[ad_1]

George the writer

Yesterday I wrote an article on the ProShares UltraPro QQQ ETF ( TQQQ ), which is a triple leveraged ETF tracking QQQ. I mentioned Amazon in that article.NASDAQ: AMZN) was the last big technology company I Most of the top 10 property reviews have put me off for now. This article covers Amazon in more detail, including recent acquisitions and Q2 earnings since my last article on the company.

Investment research

Amazon has been busy over the past couple of months. They completed a 20:1 stock split, reported Q2 earnings, and announced a couple of acquisitions. Q2 earnings were a mixed bag, but my focus at Amazon has always been on the AWS segment and more recently on the advertising segment. I have been an Amazon shareholder as long as these two divisions have been growing.

While it’s too early to write an informed opinion on recent acquisitions, I’m excited to see how the company plans to expand into the healthcare space. Shares had a nice 20% run last month but are still down about 20% YTD. While the valuation looks expensive on the surface, cash flow is expected to grow significantly over the next two years. Amazon is currently my favorite big tech company because I think the valuation is attractive, especially for investors with long-term holdings. Given the volatile markets we’ve had in 2022, a better entry point is possible soon, so waiting to buy stocks may be worth it.

Q2 earnings

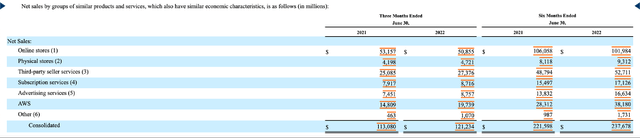

While inflation and high costs are taking a toll on Amazon’s e-commerce business, AWS and its ad units continue to grow together. The advertising segment continues to post double-digit growth, with AWS posting over 30% YoY revenue growth. While I like the other parts of the business in terms of customer acquisition and retention, AWS and advertising are where I focus as an investor because that’s where Amazon makes most of their money.

Income Growth by Segment (sec.gov)

I think we’ll see continued revenue growth for the company, but AWS and advertising will likely outpace other segments. As they become a larger revenue segment, margins improve over the long term. Amazon has also been busy with two acquisitions in recent weeks.

Purchases

Although this is after Q2, Amazon has announced two acquisitions in the last month or so. The first was for One Medical (ONEM) at $3.9B. The company is a health services company based in San Francisco. Another acquisition was iRobot ( IRBT ) for $1.7B. They make the Roomba robot vacuum and other robotic cleaning products. I have no opinion one way or the other on these acquisitions, and they are just a drop in the bucket for a trillion dollar company like Amazon.

Price

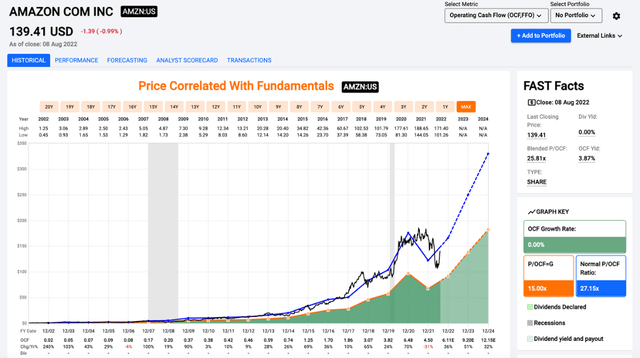

When it comes to evaluating Amazon, I think cash flows are a better valuation tool than earnings value. This is just my opinion, but there is a reason why the cash flow statement is the first financial statement in every quarterly report. The only company I’ve seen do this is Amazon. Anyway, back to the review. Amazon is trading at 25.8x cash flows, which is slightly below the average of 27.2x.

Cost/Cash Flow (fastgraphs.com)

While the large-scale nature of Amazon’s operating divisions makes it difficult to project cash flow, I think we’ll see some recent investments start to pay off. The speculation may seem rich at first, but if you look at the cash flow growth over the next couple of years, I think it will eventually show in the stock price. Amazon has begun repurchasing shares, which could be the start of an impressive capital return program to offset the downsizing.

Repurchases

Although Amazon is nowhere near tech giants like Apple ( AAPL ) or Microsoft ( MSFT ), they have started buying shares in the first half of the year. They bought back $6B in the first half of the year and have $6.1B left in their current purchase authorization. While this may not be enough to offset stock-based compensation, it does reduce the rate of dilution for existing shareholders.

Conclusion

Amazon’s latest Q2 earnings may not have been the quarter for Wall Street’s debacle, but shares responded. Although the year Due in part to the sales pressure shares have experienced so far in 2022, I think Amazon’s long-term future is still bright. As I mentioned before, I will be a shareholder as long as the high margin parts of AWS and advertising continue to grow.

The recent acquisitions will take some time to adjust, but for a company the size of Amazon, I don’t think either will move the needle. The findings show that the company will continue to look for growth opportunities internally and externally. The valuation is still attractive in my mind at 25.8x cash flows, especially with the expected growth in the coming years. While the returns aren’t stock-based compensation (yet), I think we could see more buybacks in the coming years. I’m still bullish on earnings after the next couple of years, and owning Amazon shares could yield impressive returns for investors with a long-term horizon.

[ad_2]

Source link