[ad_1]

Easing of coronavirus-related restrictions has boosted air-travel demand significantly. This is a huge positive for the Zacks Airlines industry. An increase in air traffic is likely to boost airlines’ top line performance in the September quarter. Airline players love it Delta Air Lines (D.L – free report), United Airlines (UAL – free report) and JetBlue Airlines (blue – free report) may benefit from strong air-travel demand.

However, a significant increase in fuel costs is not good for airlines, as costs on this front are significant for players in this industry. An increase in the cost of this key input will limit bottom-line growth for aviation stocks. Knee jerks are another headache.

Industry overview

The Zacks Airlines industry comprises of players engaged in transporting passengers and cargo to various destinations globally. Most operators maintain multiple mainline aircraft in addition to several regional aircraft. Operations are supported by regional airline distributors and third-party regional carriers. In addition, industry players use their respective freight divisions to offer a wide range of freight and postal services. The players invest heavily in improving technology. The industry, in addition to legacy carriers, also includes low-cost players. The welfare of companies in this group is related to the health of the entire economy. For example, the aviation sector was one of the areas where passenger revenue was hit the hardest by the pandemic. The next focus on increasing freight revenues is positive.

Key aspects governing the airline industry

Good points for awakening the interest of air-travel: Demand for air-travel, especially for leisure, is very strong and helps airlines’ top lines. Heavy air traffic created during the Labor Day holidays may boost airlines’ top line performance in the September quarter. United Airlines raised its revenue growth outlook for the third quarter of 2022 due to strong air traffic. UAL now expects total operating revenues to grow 12% from the September quarter of 2019, up from an earlier forecast of 11% growth.

Bottom Line Oil Price Increase: The current increase in fuel prices does not bode well for any airline stocks, as an increase in fuel prices means an increase in operating costs. In particular, in the first half of 2022, the price of oil increased by 48%, which is due to the war between Russia and Ukraine. JetBlue Airways raised its third-quarter fuel price forecast by 18 cents to $3.86 a gallon as fuel prices moved north.

Ban’s lack of staffThe airline industry in the United States is under stress on the labor front. The industry is grappling with labor shortages as demand returns, with airlines slashing their workforces significantly as the pandemic worsens. Many airlines are facing resistance from pilots, who are demanding higher pay and better working conditions to offset the fatigue caused by excessive workloads following insufficient hands. Due to labor shortages, many US airlines have trimmed capacity this winter, which could hurt profitability. Reduced capacity is pushing up non-fuel costs. United Airlines expects its consolidated cost per seat mile (CASM), excluding fuel, third-party business costs, profit sharing and special charges, to increase about 16% from corresponding 2019 levels in the September quarter.

Focus on cargo revenues: As passenger revenue bounces back from pandemic lows, airlines’ simultaneous focus on their cargo units could boost the top line even more. For example, in the June quarter, cargo revenue at Delta was up 86 percent year over year. This was the best freight segment ever in the second quarter of the year.

According to an IATA report, cargo revenue could account for $191 billion of the industry’s revenue by 2022. The estimated figure is That’s nearly double the $100 billion recorded in 2019. In total, airlines are expected to handle more than 68 million tons of cargo. Current year. The estimated figure is a record high.

The Zacks Industry Standard shows sunny prospects

Zacks Airlines Industry is a group of 29 stocks within the broader Zacks Transportation sector. The industry currently holds a Zacks Industry Rank #84, placing it in the top 34 percent of the 250 plus Zacks Industries.

The group’s Zacks Industry Rank, essentially the Zacks Rank average of all member stocks, reflects the bright recent outlook. Our research shows that the top 50% of industries in the Zacks Rank outperform the bottom 50% by more than 2-to-1.

The industry’s position in the top 50% of Zacks-ranked industries is the result of a positive earnings outlook for companies that participate in the aggregate.

Before we present a few stocks you may want to keep in your portfolio, let’s take a look at the industry’s recent stock market performance and valuation picture.

The industry underperforms the S&P 500 and the sector.

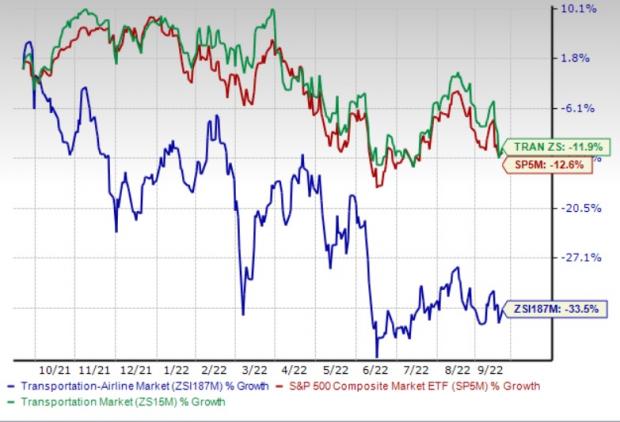

Zacks Transportation – The airline industry underperformed the Zacks S&P 500 composite and the broader transportation sector last year.

The industry is down 33.5 percent over the period, compared with a 12.6 percent decline for the S&P 500 and an 11.9 percent decline for the broader sector.

A year’s worth of performance

Pricing picture

The price/sales (P/S) ratio is often used to value airline stocks. The industry currently has a forward 12-month P/S of 0.38X, compared to the S&P 500’s 3.38X. It is also below the sector’s forward-12-month P/S of 1.55X.

Over the past five years, the industry has traded at a high of 1.01X, a low of 0.37X and a mid-range of 0.69X.

Forward 12-month price-to-sales ratio (last five years).

3 Transportation – Airline shares to keep tabs

Delta It currently has a market capitalization of $21.12 billion. DAL, based in Atlanta, GA, is booming as demand for air travel (especially for leisure) increases. DAL expects September quarter earnings to increase in the 1-5% band. High fuel costs, however, are a constraint.

Delta’s earnings have beat the Zacks Consensus Estimate in three of the past four quarters (missing the mark the rest). The shooting average is 33.7%. DAL currently maintains a Zacks Rank #3 (Hold).

Price and Agreement: DAL

.jpg)

United Airlines It currently has a market capitalization of $12.65 billion. On the back of high air travel demand, UAL has witnessed profitability in the second quarter of 2022 and expects to see the same in the third quarter. UAL forecasts average jet fuel prices to be $3.83 per gallon in the third quarter, well above the figure recorded in the third quarter of 2021. But this is a concern.

Over the past 60 days, the Zacks Consensus Estimate for 2022 earnings has moved 38.7% northward on UAL. United Airlines currently carries a Zacks Rank of 3.

Price and agreement: UAL

JetBlue It currently has a capitalization of $2.6 billion. Management recently raised its previous outlook for air traffic for the third quarter of 2022, as it continues to see strong air-travel demand even after the summer peak. In the September quarter, revenue per seat miles (RPMs: a measure of air traffic) is expected to rise in a 22-24% band from third quarter 2019 actuals (previous guidance: rises in the 19-23% range).

Over the past 60 days, the Zacks Consensus Estimate for the current quarter’s earnings has moved 17.7% northward on JBLU. JetBlue is currently rated a Zacks #3.

Price and Deal: JBLU

[ad_2]

Source link