[ad_1]

Global fintech funds reached $15 billion in the first quarter of this year, up 55 percent from the fourth quarter, according to CB Insights’ latest State of Fintech. Report.

While this generally sounds like a win, there are a few things to note. First, 2020 and 2021 have been record-breaking years for fintech investment. In comparison, fintech funding It was said 75.2 billion dollars in 2022It has decreased by 46 percent compared to the amazing situation 131.5 billion dollars have been collected in 2021. From the numbers for the first quarter, it is clear that the market is working on a correction.

Second, of the $15 billion raised this quarter, Of that, $6.5 billion was all Stripe.. Without that increase, CB Insights said funding would have been $8.5 billion, or a 12 percent reduction in funding from the fourth quarter of 2022.

And third, if we remove the Strip round and stick with $8.5 billion, when we compare this quarter to the first quarters of previous years, funding is the lowest since 2019.

Meanwhile, the number of discounts has also decreased. 983 deals were made in the first quarter, down from 1,007 in the fourth quarter of 2022 and 1,629 in the first quarter of 2022.

A bright spot in the market were “megarounds” deals worth $100 million or more. These deals accounted for 61% of total funding in the first quarter, a quarter-on-quarter increase of 179% across 16 deals, and totaled $9.2 billion, according to CB Insights. The following was a strip deal. Ripple raised $500 million In mid-March, Silicon Valley Bank was melting down. Specifically, the deal count is down, down 24% quarter over quarter.

Early stage funding continues to dominate in fintech, however; It hit a new high for the first quarter, accounting for a 72% share of deals in the three-month period, according to CB Insights. As of 2019, this number has risen to around 65% and by the first quarter of 2022 to 69%.

It’s worth noting that although the United States led on all levels during the quarter, six of the top 10 fintech seed and angel rounds invested outside of the U.S. The U.K. Carbonplus, a carbon credit settlement startup, received $45 million in seed funding. Quarter round.

Speaking of the US, the region accounted for $10.5 billion in total funding for the first quarter, more than triple the amount received in the fourth quarter of 2022, which was $3.5 billion, and coincidentally a five-year low. From the fourth quarter, repurchases increased 23% to 434.

CB Insights reported that excluding the Strip round (recall it was $6.5 billion), funding in the U.S. was $4 billion and could still cover the fourth quarter. When it comes to deal-level drilling, the share of first-rate deals in the U.S. increased to 68%, a five-year high, according to CB Insights.

Meanwhile, following a steady decline in funding dollars in the payments sector, Stripe’s megaaround helped drive this to a 200% jump to $8.1 billion in the fourth quarter of 2022, compared to $2.7 billion. quarter, down slightly from $8.3 billion in the first quarter of 2022. Meanwhile, the number of discounts continued to decline, falling to 161, down from 195 in the fourth quarter. This marked the ninth straight reduction in discount rates, CB Insights said. The increase in investment dollars was primarily seen in early-stage deals, which accounted for 74% of total deals and a five-year high of 66% in 2022.

Other highlights of the report include:

