[ad_1]

The recent surge in large-cap tech stocks has been surprising. Last year, high rates sent the broader tech sector tumbling off a cliff. The more speculative or less profitable the stock, the greater the risk. Now, the broader markets and tech scene are in recovery mode, but the relief gains haven’t even been the size.

The bigger the market cap, the bigger the gains in technology. This makes sense given the strong balance sheets, profitability, growth prospects, and efficiency gains as the broader economy begins to slow down.

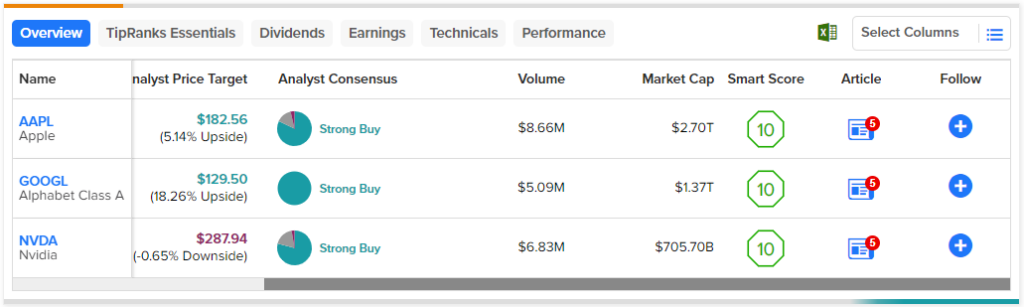

So, in this episode, we’ll take a look at three outstanding tech plays with TipRanks’ Comparison Tool — AAPL, GOOGL, and NVDA — to consider in the megacap universe.

Wall Street has every name a strong buy, even after their sharp rebounds hit their respective lows. These three stocks also have ‘Perfect 10’ Smart Scores, indicating that they can outperform the market from here, according to TipRanks. Incidentally, each tech behemoth has impressive hardware capabilities and potential upside from the AI boom.

Apple is a tech juggernaut that has been on a high since posting some very reasonable earnings results. Going into the report, Apple shares looked “higher” after rallying more than 32 percent from January lows. Still, Apple rose more than 4 percent on the earnings beat, leaving many profit-makers kicking themselves.

Although there has been a lot of valuation expansion in recent months, I’m bullish. The company seems to be on the cusp of a new product, and its expansion into India could pave the way for further growth in the next five years.

Warren Buffett gave Apple some pretty high praise over the weekend, going so far as to call it the best business in Berkshire’s portfolio. I agree. Apple has one of the best managers in the business and has a lot more to do with a product that is mainstream than something that is good.

It is difficult to say what will come after the iPhone. Regardless, Apple may be taking its sponsorship into new waters. Whether it’s about the next hardware release or new services (think fintech), Apple always seems to find the high road.

Although it’s trailing at 29.1 times price-to-earnings (P/E), I’m excited about what’s ahead. A growing service business and a potential mixed-reality headset may be on the radar of some analysts. However, it’s something that hasn’t been on any of our radars yet that will help Apple continue its upward trajectory.

The hardware business, in particular, may have disruptive potential. As AI plays a more prominent role in our daily lives, I want Apple’s Silicon Neural engine (which helps Apple devices handle certain tasks faster and more efficiently) to be even more of a differentiator.

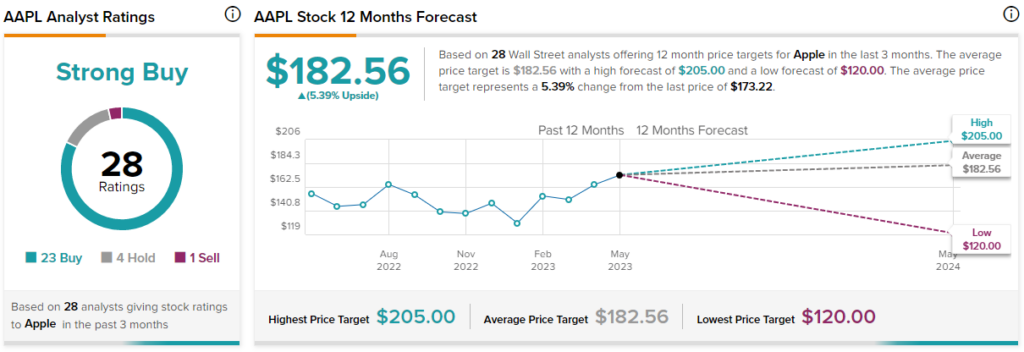

What is the price target for AAPL stock?

Apple stock comes in at Strong Buy, with 23 buys, four holds and just one sell. AAPL’s average stock price target of $182.56 includes only a 5.4% gain from this.

Alphabet was the first to play for AI. Currently, the software behemoth seems to be in a rush to get a product out the door that matches the likes of OpenAI’s ChatGPT. Google has a lot of creative AI talent behind the scenes. Still, it’s up to Google to use AI to defend its turf in the search space.

It’s not hard to imagine how AI will change the search market in the next few years. Fortunately for Google, it’s poised to defend its search dominance, while all its other businesses (like its cloud business) are looking to gain ground over their peers with some help from AI. So, I’m down on GOOGL even if the company is forced to play a bit more defensive.

For now, it’s ChatGPT that’s driving the excitement, but ChatGPT may or may not be the number one consumer-facing chatbot a year or so from now. In the near future, it still seems uncertain. Arguably, a highly competitive product could come out of Google’s pipeline.

Google Bard’s “experiment” could be off to a mixed start. However, I think it would be wise to be cautious as Google may face regulatory upheaval in the near future. By ensuring a soft launch, Google can avoid additional scrutiny from regulators, many of whom may be holding the company to market dominance.

With the big I/O event underway, we’ll learn a lot more about Google’s AI plans today. I look for new developments to boost the stock in the near to medium term.

What is the price target for GOOGL stock?

Alphabet is also a solid buy, with 29 one-vote buy ratings to its name – amazing! The $129.50 average price target for GOOGL’s stock indicates a potential upside of 18.7% from current levels.

Finally, in this piece we have Nvidia hardware gaming, which has been on a very hot run in tech stocks. The stock is burning 100% every year. Indeed, new highs seem inevitable after the recent rally. A big part of the lineup is courtesy of the AI hype.

Although AI opens new doors for Nvidia, a setback could be lurking around the corner. It’s not easy to bet against Nvidia in the amazing situation. However, I have to ignore these ratings because they are uncomfortable for me. That said, I’m more willing to reconsider at lower prices.

The stock trades at more than 160 times earnings, which is higher than the semiconductor industry average. While AI enthusiasm could send NVDA stock much higher than this, I would avoid chasing it.

Allowing it to come back to you may be the best course of action, especially if a recession creates more noise in the market.

What is the price target for NVDA stock?

Nvidia stock boasts a strong buy consensus rating, with 30 buys, seven holds and one sell rating assigned over the past three months. However, NVDA’s average price target of $286.94 indicates a downside potential of 1.2%.

Conclusion

Big tech is making big profits. Still, of the three stocks mentioned, Alphabet has the most upside potential, according to analysts. Plus, it’s the only stock that has all analysts recommending it as a buy.

Disclosure

[ad_2]

Source link