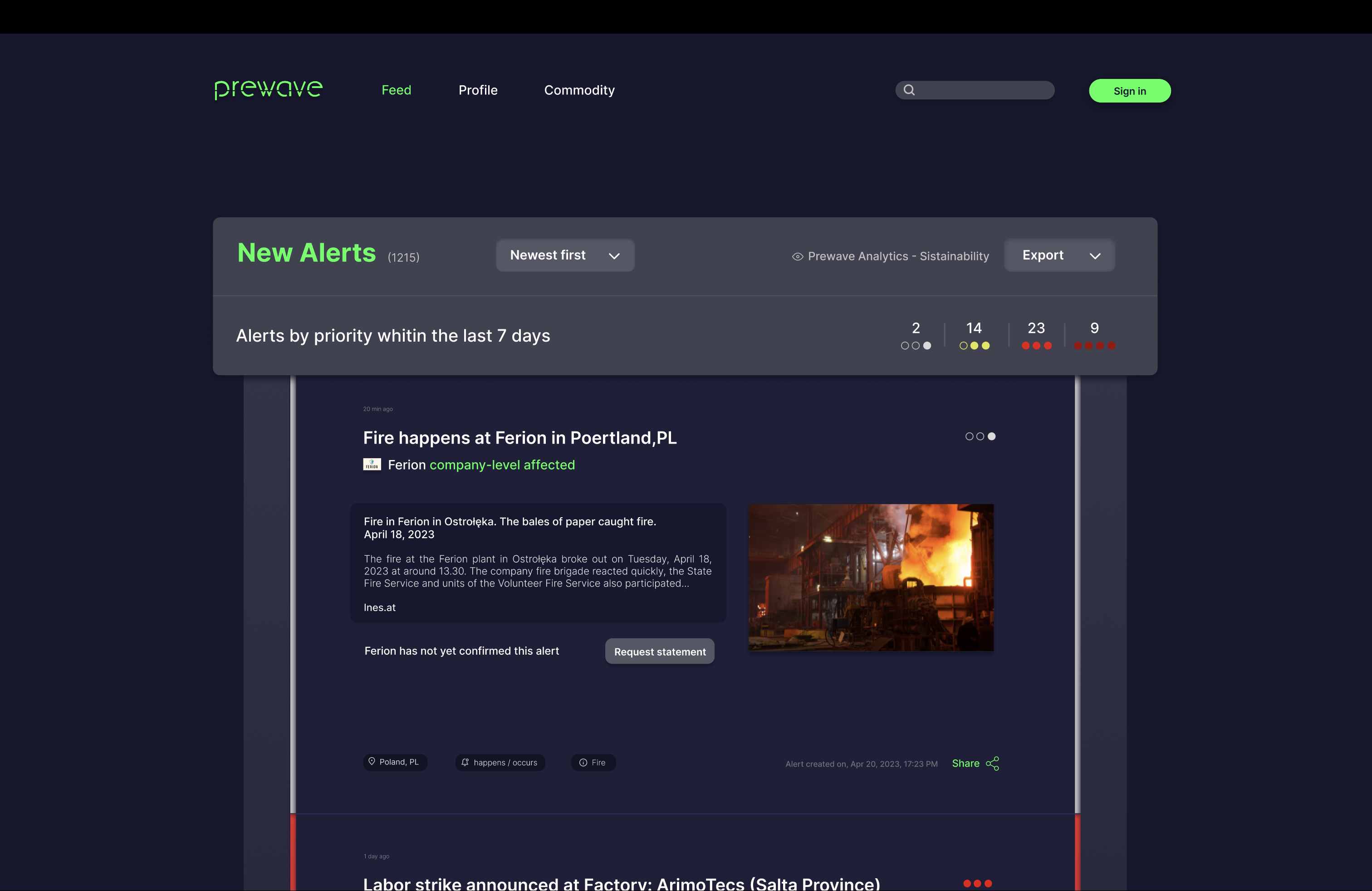

For example, companies like BMW, Lufthansa and PwC use Prewave to track every element in their supply chain through channels such as social media, news reports and other data sources. But external factors such as earthquakes, floods, political unrest, lawsuits or labor strikes—anything that could affect the international movement of goods.

Pre wave food Image creditsPre-wave

The company says it has developed its own proprietary “thinker” that finds publicly available data in dozens of languages.

“Rather than relying solely on external supply chain data providers, having our own browser allows us to continually expand and improve our coverage,” Smith explained to TechCrunch in an email. “We also connect to multiple social media platforms and use external data sources for certain types of events, such as USGS (United States Geological Survey) for earthquake data or GDACS (Global Disaster Alert and Coordination System) weather data. The combination of all these data points is local and global. Ensures comprehensive coverage of supply chain risk events.

