[ad_1]

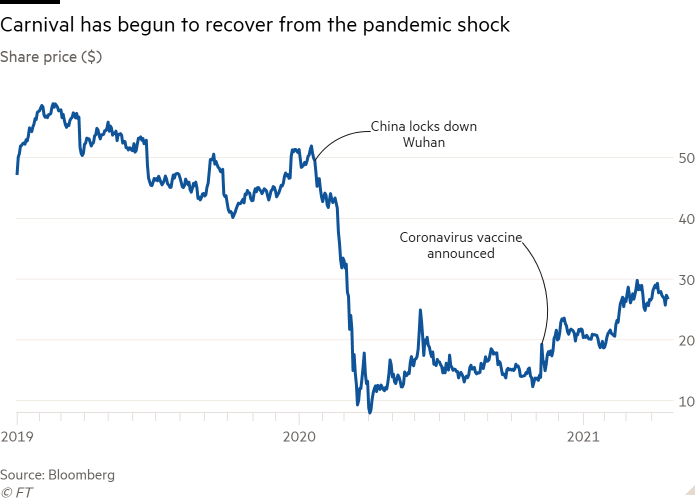

On the same day, Moody’s downgraded Carnival Corporation’s credit rating and the World Health Organization declared Covid-19 a global pandemic, with David Bernstein, head of finance for the cruise company, in the Broadway theater district , in New York, to see a play about the fall of another corporate giant.

The March 11 performance of the Lehman Brothers Trilogy was the last in 2020 at the Nederlander Theater. Later that week, the coronavirus crisis forced the closure of places as the world economy became one of the worst crises since the collapse of Lehman, in the midst of the 2008 financial crisis.

More than 2,000 miles away, off the coast of California, 3,500 passengers were trapped aboard the Grand Princess, a Carnival ship that had suffered a virus outbreak and was unable to dock. It was the beginning of a storm that ravaged the cruise industry.

Bernstein, 62, had traveled to New York to meet his new grandson born a few weeks earlier. He tried to buy a face mask for his return to Miami, but the pharmacies ran out. When he arrived at La Guardia airport on March 14, the terminal was deserted.

“It was such a weird feeling.” He said. “As a result of this trip home, I realized how dramatic the world had changed.”

