[ad_1]

The Federal Reserve’s National Small Business Lending Survey provides up-to-date insights on small business financing needs, business performance and emerging issues.

The annual survey is conducted online and distributed through a network of local, regional and national partners such as chambers of commerce, non-profits and small business development centers. Through our partners, we have access to various segments of the small business market, including startups, women’s and micro-enterprises, rural businesses and micro-enterprises.

As one of the largest data sets, the survey provides valuable information on small businesses for policy makers, service providers and lenders. The 2021 survey, which collected more than 17,000 responses, revealed a range of challenges affecting small businesses.

- The covid-19 pandemic

- Racial instability

- Growing wealth gaps

- Supply chain disruption

- Lack of labor

- Rising inflation

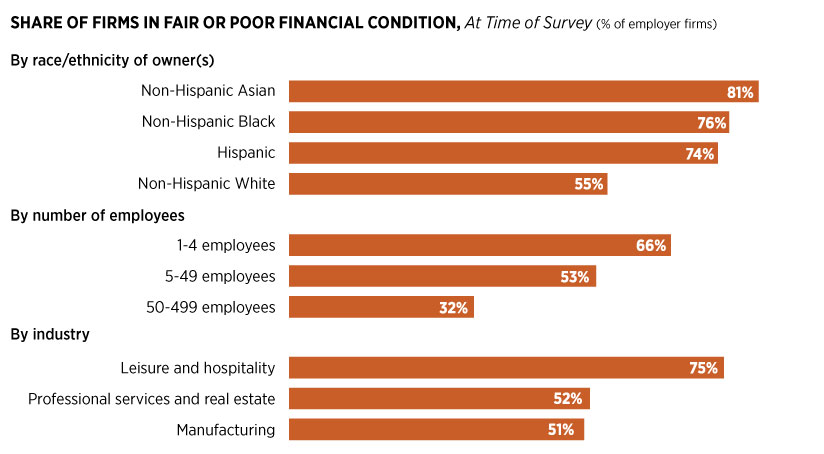

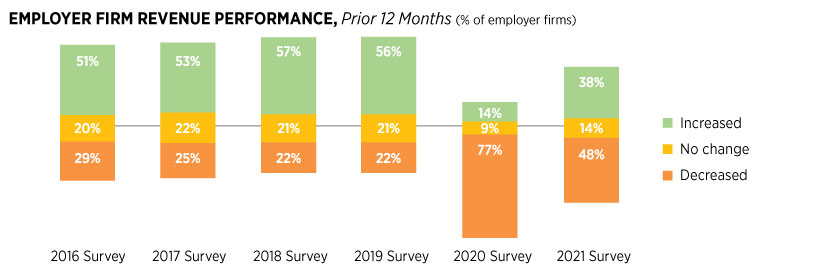

For example, small businesses owned by people of color, small businesses, and businesses in the entertainment and hospitality industries may be in fair or poor financial condition.

The financial situation varies in different categories of companies

Source: Small Business Credit Survey conducted September 8-November 19, 2021.

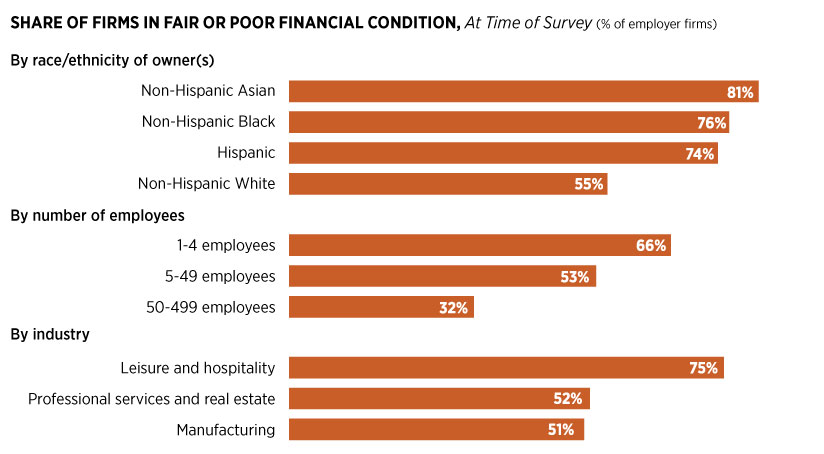

More than half of the employer organizations were in fair or poor financial condition.

Source: Small Business Credit Survey conducted September 8-November 19, 2021.

Other key findings from the 2021 survey include:

- The pandemic continues to have a significant impact on small businesses, with 77% reporting negative impacts during the survey period from September 8 to November 19, 2021.

- Hiring or retaining qualified employees and navigating supply chain issues were the main operational challenges companies faced.

- In the year In 2021, 66 percent of employer organizations received pandemic-related funding, down from 87 percent in 2020.

- The share of applicants who get the traditional financing they want has dropped from 51 percent in 2019, to 36 percent in 2020, and to 31 percent in 2021.

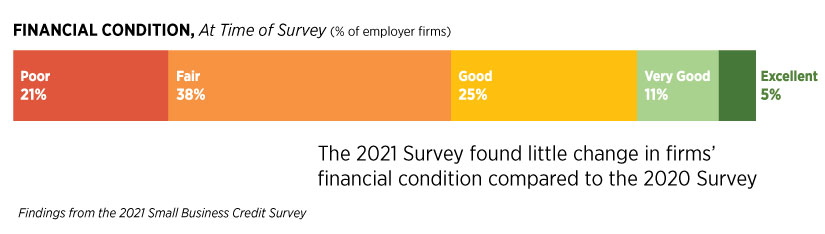

Revenue performance improved in 2021, but remained at pre-pandemic levels

Source: Small Business Credit Survey conducted September 8-November 19, 2021.

The Federal Reserve invites nonprofit organizations that work with or assist small businesses to become distribution partners for the Small Business Loan Survey. Your partnership will make a difference in amplifying the voices of small businesses. By becoming a partner:

- You help yourself – all partners who receive at least 50 responses receive a customized report that compares the businesses in your network to a national sample.

- You help small businesses – The survey allows us to reach businesses that are under-represented in other surveys – start-ups, rural businesses and women and minority-owned companies.

- You help America’s economy—feedback from the survey gives small business stakeholders insight, allowing them to make informed decisions that benefit the economy.

The 2022 Small Business Loan Survey runs from September 8th to November 4th.

Sign up to become a partner or take the survey. To learn more, please feel free to contact me at lisa.locke@stls.frb.org.

[ad_2]

Source link