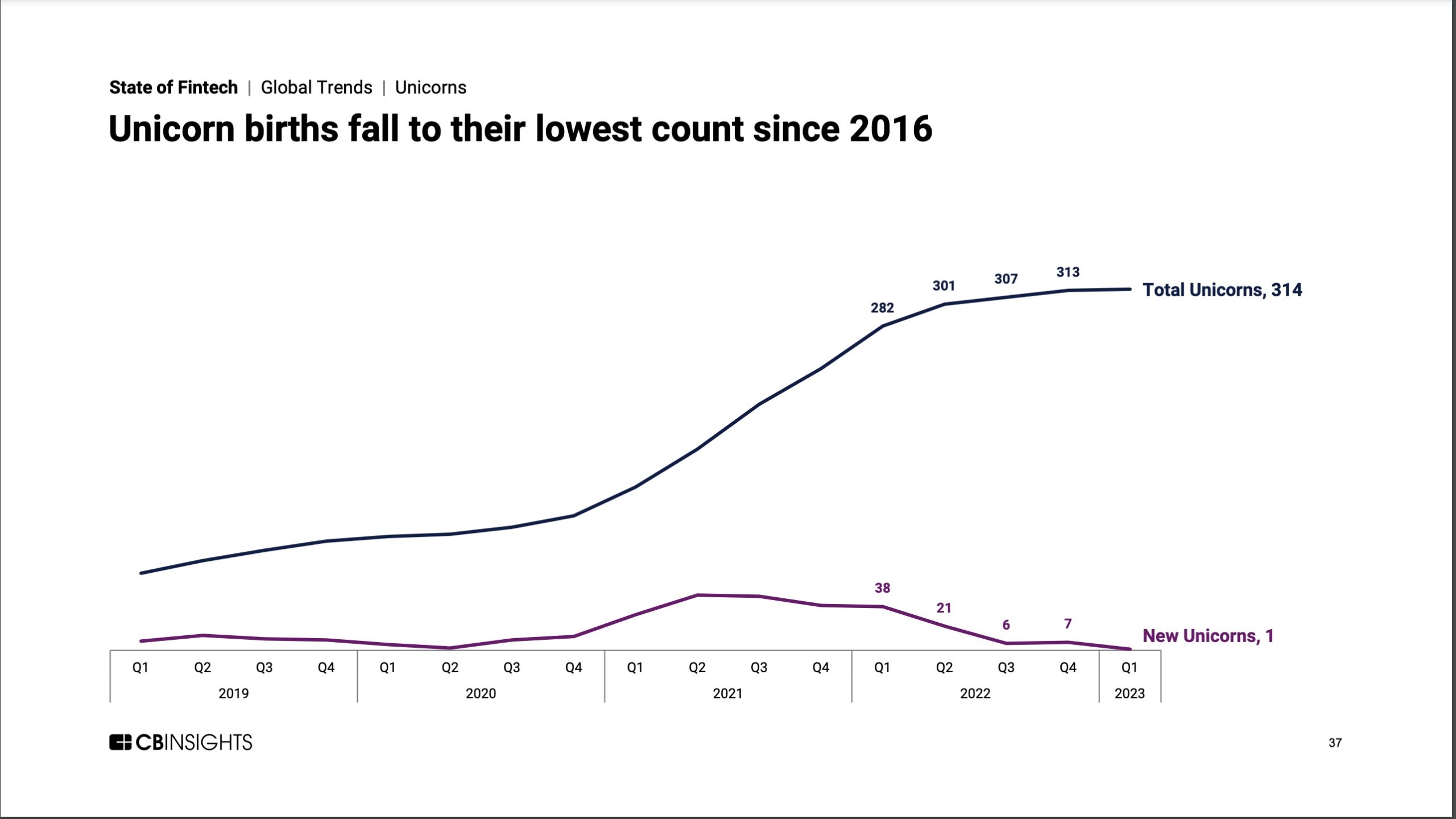

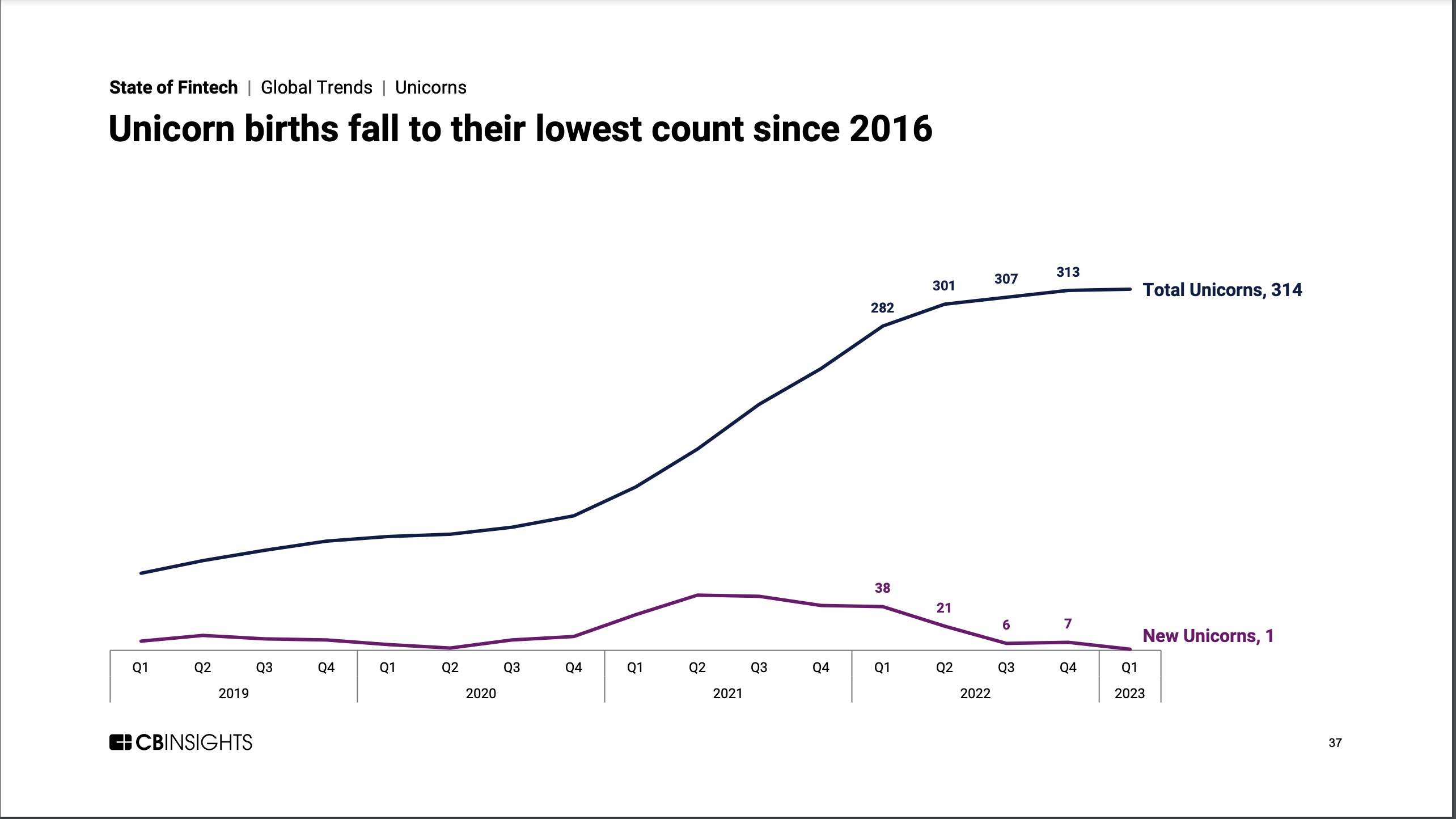

- There was only one unicorn birth in the entire quarter. This is the first time this has happened since late 2016. The only unicorn born in Q1’23 is Egypt-based MNT-Halan. This is at the beginning of February It raised $260 million in equity financing at a $1 billion valuation. But overall, according to CB Insights, the total fintech unicorn herd still stands at 314 in Q1’23, up 11% YoY.

-

Image Credits: CB Insights

- Fintech M&A will emerge He returned again, but not as much as one would expect. They were down 15% QoQ to 172. The majority of Q1’23’s top M&A deals involved fintechs based outside the US, and for the first time in the past year, the top M&A value fell below $500 million.

- Bank funding fell a whopping 64% QoQ to $500 million in Q1’23, the lowest since the second quarter of 2017 when total bank funding totaled $300 million. This fall marked the largest quarterly decline in funding across all fintech categories. Compared to Q2’21’s record high of $8.2 billion, bank financing fell by a staggering 94 percent in the first quarter. The number of deals slipped, down 16% QoQ and 63% from Q2’21’s high of 139 deals.

- Total funding fell 33% quarter-on-quarter to $1.8 billion in the first three months of 2023. Shares rose 7 percentage points from year-end 2022 to 78% in the first quarter, a five-year high. One of Asia’s top 10 equity deals has gone to early-stage startup Indian insurtech InsuranceDekho. He collected 150 million dollars In February.

- Canada was the only region to see the share of late-stage deals fall to 0%. Also, Canadian funding remained flat at $300 million quarter-over-quarter while deals fell 44 percent. Nine of Canada’s top deals in the first quarter went to early-stage companies. Crypto and blockchain infrastructure firm Blockstream has secured the largest deal – a $125 million convertible note.

Want more fintech news in your inbox? sign up over here.

Got a news tip or insider information about a topic we’ve covered? We want to hear from you. You can reach me at maryann@techcrunch.com. Or you can drop a note at tips@techcrunch.com. I am happy to honor identity requests.

[ad_2]

Source link