[ad_1]

When looking for stocks that have the potential to beat the market, there are a few ways to do so. First, you can look for value stocks that aren’t trading where they should be. Second, you can buy growth stocks that may be expensive now, but their long-term growth should overcome their high prices and drive their shares higher.

I think three stocks can beat the market using growth philosophy Cloudflare (NET -8.11%), Twilio (NET -8.11%)And We killed (Adien -3.09%). Read on to find out why (and how) these stocks are set to do just that.

Cloudflare

When you want to host a website, you can buy network equipment and do it yourself. The problem is that you are responsible for maintaining the site, dealing with threats, and making sure everything runs smoothly. Another option is to outsource all of that to Cloudflare.

When you use Cloudflare, you place code in databases located in over 275 cities worldwide, giving your site unmatched speed. Additionally, Cloudflare has a high level of security, protecting your site from DDoS (Distributed Denial of Service) attacks and controlling how many bots access the site.

If this sounds like a good solution, you’re right — over 162,000 customers have thought the same thing. 2,042 customers spend more than $100,000 per year, a metric that will grow 44 percent by 2022. Throughout 2022, Cloudflare grew its revenue by 49%, and is forecast to continue this success, with management forecasting 37% growth in 2023.

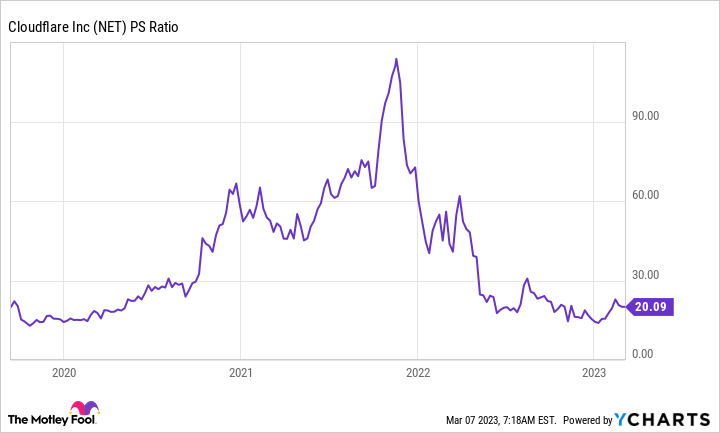

But you have to pay a premium to own that growth stock.

NET PS ratio data by YCharts

At 20 times sales, Cloudflare is not a cheap stock. But if it continues to grow at a rate of 30% or more for the next few years, this price could be a bargain.

While not profitable from a traditional perspective, Cloudflare expects to generate non-GAAP earnings of $0.16 this year, which is a step in the right direction. With Cloudflare operating to profitability and a market cap estimated at $135 billion, the stock looks like a solid buy.

Twilio

Twilio helps its customers communicate better with their customers. The products can set up automated text messages to help confirm appointments, set up video calls and reduce customer acquisition costs. However, Tiwilio’s growth-at-all-costs mentality has put the stock and the company in trouble.

Twilio in 2010 Since it went public in 2015, it hasn’t made much profit. Now that growth is slowing down, management is turning to profitability.

To achieve this goal, Twilio underwent two layoffs, laying off 11 percent of its workforce in September 2022 and another 17 percent in February. After these layoffs, Twilio’s management in 2016 It forecasts non-GAAP operating profits of $300 million in 2023. This isn’t true profitability since it doesn’t include stock-based compensation, but every company has to start somewhere.

Although Twilio’s revenue grew 22% in Q4, in Q1, that slowed to 14%, which underlies why Twilio needs to be profitable. So why buy this stock? His estimation. At 3.5 times sales, Twilio is a real bargain, as there is plenty of short-term pessimism baked into the stock.

TWLO PS ratio data by YCharts

Additionally, Wall Street analysts expect Twilio’s growth to reverse as the economy recovers. In the year They only plan for 12.4% growth in 2023, but this number will accelerate to 16.2% in 2024.

Twilio is trading that it won’t grow again. However, this is probably a wrong assumption, and when the company works towards profitability, these prices can be negotiated.

We killed

Even if you’ve never heard of Adyen (it’s based in the Netherlands), it offers payment processing services. with the competitors PayPal, Block, and Stripe, has some stiff competition. However, the company is growing rapidly and establishing a strong footprint.

In the year In the second half of 2022, Adyen’s processed payments rose 41% to 422 billion euros, or about $445 billion. For reference, PayPal did around $555 billion (comparatively). Adyen has a Europe, Middle East and Africa (AMEA) focus, but is growing rapidly in other areas.

| Range | Income makeup | YOY second half of 2022 growth |

|---|---|---|

| Ema | 55.3% | 20% |

| North America | 26.4% | 45% |

| Asia-Pacific | 10.8% | 44% |

| Latin America | 7.4% | 36% |

Source of information: Adyen Yoi = over a year.

With Adyen in key positions, it’s a stock investors should watch. Earnings are expected to grow at a 30% clip next year, which should please investors. Plus, the stock trades at a reasonable 19 times free cash flow, so you get both growth and value.

If you’re looking for a stock to make money over the long term, you’ll be hard-pressed to find a better one than Adyen.

[ad_2]

Source link