[ad_1]

As many as 2 in 3 Americans have more interest in buy now pay later (BNPL) in 2022 compared to before the pandemic.

The Rise of Buy Now-Pay Later Payment Options for Consumers and Businesses

The growing demand for BNPL is highlighted in an infographic by Opy, a payments fintech.

The infographic shares the results of the survey that investigated the trends and opinions of 1,000 US consumers.

Consumers Want Flexible Payment Options

It shows that consumers are demanding flexible payment options, with 43% of dental patients wanting BNPL and the same number of pet owners reporting that preference.

The majority of respondents said that having flexibility over payments is the most desired feature of BNPL.

Consumer Anxiety Over Payments

The infographic shows that nearly 75% of consumer aged between 43 and 57 are worried about healthcare costs. 66% of pet owners are concerned about affirming future vet costs. With concerns about commonplace payments, 2 in 3 Americans are familiar with BNPL as an alternative to credit, debit or cash, the survey found.

Benefits of BNPL

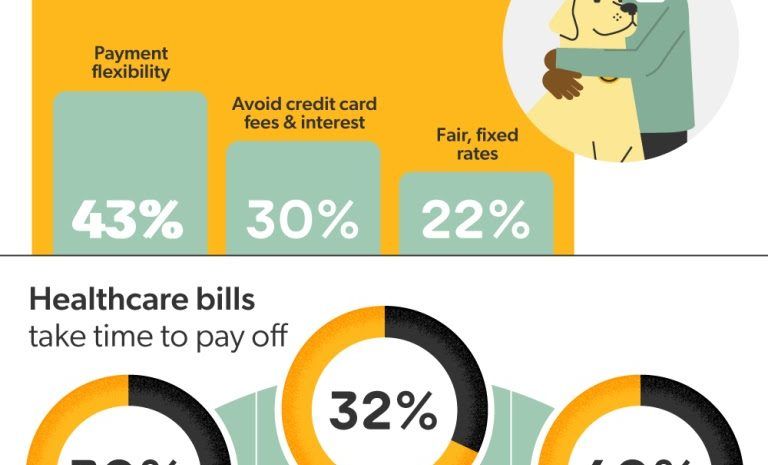

The study looked at what consumers deem as the benefits of BNPL. 43% of pet parents cited payment flexibility as the biggest advantage. 30% of respondents like using BNPL to avoid credit card fees and interest, and 22% of consumers like the fair, fixed rates BNPL offers.

Who is Interested in BNPL?

Opy’s study explored different demographics’ relationship with this type of payment solution.

If found that consumers located on the East Coast are likelier to use BNPL than the West Coast, with 55% of East Coast respondents saying they are interested in BNPL compared to 42% on the West Coast.

The research also revealed that millennials’ interest in BNPL has increased more than any other age group during the pandemic.

Opy’s survey might be concentrated on veterinary and dental payments, but it emphasizes the importance of giving consumers BNPL and flexible payment solutions, regardless of what items a business is selling.

Image: Opy

[ad_2]

Source link