[ad_1]

The Turkish lira fell to a new low against the dollar on Friday, causing losses of 3% this month due to growing concerns that the policies of President Recep Tayyip Erdogan have driven foreign investors out.

Erdogan has fired three senior central bank officials, including the governor, since March, has raised concerns that policymakers cannot withstand political pressure to cut borrowing costs at the expense of curbing the country’s double-digit inflation.

The lira traded at $ 8.6145 on Friday, a drop of more than 13% since the start of the year. It marks the lowest level the currency has reached during the hours when the lira is being actively traded.

“Things look bleak, and macroeconomic and political situations are turning negative,” said Enver Erkan, an economist at Tera Securities in Istanbul. “The central bank cannot set the proactive tone and there has been a divergence with other emerging market currencies on Turkey’s idiosyncratic dynamics.”

In an indication of the aggressive prospects of investors, the California Senate voted this week to demand that the public employee pension system and the public employee retirement system, two of the world’s largest pension investors, allow districts schools and cities opt for yout of investment vehicles owned or issued by Turkey.

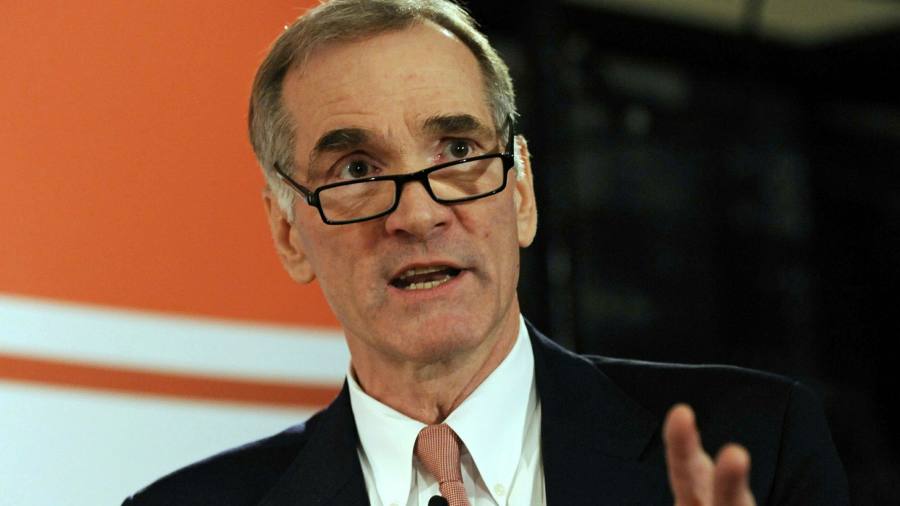

The pressure to divest was aimed at punishing the government for refusing to acknowledge that even the massacre and deportation 1.5 million Armenians during the last days of the Ottoman Empire were genocide, said California Sen. Anthony Portantino, who was one of the sponsors of the bill. Turkey claims that both Muslims and Christians died during the chaos of World War I and the consequent collapse of the Ottoman Empire.

S&P Global Ratings will announce its latest rating decision on Turkey later on Friday. Since August 2018, it has maintained the country’s rating at B +, below the investment grade. The top three rating agencies, S&P, Fitch and Moody’s, classify Turkish debt as rubbish.

“This was the peak of the last balance of payments crisis, [and] it’s hard not to argue that things have deteriorated even further since then, ”said Timothy Ash, chief strategist at BlueBay Asset Management, referring to S & P’s latest rating action.

Erdogan, who has a history of intervention at the central bank, abruptly fired the central bank governor in March after raising interest rates abruptly to cool inflation now exceeding 17%. He the president installed Sahap Kavcioglu, a newspaper columnist who shares his orthodox faith that high interest rates drive inflation at the head of the bank.

This week, Erdogan replaced him a second deputy governor of the central bank after firing a first shortly after Kavcioglu’s appointment. The central bank also replaced several executives, including heads of the banking, research and statistics departments, on Thursday, Bloomberg reported.

[ad_2]

Source link