[ad_1]

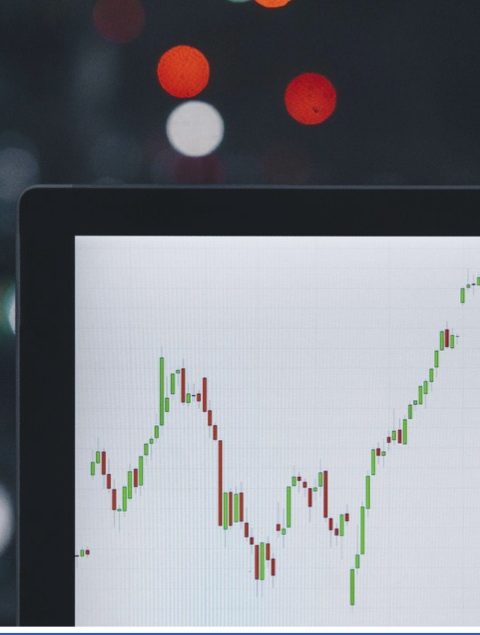

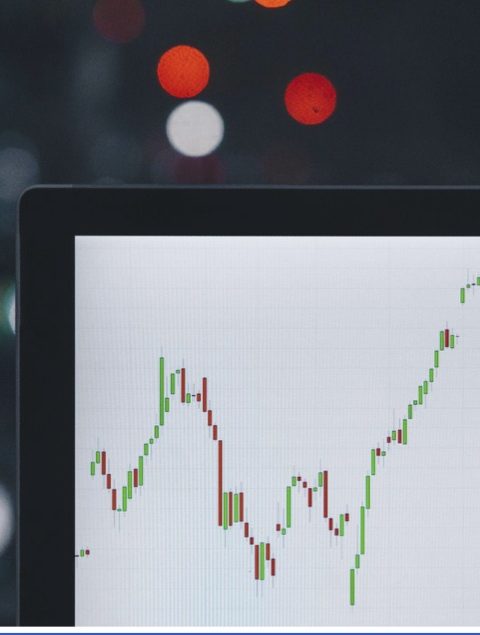

For foreign exchange traders, Forex harmonic patterns are essentially charting patterns that can assist traders in discovering pricing trends by forecasting future market movements as part of a trading strategy and can be utilized to spot fresh trading opportunities and pricing trends when a trader knows what they ‘ re searching for.

Moreover, these patterns use the Fibonacci numbers to generate geometric price patterns to spot possible price shifts or trend reversals. Traders can spot these patterns and use them to help them make their next trade.

There are a variety of chart patterns to pick from, from the Butterfly chart pattern to the Crab pattern, the AB = CD pattern, and each of these patterns could be used to recognize a specific type of trend in the Forex market. It’s vital to remember, though, that before you follow any pattern, you ought to be successful in performing your scientific analysis to always make the best – and quickest – trading decisions.

The Butterfly Pattern

The Butterfly harmonic pattern is a reversal indicator for the market as it’s more common at the top and bottom of the pricing range. As a result, the bearish butterfly pattern develops at the top of the market, while the bullish butterfly pattern appears at the bottom.

XA, AB, BC, and CD are the four legs of this pattern, with X being the starting point and D being the trading entry point. Nevertheless, let’s have a quick peek at the Butterfly pattern in action:

- XA = The major leg is XA.

- AB = The AB leg retraces 78.6% of the XA leg.

- BC = BC should retrace 38.2 percent of AB to 88.6 percent.

- CD = can cover up to 161.8 percent of BC and even 261.8 percent.

Quite similarly, the ratios are identical in the bullish Butterfly pattern. However, it opens with an up XA wave up. The B wave retraces to 0.886, which is somewhat higher than ideal but still very close. D is 1.23 of XA, while BC retraces 0.75 of AB. The price drops lower off D for a potential short trade, and the stop-loss order moves above the swing high at D.

The Crab Pattern

The Crab trades in an XA, AB, BC, and CD pattern, allowing traders to enter at extreme highs or lows. The 1,618 extension of the XA movement that determines the PRZ is the essential characteristic of the Crab pattern.

When the price rises strongly from point X to point A in the bullish version of the Crab, the first leg forms. An extensive projection of BC (2.618 – 3.14 – 3.618) completes the pattern, providing a plausible site for pattern fulfillment and likely trend reversal. A bearish crab will look for a dip from point X to point A, then a minor price rise, a small drop, and a rapid climb to point D.

The ABCD Pattern

When contemplating using Forex harmonic patterns, three motions and four points make up the ABCD (or AB = CD) pattern, arguably one of the most straightforward patterns. First, there’s a sudden movement (AB), then a corrective movement (BC), and ultimately another impulsive motion (DC) in the same manner as AB.

The BC leg should reach precisely 0.618 using the Fibonacci retracement tool on the AB leg. Then, traders can place their entry orders at the C point, known as the Potential Reversal Zone (PRZ), or wait until the entire pattern is completed before deciding whether to go long or short from the D point.

The BAT Pattern

The BAT pattern, which got its name from the bat-shaped product, was first identified by Scott Carney in 2001 and is made up of exact features that identify PRZs. With this pattern, a BC retracement action will follow the first leg (XA).

The CD prolongation must be at least 1,618 times the BC keg and can go up to 2,618 times the BC keg. The PRZ is created by the endpoint (D), which means that investors can open accounts to trade either a bearish or bullish price reversal.

The Gartley Pattern

HM Gartley constructed the Gartley pattern, which has two fundamental rules:

- The retracement of Point B has to equal 0.618 of XA.

- The retracement of Point D must equal 0.786 of the XA motion.

The XA leg results in a BC retracement, identical to the BAT pattern, except that the pullback of point B has to be precisely 0.618 of XA. The take-profit is frequently set at point C, whereas the stop-loss is frequently set at point X.

Final Thoughts

The presence of Forex harmonic patterns can help you determine when to enter a trade and provide valuable information about possible upcoming trend reversals. The five harmonic patterns we covered here, provide traders with specific points at which market sentiment is likely to change based on past and current Fibonacci retracement levels.

Although not foolproof at all times, knowing these key Fibonacci retracements can help you avoid stressful situations and give you the confidence to trade more rationally.

The post Top 5 Harmonic Patterns In Forex Trading appeared first on The Startup Magazine.

[ad_2]

Source link