[ad_1]

A group of four founders two weeks ago kick off Involve venture partnersA Minneapolis-based venture capital firm focused on early-stage medical technology companies.

Participation is available in Minnesota. Treatment method. With more than 1,000 healthcare technology companies calling the region home, the area is one of the nation’s hottest incubators for medical technology innovation.

The founding team formed Engage to reduce friction between early-stage medical technology companies and their investors by bringing their investments to market through special purpose vehicles (SPVs). This team consists of four members, two of whom serve as the company’s executive directors.

Steve Sigmund and Kelly Prechal are the Managing Directors of Engage. Sigmund most recently served as Founder and Chief Financial Officer. Carrot healthHealthcare analytics software company Ya Make us one. obtained last year. Prachal is a co-founded active angel investor. AlliedVirtualCareA telehealth platform focused on advanced mental health and age-related hearing loss. They were joined by Morgan Evans, who founded two medical technology companies (Frustrated solutions And Creations of the Highland Circle) and Ryan Spanheimer, a patent attorney specializing in medical technology.

All of Engage’s founding members have experience in the health tech investment sector and created the firm through an SPV model to provide investors with greater flexibility and lower management fees, Sigmund said in an interview. The company is currently building a network of accredited investors, which includes angel investors, trusts, IRAs and corporate entities, he said.

Instead of raising a huge upfront fund – which takes six to 10 years and requires investors to make a blind investment commitment – Participate organizes an SPV for each startup investment. That “makes it very different from a traditional venture capital fund,” Sigmund said.

While angel investors are a limited partner in a traditional venture fund, they typically have to make an attractively low commitment. The minimum investment allowed to participate in an Engage SPV is “absolutely very small,” Sigmund said, adding that the model allows investors access to quality investment opportunities in the healthcare technology space.

“You can sign up as an investor in any or all of the SPVs we bring to market,” he said. You can do each or just one deal – there are no minimum requirements. This allows for a different level of control and flexibility in our venture investment model compared to traditional funds.

Management fees are also much lower with the Engage model. Participation charges investors in the network a one-time, upfront management fee, usually 4-5 percent. Sigmund notes that traditional venture funds charge their angel investors a management fee of 2-2.5%, but this fee is compounded annually over the life of the fund. As much as 20% of an investor’s capital can go to management fees in a traditional fund, he said.

The Engage model is attractive to health tech entrepreneurs because it simplifies the fundraising journey, Sigmund said. Rather than the difficult and time-consuming process of identifying accredited investors and making the same pitch over and over, startups can use Engage as a “single point of contact for fundraising,” he said.

As for the companies the company intends to invest in, Engage’s initial investment focus is on medical devices designed to address unmet needs. Early-stage medical device companies often don’t yet have regulatory approval, so when screening potential startups for investment, Sigmund says his team looks at their early research and product development, the strength of their medical advisory board, and how they got started. To protect their intellectual property.

At the same time, Engage announced that it has started investing Melody health, a surgical device company creates an absorbable scaffold designed to support soft tissue. The startup was founded with the goal of reducing infection rates among women undergoing reconstructive or cosmetic breast surgery.

For each SPV it brings to market, the investment is typically in the $500,000 to $1 million range, Sigmund shared. Going forward, Engage will probably organize four to six SPVs a year, he said.

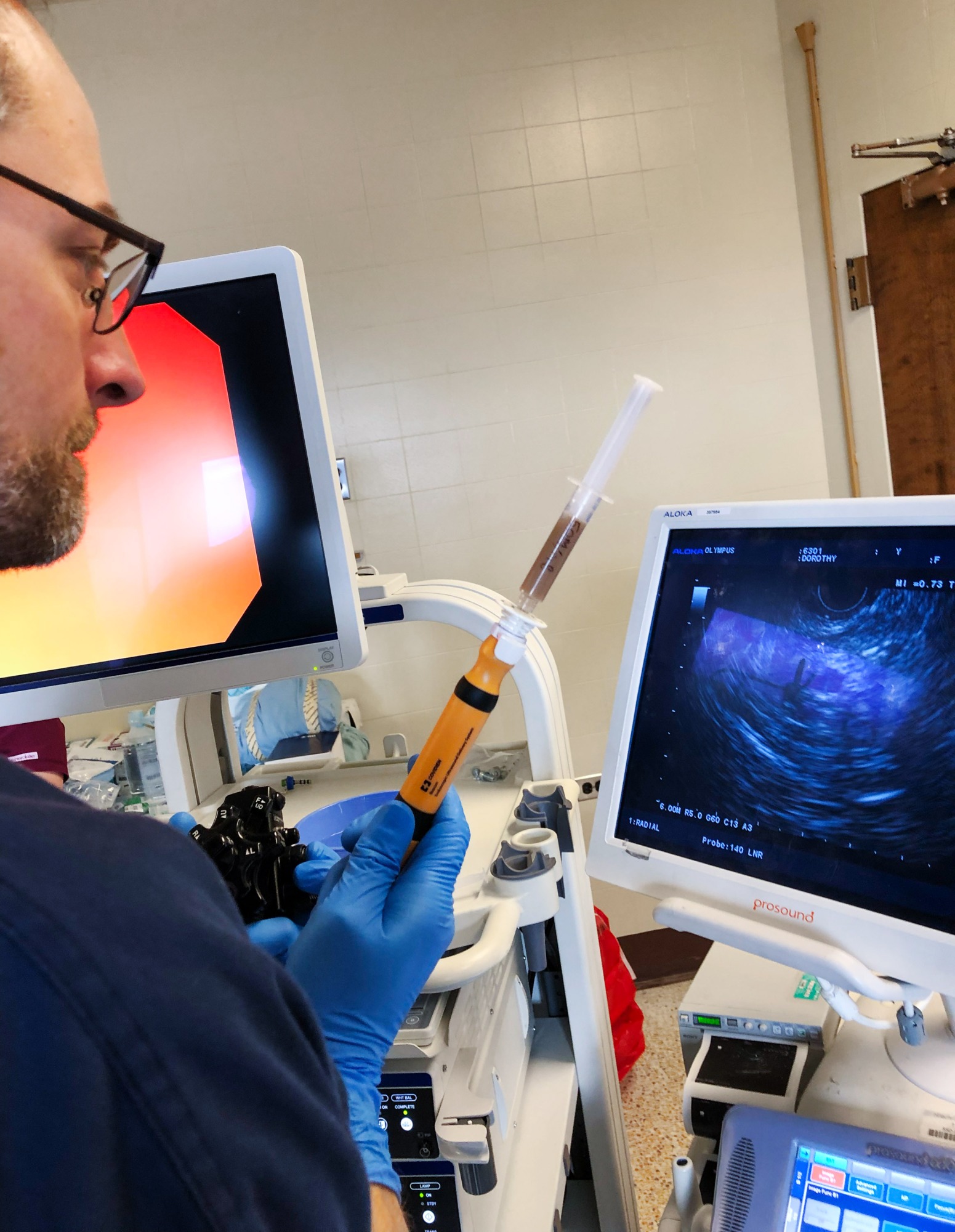

Photo: Engage Venture Partners

[ad_2]

Source link