[ad_1]

A Chinese company that owns a 99-year lease in the port of Darwin has warned that its treatment at the hands of the Australian government runs the risk of scaring investors from other countries.

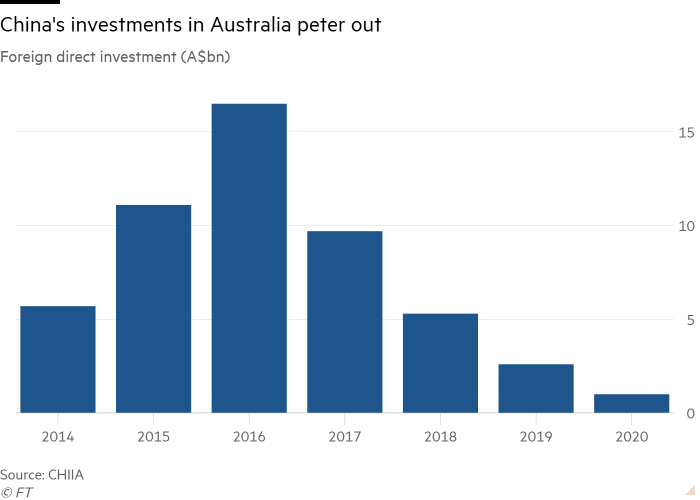

Landbridge, a Shandong-based company founded by billionaire Ye Cheng, was informed last month of a security review of its operations in the Northern Territory, which it bought in 2015 for $ 506 million ($ 380 million). USA). The development followed a sharp deterioration in relations between Canberra and Beijing and collapse in investment by Chinese companies in Australia since 2016, when revenues reached A $ 16.5 billion.

“My problem as a foreign investor is that the government approved us, we went through a very painful situation [review] process and for five years no one can think of anything concrete about what the problem is, “Mike Hughes Landbridge Australia CEO, told the Financial Times.

“We are not the Chinese government, we are a private company. If the review forced us to sell the port lease, it would certainly increase the sovereign risk for any foreign investor looking to Australia, not just Chinese investors. ”

The controversy provokes a ferocity debate between Australian security hawks and pro-business forces. The latter are concerned that the decision to force Landbridge to sell the lease threatens foreign investment.

Falcons reject that allowing a Chinese company to control vital infrastructure in the Asia-Pacific is risky.

A group of 15 right-wing MPs are also heading to China Merchants Group, a state-owned company that has a 50% stake in the port of Newcastle, the world’s largest coal port. Last week, the group called on the government to take a closer look at the port, arguing that participation gave the “Communist Party of China a geopolitical advantage over Australian coal exports.”

As the rage for Chinese investment intensifies, the opposition Labor Party has criticized the way the Conservative government manages Sino-Australian relations, arguing that it is igniting “nationalist sentiment” for electoral gain.

“The federal conversation about the conflict, about trade retaliation can and should stop,” Mark McGowan, the prime minister of the Labor state government in Western Australia, said last week.

In May, Canberra announced it reviewing if the controversial lease of the port of Darwin, which is near a U.S. naval base in the far north of Australia, is to be dismissed. It follows April’s decision to cancel two Belt & Road initiative agreements between Victoria and Beijing, a central element of President Xi Jinping’s foreign policy.

“My thought is that when the decision was made in 2015 [on the port lease] the circumstances were very different from those of 2021, ”said Peter Dutton, Australia’s defense minister, when announcing the review.

The decision to lease Darwin’s port to Landbridge has caused concern in Washington, while the Australian Strategic Policy Institute, a think tank, alleges that Landbridge has connections to the People’s Liberation Army and the Communist Party. . Landbridge says it is a commercial entity and this criticism is unfair.

Many analysts think the government will demand changes in leasing.

“Canberra could, for example, subject the lease to half-yearly security reviews,” said Richard McGregor, an analyst at the Lowy Institute. “Or they could adopt the nuclear option, which would also be the most expensive and risky, of breaking the lease.”

McGregor said Beijing would surely retaliate, although there were limited Australian investments of a similar nature to China. Sanctions have already been imposed on several Australian exports.

“Retaliation is less important than how the decision will introduce a new level of sovereign risk for foreign investors in Australia,” McGregor said.

Chinese companies have been cautious about making deals in Australia due to increased control of deals and the deterioration of bilateral ties. Chinese investment fell 61% up to $ 1 billion in 2020, up from $ 2.6 billion the year before, according to the Australian National University.

Hughes, of Landbridge, said forced divestment risked hardening Asian investment in Australia.

“Obviously, if you’re an American company, it won’t bother you so much. But, you know, foreign investors from other countries, who know how things can change for a decade or more, ”Hughes said.

Analysts are divided on whether breaking the Darwin port lease would significantly alter the sovereign risk environment for non-Chinese companies.

“In the case of Darwin Port, there are clearly special and strange factors at play,” said Jeffrey Wilson, research director at the Perth USAsia Center.

However, business leaders are calling for caution and pushing Canberra to restore relations with China, the nation’s largest trading partner with $ 251 billion in two-way operations in 2019-20. Some worry about breaking the port lease and can fatally damage bilateral ties and outrage foreign investors.

“There will be consequences beyond China,” said Andrew Robb, a former Australian trade minister who oversaw negotiations on the China-Australia free trade agreement reached in 2015.

Robb, who acted as a paid advisor to Landbridge and other Chinese companies when he left political office, said Canberra had every right to re-evaluate port leasing in light of changing strategic circumstances.

But he warned that Australia-China political relations had “turned into flames” and that trade ties could continue.

“In some cases, the tone has not taken into account the sensibilities of the Chinese side,” Robb said. “There are certain things that have been developed over thousands of years with respect to China, such as saving face.”

[ad_2]

Source link