[ad_1]

Debate continues over the extent to which the global tourism recovery will be boosted by inflation and travel disruptions.

So far, no impact has been seen on the hospitality sector. Based on data for the week of July 30, 2022, STR’s Market Recovery Display shows that more than 90% of North American markets and 80% of global markets were achieving RevPAR of 80% or more in 2019. Levels when adjusted for inflation.

However, the expected current downturn is being met by the start of the peak leisure season and significant macroeconomic headwinds. With that in mind, STR has examined consumer attitudes in the current state of tourism. Finally, we want to continue to monitor how travel sentiment is affected by growing financial and travel pressures alongside easing Covid-19 concerns.

Our latest survey from July 2022 highlights that consumers are conscious about their personal finances and Covid-19, but wanderlust continues to drive travel demand despite greater concerns about travel disruption.

Slow short-term sentiment, positive long-term view

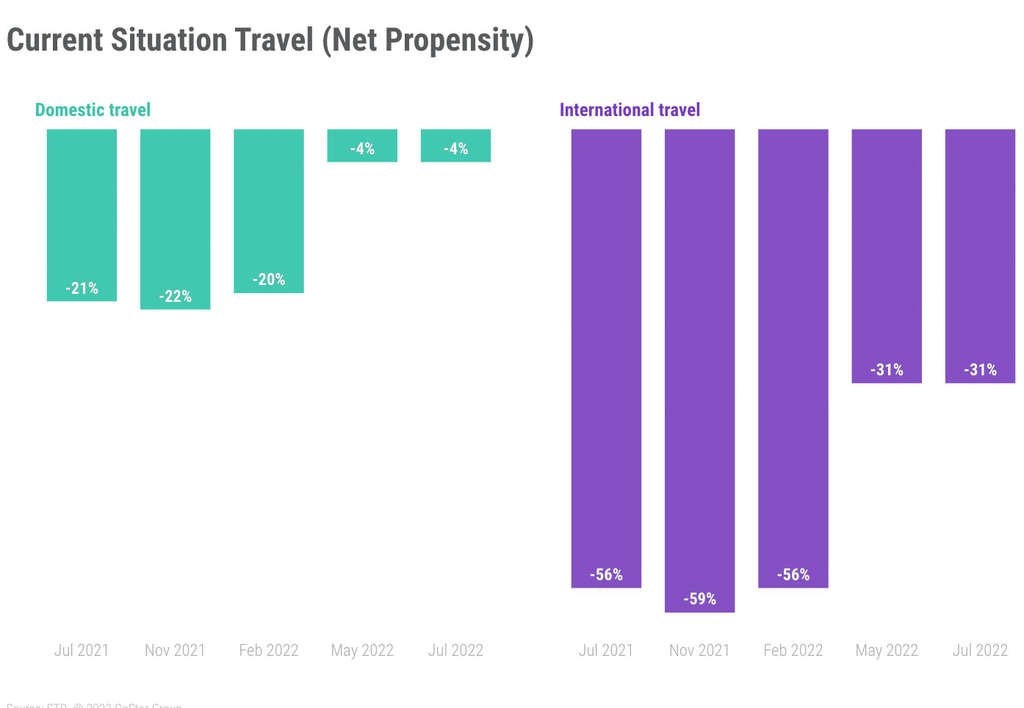

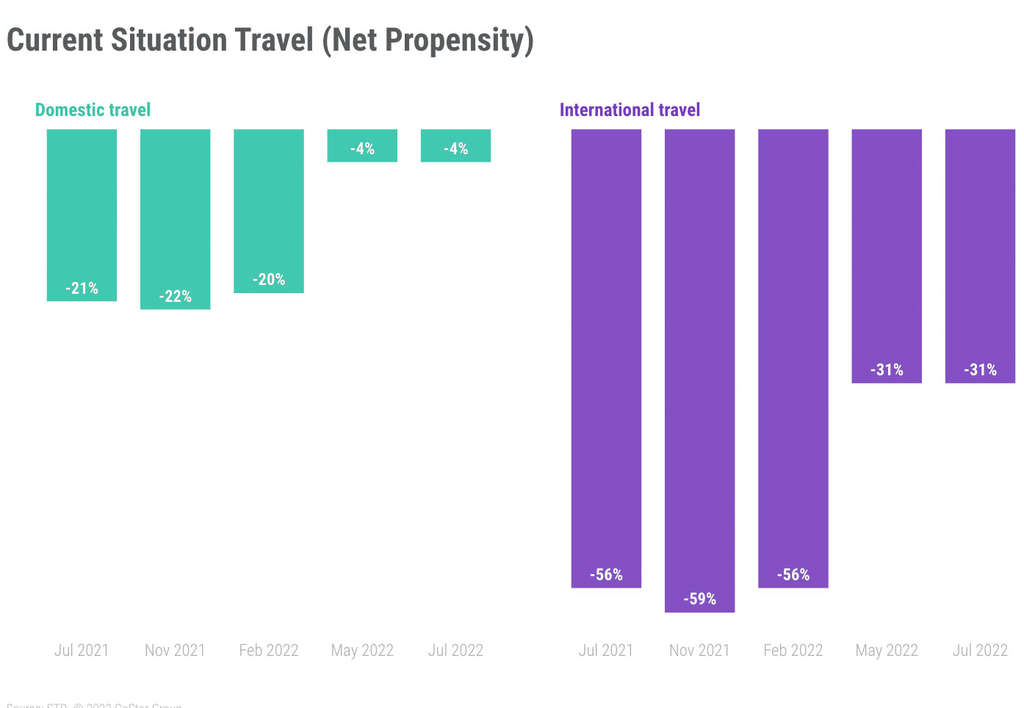