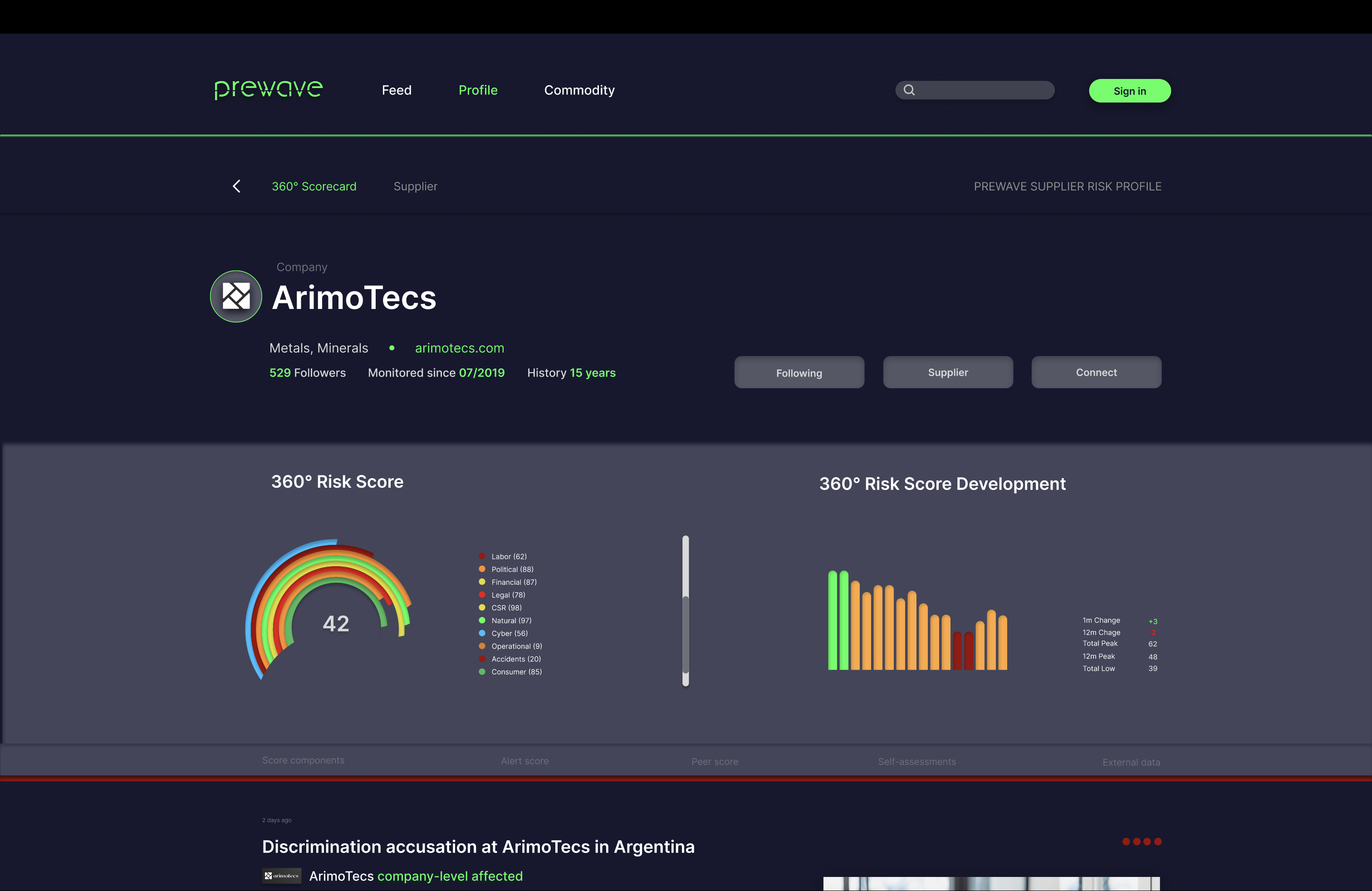

Pre-Wave aggregates all data and provides a dynamic supplier risk score proportional to the new data entered.

Pre wave provider page with 360 degree score card Image creditsPre-wave

Supply (chain) and demand

There are several reasons why the demand for supply chain awareness is increasing, beyond improving the bottom line by eliminating disruptions. These include legal obligations, for example Germany recently passed a new supply chain law requiring large companies to monitor human rights violations and environmental risks in their supply chain. A similar directive is being proposed for the wider European Union (EU).

And then there’s the simple fact that consumers expect the companies they do business with to have at least some moral and ethical principles and not just the sentiments of shareholders.

“Supply chain technology has weathered the economic headwinds in recent years as it has become increasingly important for companies to optimize operations, adapt to external threats and reduce costs in the supply chain,” Nitschinger told TechCrunch in an email. “The pandemic, for example, has exposed critical vulnerabilities in global supply chains, making it clear that businesses need to invest in technologies that improve visibility and sustainability, predict potential disruptions, and enable more agile and responsive strategies. As businesses continue to face economic challenges, the importance of supply chain risk management technology can only be expected to grow.

With another $20 million in the bank, PreWave plans to double its recent headcount from 20 employees at the beginning of last year to more than 100 today, which Nitschinger said “represents significant revenue growth.” It was seen at the same time.

In addition to lead backer Creandum, Prewave’s latest investment includes contributions from Ventech, Compass, Seed+Speed, Signalita, SpeedInvest, Working Capital Fund and Xista Science Ventures.

[ad_2]

Source link