[ad_1]

While the companies are bringing in new benefits while increasing wages and promotions to stem the exodus, efforts over the past three quarters have yielded little success.

See full picture

For the companies, this worry coincides with increasing margin pressure and few big deals, as their biggest markets, the US and Europe, could slide into recession as central banks raise interest rates sharply to contain runaway inflation.

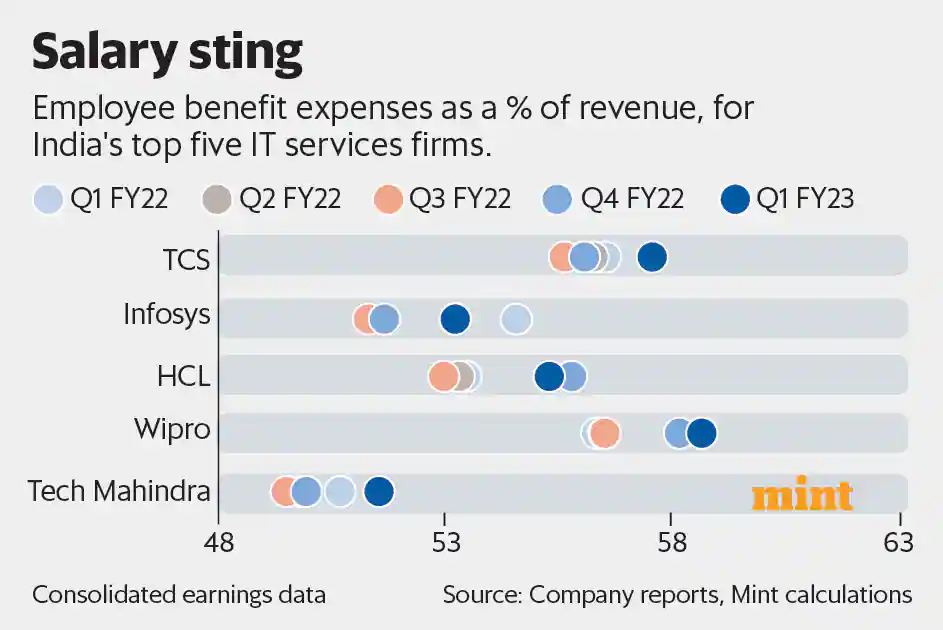

Four out of five companies have increased wage costs as a share of revenue as they struggle to retain employees with growth and frequent pay raises, a Mint analysis shows.

“Top service companies need to invest, to attract and retain talent in key areas, especially high-performing employees, and deliver projects. Gone are the days when TCS or Infosys alone were enough to sustain major ‘brands’,” said Prasanto K. Roy, technology policy consultant.

Average salary costs as a share of revenue were 55.2% in the quarter ended June 30, compared to 54.3% in the prior three months.

See full picture

While Infosys and Tech Mahindra saw the biggest jump (up 1.6 percentage points), TCS was close behind, up 1.5 percentage points (to 57.5% from 56%). Only HCL Technologies sees a slight decline (from 55.3% to 55.8%).

Wipro reported the largest wage cost burden as a share of revenue, at 58.6%, followed by TCS at 57.5%.

The ever-increasing wage costs come at a time when the technology services sector has tried all means to reduce workforce cuts. For the past four quarters, it’s been a hiring frenzy across sectors, with corporates steadily poaching workers from tech firms to digitize their services.

But as global tech giants like Apple, Google and Microsoft slow their hiring pace, there are fears that tech services could also be hit by declining deal rates.

“At this point the interest is a little bit lower, but it’s still very healthy. Due to offshore, I expect the demand situation to remain healthy in the near future,” said AR Ramesh, Director of Digital Business Solutions, Professional Staffing and Director of Global Engagement, Adecco India. “However, staffing costs have increased significantly, but this is expected to stabilize soon.

Mint’s analysis of quarterly data shows that growth in employee benefits has boosted revenue growth for all companies, outpacing Infosys.

TCS’s June quarter revenue rose 16 percent from a year ago, less than the 18.2 percent increase in wage costs. For Infosys, India’s second-largest software services company, revenue growth of 23.6 percent outpaced wage costs of 20.4 percent. Rival HCL’s revenue grew 16.9 percent, while wage costs rose 21.2 percent. Wipro’s salary expenses grew by 22.8% while its revenue grew by 17.9%. Wage expenses and income for the June quarter rose 26.9% and 24.6%, respectively, for Tech Mahindra.

The tech companies are using no-nonsense poaching deals and bringing in more promotions to retain talent.

“We can’t take a big walk because it affects our profitability and now the focus is on retaining key talent,” said a senior executive from one of the technology firms.

In the June quarter, companies’ earnings were 19.7% for TCS, 28.4% for Infosys, 23.8% for HCL, 23.3% for Wipro, and 22% for Tech Mahindra. Only Wipro and Tech Mahindra saw a slight decline compared to the previous quarter.

Although revenue growth remained below that in most cases, total spending for the technology companies increased by more than 20 percent last year. This affected profitability.

Year-over-year and sequentially, each of the five companies saw operating margins squeeze. Tech Mahindra narrowed its margins by 240 basis points sequentially and 360 basis points a year ago, the biggest among the companies. A basis point is 0.01%.

Analysts at ICCI Securities said further headwinds from rising travel costs, wage hikes for senior staff and supply-side price pressures are likely to hit Infosys’ margins.

For Wipro, the brokerage forecasts cost pressures from the quarterly promotion cycle starting July 1, salary hikes from September 1, and increased travel and discretionary expenses.

Manjul Paul contributed to data analysis.

Get all the corporate news and updates on Mint Live. Download the Mint News app to get daily market updates and live business news.

A little bit of booze

[ad_2]

Source link