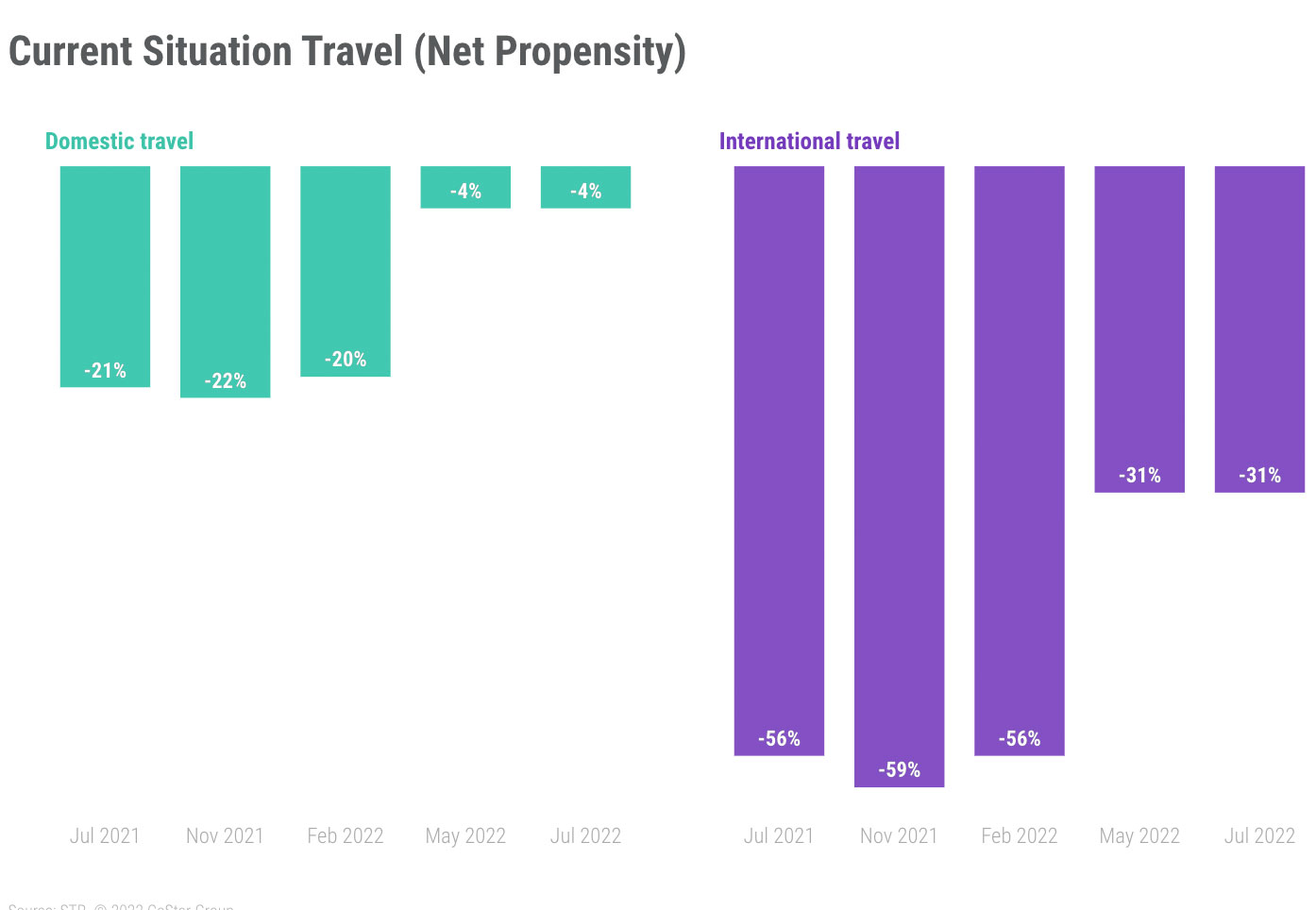

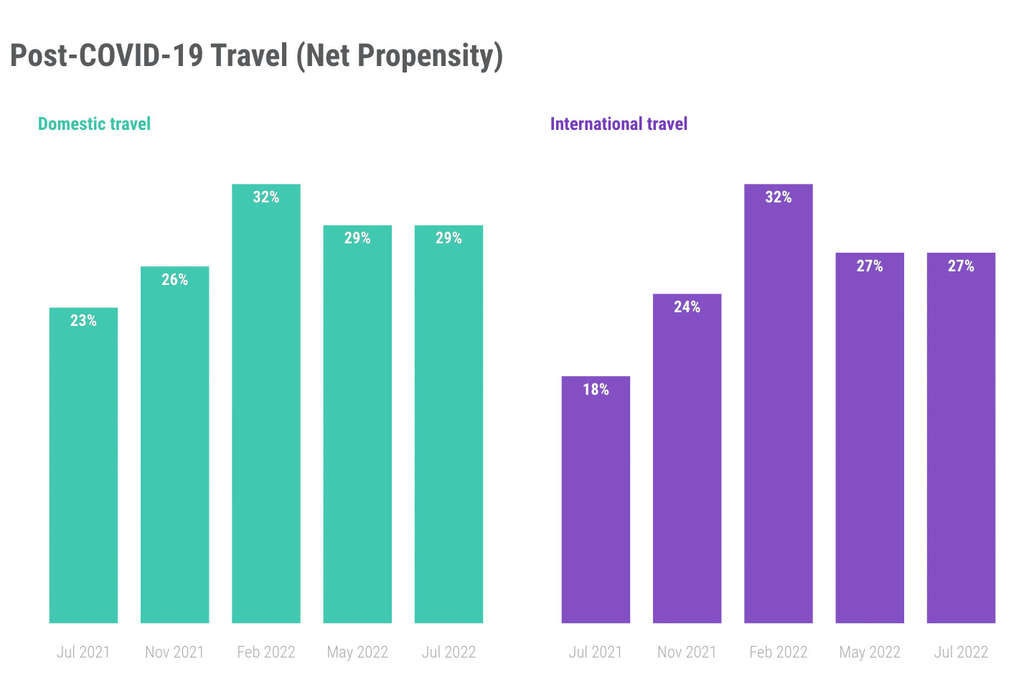

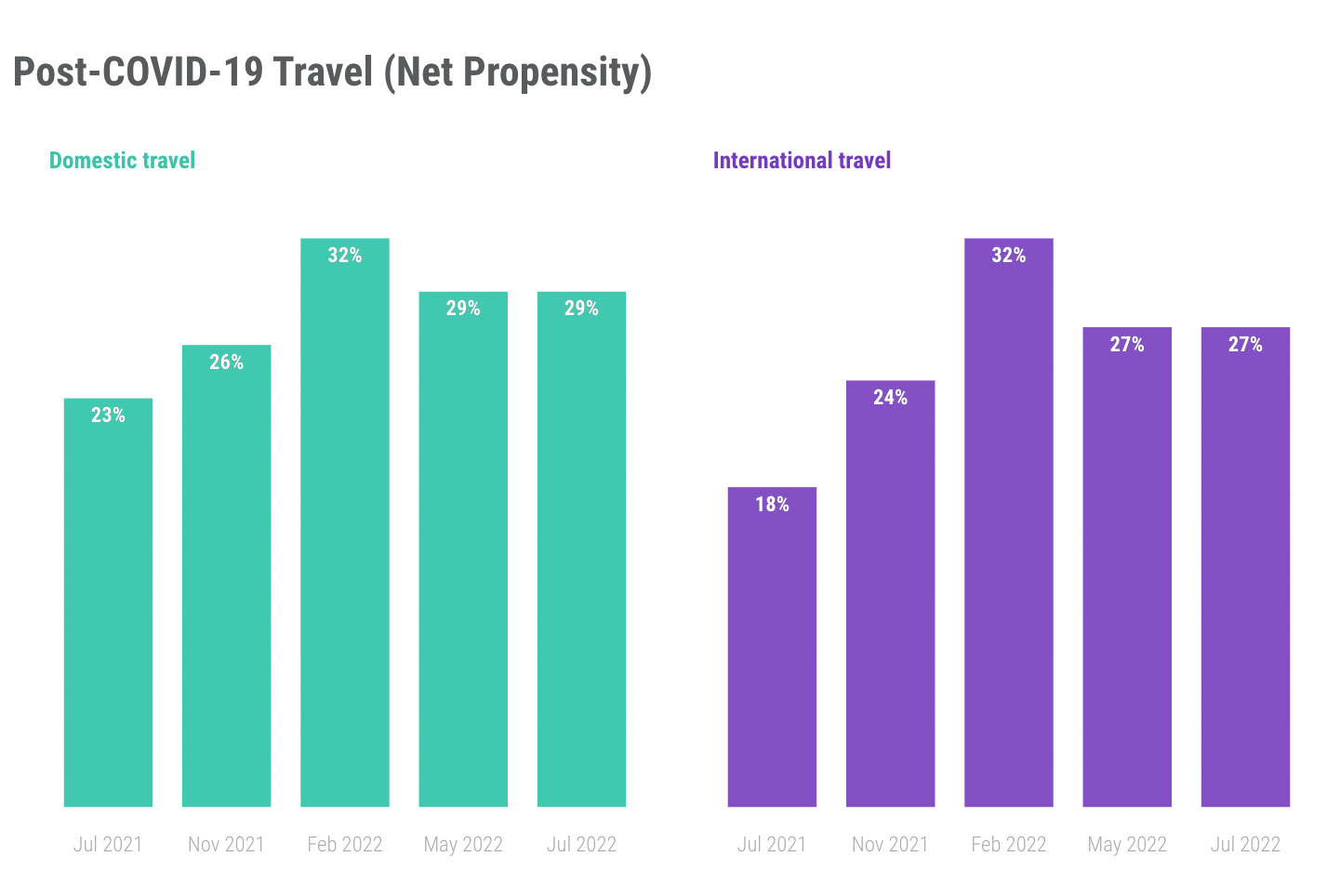

In the previous May 2022 survey, STR showed that propensity to travel significantly – the difference between those who said they were least likely to travel in the current area – increased significantly for both domestic and international travel compared to February 2022. .

