[ad_1]

© iStock.com

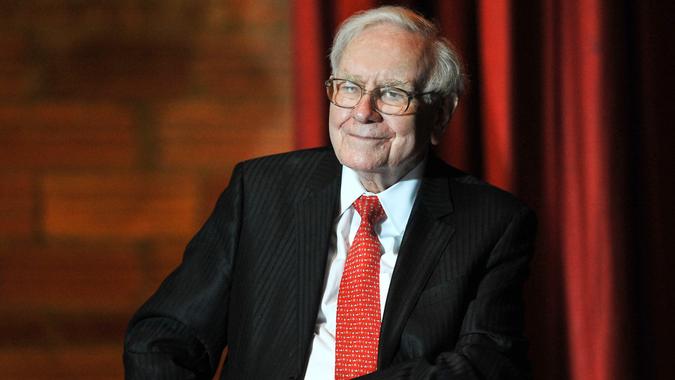

Warren Buffett, sometimes called the Oracle Omaha, is one of the most successful investors in the world. Similarly, it is often referred to as homespun wisdom that encourages intelligent and knowledgeable investment. Here are some tips to help you invest in Warren Buffett.

Warren Buffett’s advice on market failure

1. “Only when the storm comes up do you know who is swimming naked.” Buffett noted that most companies make money when the market is good. You can see which companies have weak fundamentals when the market is gone.

2. “We try to be afraid of others and to be greedy only when others are afraid. Buffet sees market failures as opportunities to buy.

3. “Look at the market fluctuations as your friend rather than your enemy. Instead of participating in it, do not be lazy. ” Buffett knows that the market is volatile and represents opportunities for change.

Warren Buffett’s advice on buying what you know

4. “Beware of GC formulas.” Buffett is known for refusing to buy technology shares with millions of others, such as Apple, Google and Amazon. He said he did not buy shares of companies he did not deserve. As technology stocks become more dominant, however, the fingerprint law has changed its mind, or it has acquired sufficient knowledge of the technology to make it easier to invest in Apple and Amazon.

Warren Buffett’s advice on patience

5. “A friend of the wonderful company, the enemy of the Middle Ages.” Buffett’s philosophy is to buy high-quality, long-term stocks.

6. “Today someone is sitting in the shade because he planted a tree a long time ago.” This interesting quote can be seen as life advice and general investment advice, because it shows the value of patience and long-term planning.

7. “Our favorite retention time is forever.” Explaining his philosophy to shareholders, he went on to say.

8. “We are different from people who are quick to sell and make a profit when companies are doing well, but they are also relying on frustrated businesses. Peter Lynch loves this kind of behavior to cut flowers and weed.

9. “If the market is closed for 10 years, buy only what you can enjoy.” This verse is partly about patience and partly about the importance of investing in solid stocks.

Warren Buffett’s Negotiation Hunting Advice

10. “The price is what you pay for. You get the price.” Buffett carefully inspects the shares it buys and makes its choices based on the company’s basics. When he finds a company that he thinks is less valuable, he buys it, even though others think it is too expensive.

11. “It’s much better to buy an amazing company at the right price.” Good companies are becoming more and more valuable, and unlike margin companies, they can be found at bargain prices but they are not appreciated over time.

Warren Buffett’s advice on business offerings

12. “It takes 20 years to build his name and it takes five minutes to ruin it. If you think about it, you will do things differently. The wise investor and wise merchant Buffett knows how weak he is, and he keeps his name.

13. “When a brilliant administration dissolves a business in the name of bad economics, the name of the business remains intact.”

14. “It is useless to predict rain. Making an ark works. The verse emphasizes Buffett’s understanding that there are always failures in the market and there can always be obstacles in the business. The main thing is to protect them and plan for them.

15. “In the business world, the rearview mirror is always clearer than the windshield.” Learning from mistakes – and one’s success – means understanding the past and why it happened and preparing for the same event in the future.

Warren Buffett’s own success

16. “I always knew I would be rich. I don’t think I doubted it for a minute. Buffett does not brag, but he knows that it is easy to say no. At least part of the success is self-confidence.

17. “I don’t want to jump from a 7-foot bar; I look around for a 1-foot bar. Patience, perseverance and perseverance – these are the keys to buffet success.

Warren Buffett about humility

As successful as Buffett was, he remained humble in the Middle West.

18. “I buy expensive clothes. They look cheap to me. Buffet is often called for to wear cheap clothes and live in the same modest house for dozens of years.

19. “It is better to spend time with people than with you. Choose partners who are better than you, and you will move in that direction. Buffett recognizes the value of being surrounded by intelligent, hardworking, and industrious people, including those who are knowledgeable.

20. “Wall Street is the only place where people ride on the Rolls-Royce to get advice from the subway.” Buffett always chooses his own shares and is happy to share his secrets with others.

Warren Buffett, philosopher

Buffett commented on many issues, and the general wisdom is the same. Many of his quotes go beyond investment and business and are simply good life advice.

21. “If you find yourself in a long-drift boat, your energy to change ships may be more effective than the effort to pack the cracks.” Although this verse includes the teaching of investing in good things after the bad, it is also a guide to living.

22. “Looks like there are some twisted people who like to make simple things difficult.” Buffett’s investment strategy is simply effective and the first to accept it.

23. “Unless you make a lot of mistakes, you just have to do very few things right in your life.”

What is Warren Buffett’s most famous quote?

24. “Rule No. 1: You will never lose money. Rule No. 2 Never forget Rule No. 1. This buffet is one of the most frequently mentioned facts, which includes the philosophy of investment.

The art of Buffett homespun is fun, but if you take it to heart, it can make you a better investor.

Our in-house research team and on-site financial experts work together to create accurate, impartial and up-to-date content. We check each statistic, quote, and fact, using trusted resources to make sure the information we provide is accurate. You can learn more about GOBankingRates processes and standards in our editorial policy.

[ad_2]

Source link