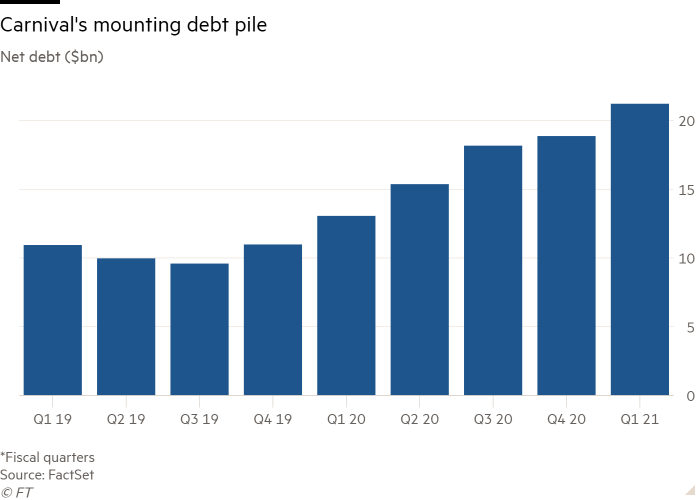

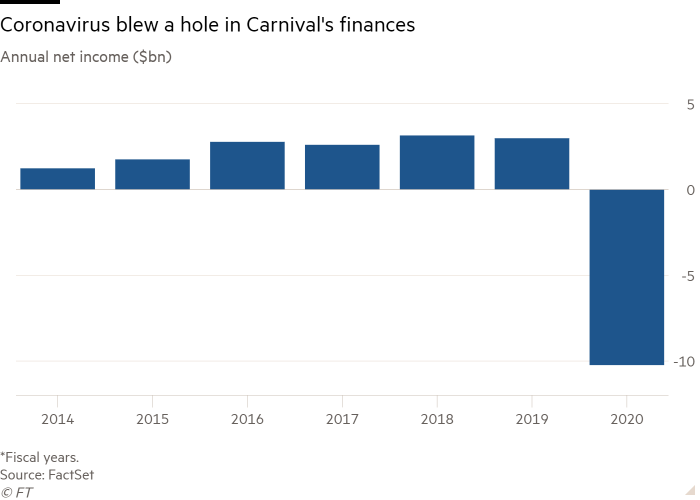

In the year to March 2021, Carnival burned more than $ 7 billion in cash. The group recorded a net loss of $ 10.2 billion in its 2020 fiscal year, as its revenues fell by 73%. As a sign of financial healing, Carnival’s credit rating fell from A minus, a top-tier investment rating, to B, a rating associated with venture capital.

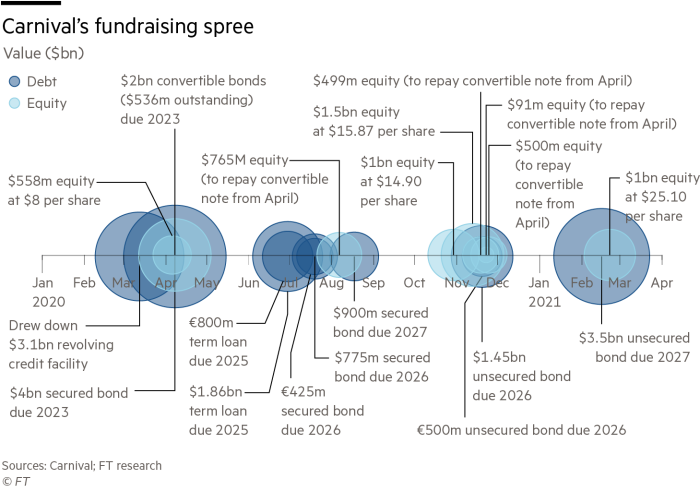

Carnival endured ordeal in large part because of its ability to raise $ 23.6 billion from investors in debt and equity in less than 12 months, prompting it to become one of the largest issuers of good american garbage market.

Its history exemplifies the debt-fueled recovery of the pandemic that has been consolidated around the world, aided by historic interventions by central banks that have favored large companies with access to capital markets. It is also a symbol of last year’s excess lending, as companies now find themselves in large piles of debt.

“It’s really amazing,” said Pete Trombetta, an analyst at Moody’s responsible for classifying cruise lines. “Without access to capital markets [Carnival] I wouldn’t have gotten this far. “

Crisis conversations

Bernstein had already begun crisis talks with bankers from JPMorgan, Goldman Sachs and Bank of America to save Carnival from the economic consequences of the virus that was spreading in late January.

As cases escalated and governments began to take drastic measures to curb the spread, the talks took on more urgency. In March, the amount the company needed to borrow rose from about $ 1 billion to about $ 6 billion. Bernstein “planned the worst,” he said.

There was no solution off the table. In addition to talking to banks and exploring public debt supply, Bernstein held talks with “virtually every major U.S. private equity firm” about possible financing packages. He examined small loan consortia and sold shares directly to private investors.

It was unfamiliar territory for the CFO of a quality investor company, accustomed to more conventional financing options. “During the month of March, I had the most extensive training on all possible financial instruments available at that time,” Bernstein said.

He says he slept only three or four hours a night, waking up at four in the morning, this time, to talk to European investors, as the need for cash became more urgent.

A fund group that included Elliott Management Corporation and Apollo Global Management launched a multimillion-dollar loan at an interest rate close to 15%, according to people familiar with the operations. Sixth Street had also addressed banks in March with a list of companies they would consider financing, eventually offering $ 1.5 billion to Carnival that would turn into equities and fall behind a public bond and guaranteed to scale. of antiquity. The Wall Street Journal first reported details of possible packages.