However, the latest findings show a similar sentiment to May 2022 because the net inclination to travel has not changed in the current situation, remaining in the negative range for domestic and international trips (-4% and -31%). While the outlook has improved from last year, these results indicate that financial pressures, COVID-19 and other factors are currently weakening the overall appeal of travel.

Despite the subdued short-term sentiment, the medium- to long-term outlook for tourism remains overwhelmingly positive. Net travel propensity for both domestic and international trips was again close to +30%. These results indicate a healthy appetite and strong underlying demand among consumers to increase their future travel efficiency.

A new obstacle to the ban: travel cancellations

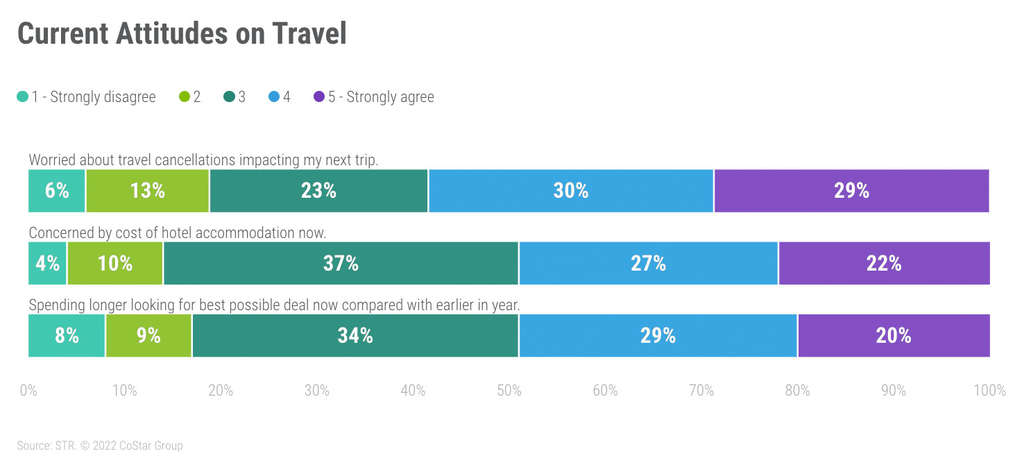

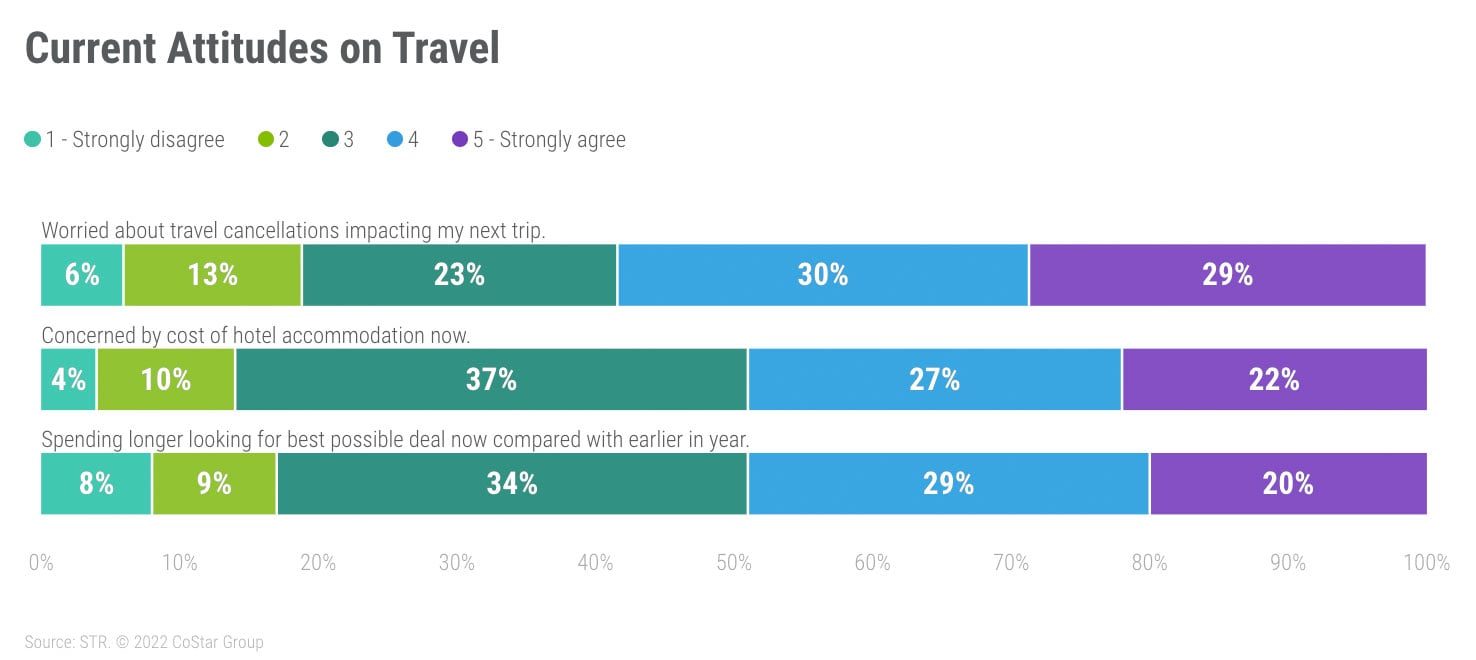

