[ad_1]

High-growth stocks appear to be back in style with Wall Street after the worst of 2022. CrowdStrike (CRWD -0.14%) And buy now (Pikor -1.46%) There are two stocks that investors are betting big on this shift. As a bonus, neither stock is overvalued, so investors don’t have to worry about getting burned like they did in 2022.

So let’s find out why these two make such a compelling investment.

CrowdStrike

CrowdStrike is a leader in endpoint cybersecurity software that protects network access points such as mobile phones, laptops or cloud workloads. In the year With over 21,000 customers as of November 2022, CrowdStrike has a large customer base whose security is powered by artificial intelligence (AI). It’s also growing fast, with annual recurring revenue increasing 54% to $2.34 billion in the third quarter of 2023 (ending October 31).

So why is CrowdStrike a great buy now?

Cybersecurity Ventures projects that cybercrime will cost the global economy $10.5 trillion by 2025, so increased protection will be critical. Additionally, businesses may not be able to recoup their spending on cybersecurity software during tough economic times. If they did, they would be vulnerable if they were powerless.

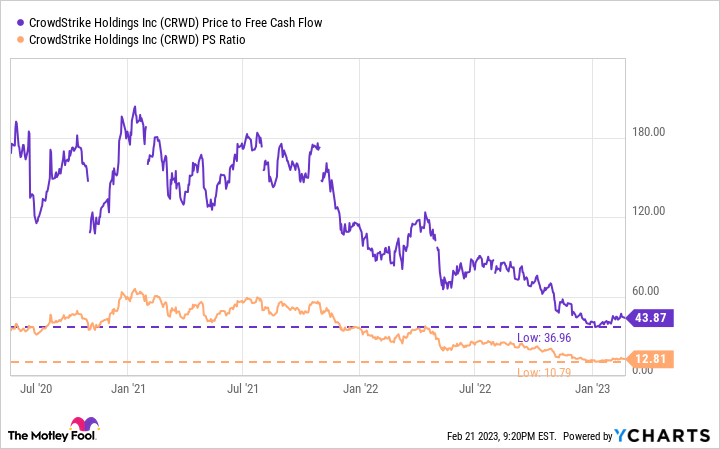

This combination of critical offering and in-class protection makes CrowdStrike a profitable investment. Stocks Trading With prices relatively low, now seems like a good time to take a position in stocks.

CRWD price to free cash flow data by YCharts. PS Ratio = Price-to-Sales Ratio.

CrowdStrike in 2011 It has a huge market potential that is expected to reach $158 billion by 2026. With the stock up just 12% this year, it has plenty of room to run, especially as Wall Street analysts estimate 33% earnings growth for the next fiscal year.

buy now

Bringing the construction industry into the digital age is no easy task, but that’s exactly what Procor is doing with its construction management software. By connecting project owners, contractors, and subcontractors on one platform, all parties can view progress, budgets, and drawings. While these are great benefits, the main point of using Procore is to create a single point of truth.

Few mistakes are made when everyone goes to the same place for recent pictures and communications. This also saves time and money, both of which are critical in the construction industry, which has razor-thin margins.

Procor has experienced strong revenue growth as a public company, and Q4 was no different. Q4 revenue was up 38% from last year, with 2022 revenue up 40%. Guidance for 2023 was strong, with revenue expected to reach $900 million, representing 25% growth.

While Procor isn’t profitable, it’s taking steps to become close. In Q4, operating expenses rose just 24 percent, much slower than the rate of revenue growth. Even Procor has a long way to go before breaking even (it lost $71.2 million on revenue of $202 million in Q4), but that’s still a positive sign.

Procor performed strongly in 2023, with stock up 44%. But his estimation is still at a reasonable level.

PCOR PS ratio data by YCharts. PS Ratio = Price-to-Sales Ratio.

Procore is much earlier in the company’s life cycle than CrowdStrike, which means it’s more advanced. With business continuing to be strong, costs trending in the right direction, and a big opportunity in construction, Procor could remain a strong growth stock for years to come.

Keithen Drury has positions at CrowdStrike and Procore Technologies. He has positions in the Motley Fool and recommends CrowdStrike and Procore Technologies. The Motley Fool has a disclosure policy.

[ad_2]

Source link