But on April 1, the company went solely to public markets, selling one $ 4 billion bond deal, backed by 86 of its vessels, along with a convertible note and heritage value, added to help comfort lenders.

The result was almost different. People who were familiar with the operations said calls and emails between bank bosses, private equity bosses and Bernstein went to the limit. “Decisions were made at 11, 12 and 1 a.m. the day before the launch as to the optimal structure,” Bernstein said.

The reason Carnival moved away from private equity offerings came down to cost, Bernstein said, helped by the furious demand from bond investors. Carnival earned an 11.5% coupon for the three-year guaranteed bond, still an interest rate typically associated with some of the world’s most distressed companies.

The Carnival deal marked a crucial moment, not only for the cruise line, but for corporate companies more broadly because it showed that capital markets were open to even the companies most affected by the Covid crisis. -19.

Investors, bankers and analysts say such deals would not have been possible without the Federal Reserve, which on March 23 made the unprecedented decision to start buying corporate bonds amid a number of other measures that calmed turbulent markets.

People familiar with the proposed private equity agreements say the nature of the talks changed as soon as the Fed announcement came.

Bernstein said he believes Carnival would have overcome the crisis even without the central bank’s stimulus, but “to this day I have no way of judging what would have happened if the Fed had not done what they did.”

The fundraiser was a lifeline, providing the company with enough money to last until the end of the year, according to estimates by S&P Global Ratings. The focus was on modifying the key terms of the agreement documents with dozens of different institutions, in part to allow the company to raise more money in the future.

The company raised another $ 2.8 billion in the loan market in June, Followed by a $ 1.3 billion bail in July and another $ 900 million bail in August. Private equity firms still called from time to time, but “it became clear that public markets were available and that they were the best alternative,” Bernstein said.

“From the perspective of a lender, if you have already lent [a company] money you don’t want to file for bankruptcy, ”said John McClain, portfolio manager at Diamond Hill Capital Management, noting that Carnival is now almost too big to fail from a debt market perspective. more money until they return to normal. ”

Vaccine “game changer”

Bernstein had just come out of the shower on the morning of November 9 when he received the news that Pfizer and BioNTech had developed a coronavirus vaccine that was found to be 90% effective. “I was just ecstatic. I realized that this changed the game, “said Bernstein.

The company’s bonds had already begun to rise over the summer. They were further shaken by the news about the vaccine. Carnival stock prices rose from $ 13.71 in late October to $ 21.66 in late 2020. The end was in sight.

“It simply came to our notice then. I knew we would survive. But how would we be? ”Bernstein said, adding that the announcement of the vaccine drastically reduced the possibility of a messy corporate restructuring.

But the company that exists today still looks very different from what it was in early 2020. Carnival has $ 11.5 billion in cash on its balance sheet after completing a $ 3.5 billion bond deal in February, enough to last next year even with zero income. It is still locked in negotiations with authorities to get permission to restart the cruise in the US, its most lucrative market.

It is also defending against potentially costly class action lawsuits filed in the United States by more than 100 passengers who claim to have caught coronavirus aboard Carnival ships in February and March last year.

Even once the revenue comes back, most of Carnival’s cash will have to be spent on maintaining its huge amount of debt. Carnival has paid more than $ 1.2 billion in interest over the past year, up from $ 200 million in 2019.

“There’s still a lot of risk here,” Moody’s Trombetta said, adding that the increased interest burden “makes it difficult” for Carnival’s prospects.

Bernstein says he is already working to extend Carnival’s debt maturity through new fundraisers and reduce the amount the group has to spend on interest payments. He also hopes to regain the coveted investment status.

“This will happen a few years before we get our balance back to the place before Covid,” he said. “Our goal is to get back to that level.”

[ad_2]

Source link