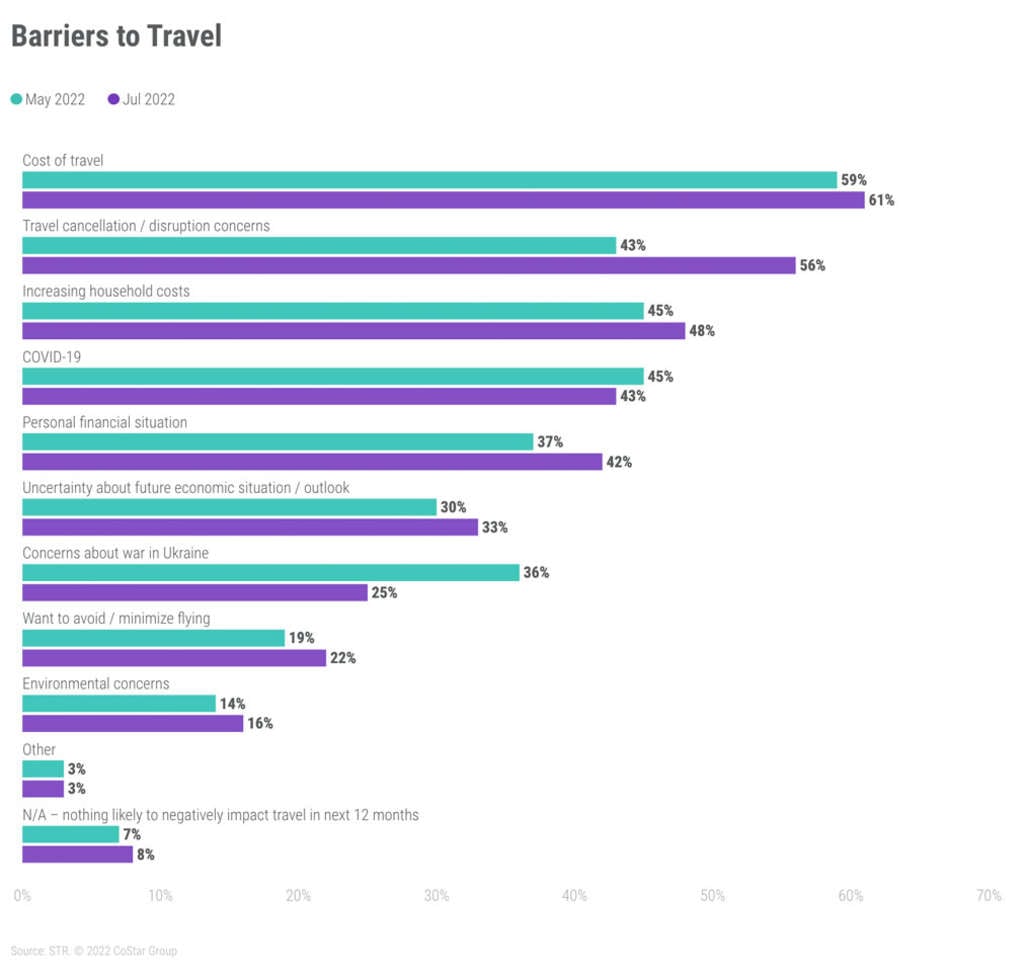

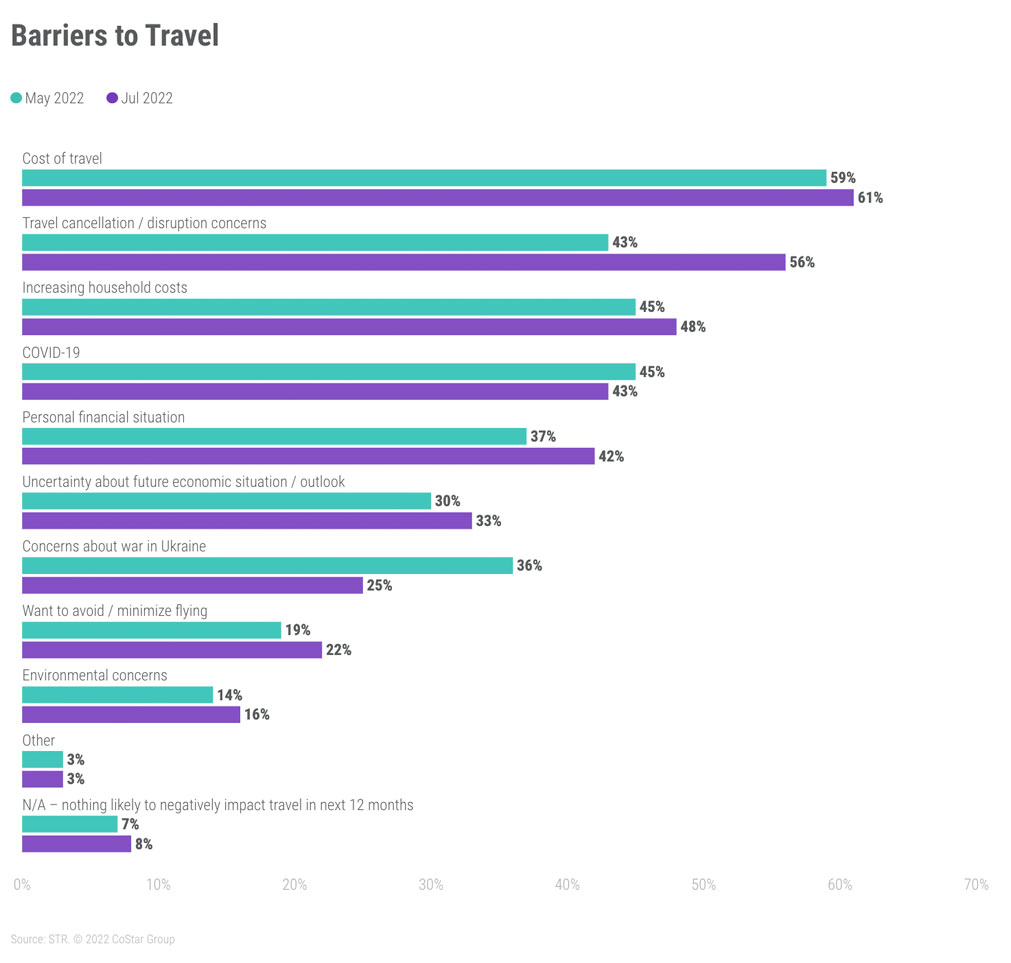

Travel cancellations and disruptions have recently been announced as airlines and airports must manage increased demand, particularly with supply chain and staffing issues. Concerns about travel disruption emerged as a major barrier to travel, influenced by media reports as well as first-hand and concrete negative experiences.

