[ad_1]

The last decade Many technology companies have seen product-led growth (PLG) and bottom-line sales strategies, as opposed to traditional enterprise sales, improve their go-to-market strategies and overall growth.

Many software startups loved (and still love!) the bottom-up approach. What’s not to love about designing a software product to “sell itself” through viral adoption and word-of-mouth marketing? Bottom Line and PLG both promise a fast sales cycle at very low costs – no more golf and expensive steak dinners on the bill.

PLG also offers other strategic benefits: By shortening the feedback loop between users and product teams, it allows early-stage and growth-stage technology companies to produce and use their technology in corporate accounts, with internal champions driving sales.

But, as enterprise-technology buyers keep a close eye on costs these days, they’re also tightening the limits on autonomy. This means founders who rely heavily on the bottom-up need a stronger corporate-sales strategy, fast.

It’s too soon to say that the bottom-up is dead, but it looks very dead. And ‘pure’ PLG should also change quickly. Today’s PLG must inform both its product. And So that sales teams can work together seamlessly and close the next deal.

Enterprise software costs: slower approval cycles, more research

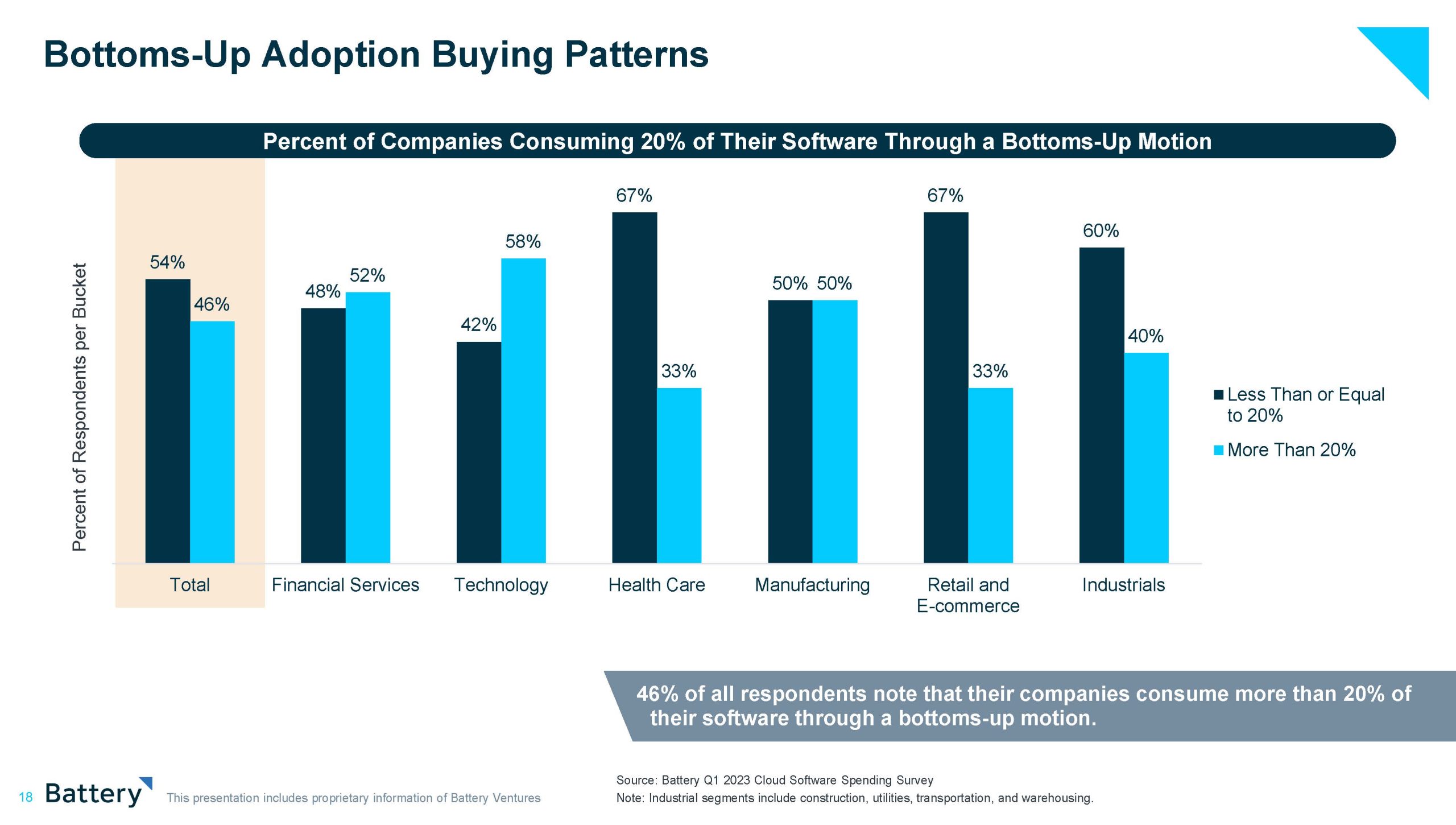

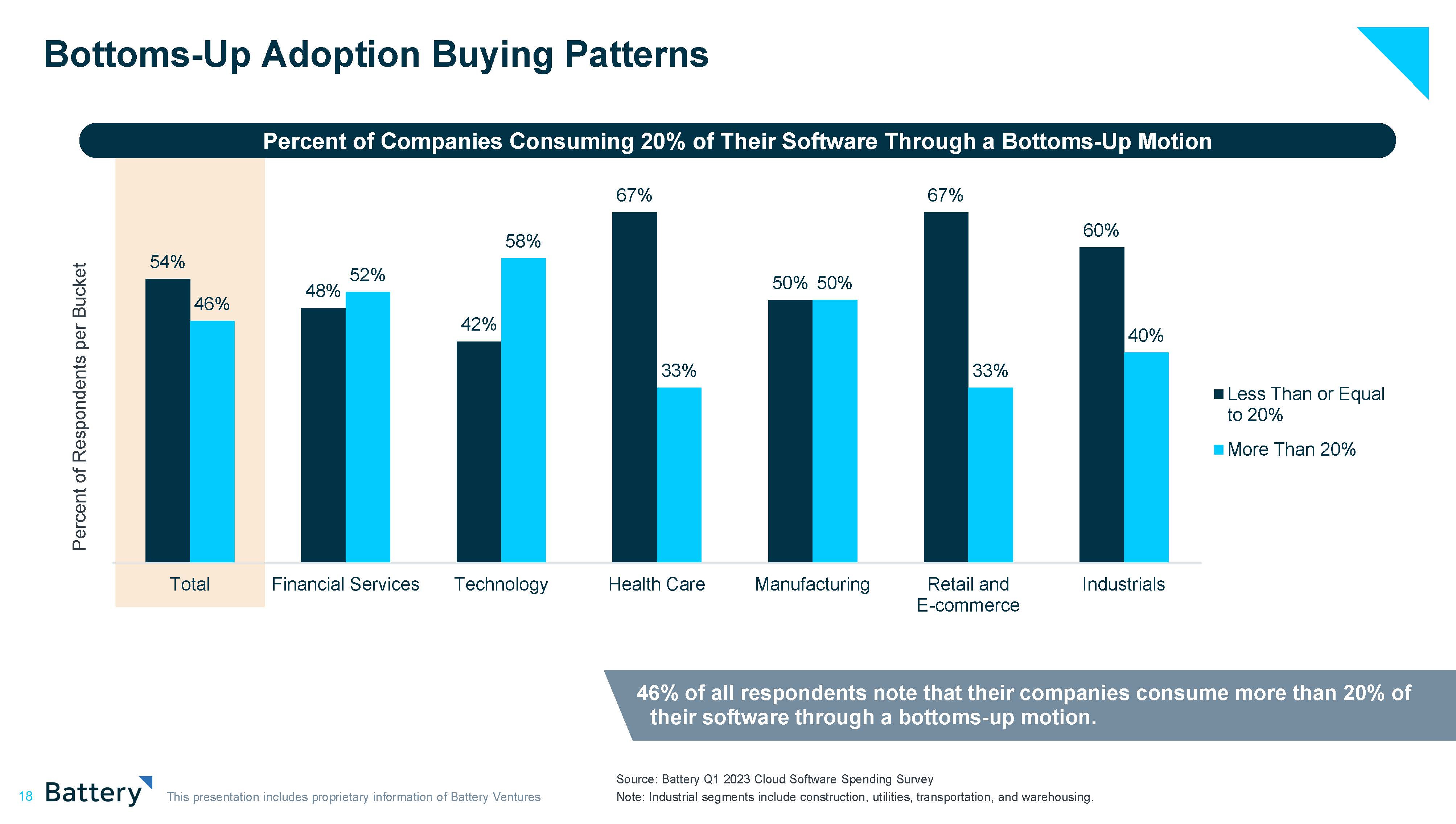

Some clues about corporate technology spending can be found in Battery Ventures’ State of the Cloud Software Spending Report, which surveyed 100 chief technology officers, chief information officers and other large technology buyers in industries ranging from financial services to manufacturing. .

Collectively, survey respondents represent $30 billion in annual technology spending. As the slide below indicates, our respondents comprise a healthy sample of enterprises adopting a software bottom-up/PLG movement.

Lower adoption buying patterns Image: Battery Q1 2023 Cloud Software Spending Survey

While nearly half of our respondents (46%) expect to increase their overall technology budgets by 2023, enterprises they are. Finding alternatives that are more conservative and prioritized. Many plan to standardize costs, consolidate vendors to save money, and streamline SaaS licensing. Enterprises are reexamining pricing models by choosing how software is used and partially choosing vendors to determine whether usage or seat-based pricing makes the most sense.

Today’s PLG must inform both the product and sales teams so they can work together smoothly and close the next deal.

Sometimes-bureaucratic management systems in enterprises may run more slowly in the coming months as organizations across industries strive to become more efficient and increase cost controls.

The slide below summarizes our findings that bottom-up and PLG adoption is declining. One example: Only 46% of survey respondents now allow individual engineers to install tools in a “sandbox dev” environment – down from 76% since the last survey in September 2022. The reduction in engineer-selected equipment going into production is also significant. Now, only 11 percent of enterprises allow this to happen, down 27 percent from September 2022.

[ad_2]

Source link