[ad_1]

Like high-flying tech stocks Tesla They tend to get a lot of attention from the media and investors. But investors looking for more stability and less volatility in their portfolios may want to focus on dividend stocks instead. Dividends, especially those that increase their installments each year, can be great stocks to own for the long term and some can even be effective in helping one accumulate wealth to fund retirement.

Let’s take a look at three dividend tech stocks worth paying more attention to in August.

1. Microsoft: 0.88% dividend

Microsoft (MSFT -0.26%) It is one of the companies with a market value of $2.1 trillion. The software giant is known for its Microsoft Office products, its personal computing division and even its Xbox video game division. All these subsidiaries helped bring the company’s revenue to $198 billion last year.

However, the highlight of Microsoft’s business right now is cloud computing, specifically its Azure division. Azure is a cloud infrastructure provider that sells computing and storage services to other businesses, allowing them to avoid buying computer servers themselves. such as Amazon Web Services (AWS) and AlphabetGoogle Cloud, Microsoft Azure is rapidly evolving world from on-premise servers to the cloud. Last quarter, Microsoft Intelligent Cloud revenue was $20.9 billion, with Azure accounting for 40% of revenue during the period, accounting for most of the growth.

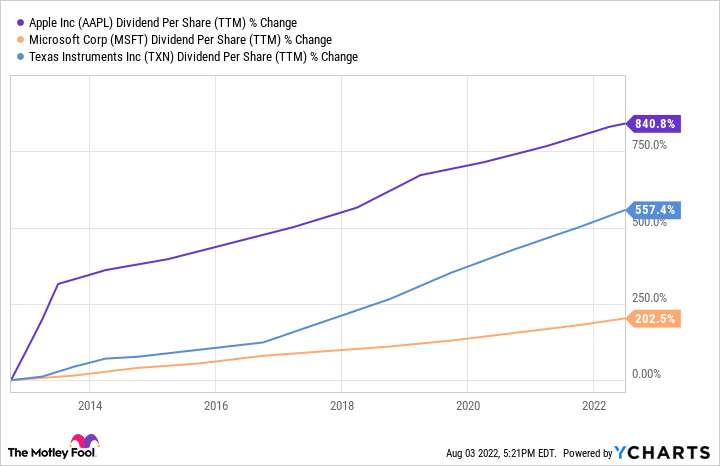

Azure, along with the sustainability of Microsoft’s other divisions, should help propel Microsoft’s revenue power to new heights this decade. This revenue growth will help accelerate its dividend yield, which is currently yielding 0.88%. While not a high yield, the company’s dividend has increased 200 percent over the past 10 years. If Azure continues to grow rapidly, investors should expect this dividend growth to continue going forward.

2. Texas Instruments: 2.51% dividend

Not only a graphics company Texas Instruments (TXN -0.33%) It is one of the largest semiconductor manufacturers in the world. Unlike previous technology innovators, the company focuses on having a diverse portfolio of legacy technology chips that are constantly in demand in the manufacturing, automotive and electronics industries.

This focus, along with a great brand, has led Texas Instruments to generate high returns for shareholders. Last quarter, revenue grew 14 percent year over year to $5.2 billion, with trailing 12-month free cash flow of $5.9 billion. With all this cash flow, the company pays a healthy dividend of 2.51 percent, which has grown 557 percent over the past 10 years.

Industry experts expect semiconductor demand to grow more than 66% by 2030. With this industry tailwind, Texas Instruments appears poised to continue generating cash flow for shareholders and continue to increase its dividends.

AAPL Dividend Per Share (TTM) data by YCharts.

3. Apple: 0.55% profit rate

Finally, we have the largest company in the world; Apple (A.P.L -0.14%). The $2.7 trillion market cap company dominates the smartphone market with its flagship iPhone; Especially in America. It is also developing other computing devices such as the iPad, AirPods and Apple Watch. On top of these devices, Apple has a strong software and services business driven by sales on the App Store. For reference, Apple’s services business generated $19.6 billion in revenue last quarter, or nearly $80 billion annually.

This combination of hardware and software dominance has made Apple extremely profitable. Over the past 12 months, the company generated $108 billion in free cash flow. With more cash coming in, Apple has been giving more money to shareholders in the form of stock buybacks and dividends. The dividend is currently yielding just 0.55%, but has grown 841% over the past 10 years.

If you believe in the continued dominance of the iPhone and Apple’s computing ecosystem, this could be a great dividend payer to own in your portfolio.

A word about products

When it comes to dividends, it’s important to note that if the share price is growing quickly (even when the company is paying good dividends), they may seem too low.

^ SPX data by YCharts

All these three shares from S&P 500 In the last two years and their division appears to be very misleading. Dividend-focused investors should consider this stock price appreciation when deciding whether a dividend-paying stock is worth considering.

John McKee, CEO of Whole Foods Market, a subsidiary of Amazon, is a member of the Motley Fool’s board of directors. Alphabet CEO Susan Frey is a member of The Motley Fool’s board of directors. Brett Shaffer has no position in the mentioned stocks. The Motley Fool has positions in and recommends Alphabet (A shares), Alphabet (C shares), Amazon, Apple, Microsoft, Tesla and Texas Instruments. The Motley Fool recommends the following options: long March 2023 $120 calls on Apple and short March 2023 calls on $130 on Apple. The Motley Fool has a disclosure policy.

[ad_2]

Source link