Overall, nearly 6 in 10 said cancellations and disruptions would affect their next trip. North Americans are more concerned than others, with 63% worried about travel disruptions compared to 54% among Brits and Europeans.

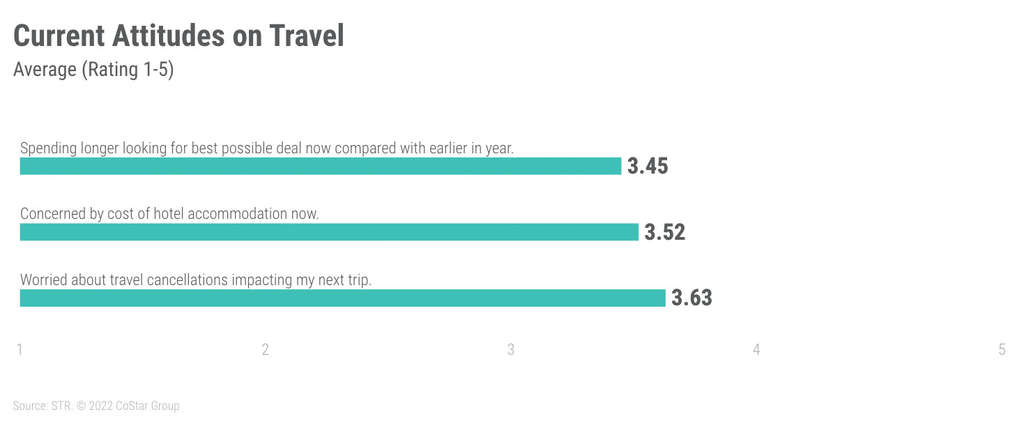

Meanwhile, almost half agreed that they are now concerned about hotel accommodation prices and the same proportion said they spend more time looking for deals. These findings suggest that while consumers are increasingly scrutinizing the cost of travel, they are eager to get away. How consumers balance increased costs with the benefits of travel is a key issue that could shape the performance of world tourism in the coming months.

Financial conditions are more of a concern, the stress around the war in Ukraine has decreased

Travel costs continue to be the biggest obstacle to tourism growth. As of May 2022, nearly 60% of spending is projected to negatively impact travel over the next 12 months. Unsurprisingly for the reasons stated above, the second biggest obstacle was travel cancellations and disruptions cited by 56 percent compared to 43 percent in May 2022.

Compared to May 2022, as other financial barriers – rising household costs, personal financial conditions and economic uncertainty – increased, the overall significance was in a downward trend. How the global economy develops will determine whether these barriers pose a greater threat to tourism later in the year.

Meanwhile, on the contrary, the war in Ukraine is perceived as less of a barrier to travel than in May 2022. A quarter thought it would negatively impact their travel in the next 12 months, down from May 2022 (36%). Although Europeans were more conservative than others about the war, 31% saw it as defensive.

A cost-benefit analysis awaits.

Despite economic uncertainty and rising inflation, travel prospects are still good due to strong demand. Concerns about travel disruption may be a bigger factor than financial considerations, which led to a muted response in this latest survey. The good news is that travel disruption, unlike financial issues, is something the industry can address if staffing and supply chain issues are eased. Timely forecasting of future demand also allows businesses to better manage the situation.

However, these factors combined with the concerns of Covid-19 create a challenging backdrop for tourism. Tourism businesses, like consumers, are eagerly watching the government’s efforts to address the economic challenges ahead. Declining real incomes will also impact future performance on how consumers evaluate the overall cost and benefits of travel. Travel disruption – perceptions and realities – is likely to remain a hot topic for the rest of the peak travel season.

About STR

STR provides premium data reference, analytics and marketplace insights to the global hospitality industry. Founded in 1985, STR has operations in 15 countries with corporate North American headquarters in Hendersonville, Tennessee, global headquarters in London, and Asia Pacific headquarters in Singapore. STR was acquired by CoStar Group Inc. in October 2019. (NASDAQ: CSGP), a leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.

See the source

[ad_2]

Source link