[ad_1]

E-commerce giant Etsy (ETSY 0.80%) Its second-quarter results impressed investors — and the company’s shares soared on the heels of the update. That’s in stark contrast to many other companies that headed south during a busy earnings week.

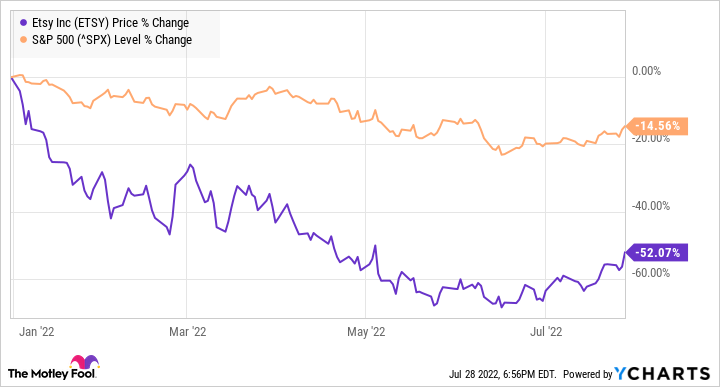

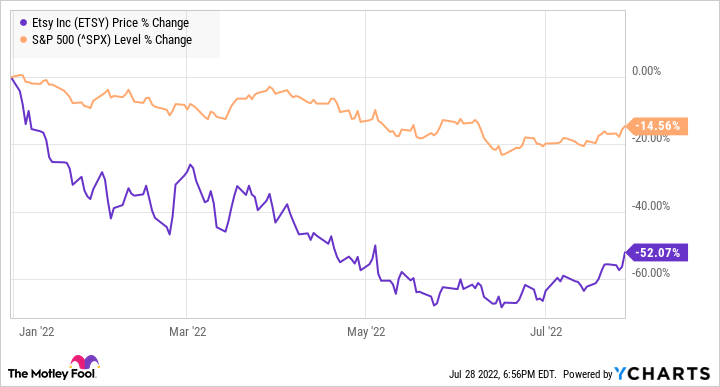

Despite the jump, Etsy shares are down 52% over the past 12 months. However, the company’s strong second-quarter performance shows good reasons to stick with the tech company — even if important challenges remain. Should Investors Pick Up Etsy’s Shares Following Its Latest Quarterly Update?

ETSY data by YCharts

Growth has slowed, but there are encouraging signs.

Etsy and other e-commerce companies benefited from the windfall caused by the pandemic. That’s partly why Etsy isn’t posting the same growth rate as last year. Etsy’s revenue increased 10.6% year over year to $585.1 million in the second quarter. That’s not as dramatic a jump as investors are used to, but it’s slightly more than double the rate of growth in the first quarter.

Etsy’s gross merchandise volume (GMS) in the quarter — the total value of orders placed on the platform — fell 0.4% to $3 billion. Although this is not good news for the company, it is not surprising. A complex macroeconomic environment and geopolitical tensions contributed to lower consumer spending that impacted Etsy’s GMS.

In other bad news for Etsy, the company’s net income fell 25.6% to $73.1 million. Management attributed the decrease to an increase in expenses, particularly related to payroll, as the company increased its employee count.

On the other hand, Etsy continues to add buyers and sellers to its platform. Active buyers grew 3.8% to 93.9 million and active sellers jumped 41.5% year over year to 7.4 million.

Last but not least, Etsy’s adjusted earnings before taxes, expenses, depreciation and amortization (EBITDA) rose two percentage points to 68 percent in the period — another good sign for the business.

See the dynamics related to the epidemic

The coronavirus pandemic affected consumer activity in a way that initially benefited Etsy, but also made year-over-year comparisons difficult for the e-commerce platform. Additionally, factors that are now completely outside of Etsy’s control (inflation, geopolitical tensions, etc.) are affecting consumer spending.

The last two and a half years have been extraordinary. So in order to determine whether Etsy will buy and last for years, it’s important to focus on the prospects above all that has happened recently and will happen in the future, but it won’t last forever.

The company’s strong and growing moat may be the best reason to consider investing in Etsy. While the e-commerce industry is highly competitive, Etsy is primarily concerned with vintage and handmade goods due to its niche in this sector. The advantage of this strategy is that Etsy is the place to exchange such goods, and buyers or sellers of these goods will continue to flock to the platform.

Etsy benefits from the network effect — the more people use it, the higher the value of the platform. Meanwhile, despite the industry’s recent struggles, e-commerce is on an unstoppable long-term upward trend.

The growth of digital payments has increased internet piracy around the world, and higher consumer spending all contribute to the shift of important transactions from brick and mortar channels to online platforms. Some projections show that the e-commerce sector will be worth $7.45 trillion by 2030, compared to $3.86 trillion by 2021—a 7.6% compounded growth rate by the end of the decade.

Vintage and handmade items account for only a fraction of this total, but sales of these items follow the same upward pattern. This means higher GMS, revenue and profit for Etsy. A company’s stock performance should follow suit.

That’s why it’s too early to leave on Etsy. The company is still well positioned to reward its shareholders with impressive market performance.

[ad_2]

Source link