[ad_1]

Welcome to Thomas Insights – Every day, we publish new news and analysis to keep our readers up to date with what’s happening in the industry. Sign up here to get the top stories of the day delivered straight to your inbox.

Mergers and acquisitions in the technology sector continue at a healthy pace, and Q2 M&A results highlight several large deals. In Q2, the largest US acquisition was VMWare by Broadcom, which was a $61 billion purchase. Other major M&A news deals include Thermo Fisher Scientific’s $21 billion acquisition of PPD Inc and Microsoft’s purchase of Nuance Communications for more than $19 billion.

According to Global Data Research, global technology deals hit $3 trillion in Q3. While M&A deals fell 25.5% globally, tech deals remained stable in Q2 and accounted for one-quarter of the market in the US.

“Transactions are still emerging,” said Mark Shafir, global associate head of M&A at Citigroup.

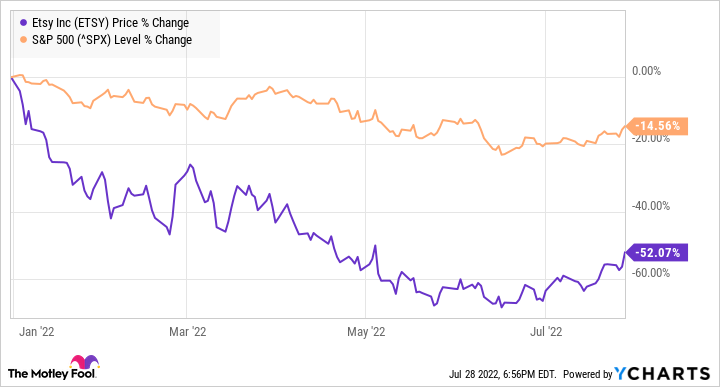

Experts point to inflation and stock market volatility, as well as the Ukraine war, to a slowdown in M&A activity. However, Alison Harding-Jones, head of Citigroup Inc’s EMEA M&A, said this trend will not continue and “there will be a time for negotiation”.

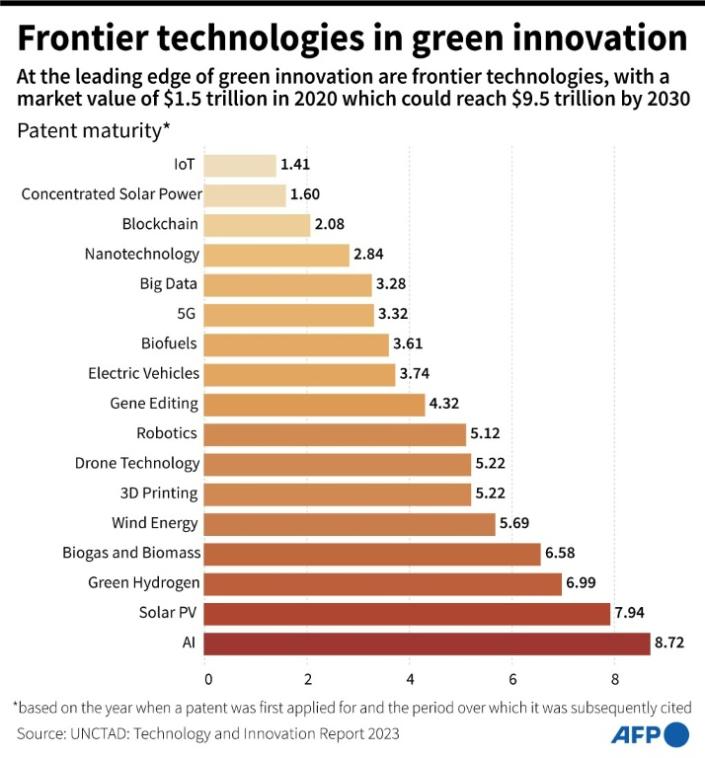

Looking ahead, many experts predict that virtual M&A will continue to grow and ESG initiatives will increase in 2022. And according to PWC, headlines are attention grabbers. [M&A activity] Falling, the big picture shows an active market.

Image credit: Song_about_summer / Shutterstock.com

More from business and industry

[ad_2]

Source link