[ad_1]

Big money — from the three biggest economies in the world, as well as scores of ambitious venture capitalists — is suddenly flying toward startups promising to help the world build a carbon-free future.

It’s a shift from the world of software into the actual world, following the trajectory of a tech founder like Peter Reinhardt, who sold a software company for $3.2 billion in 2020 and now leads carbon-storage company Charm Industrial. The newer startup, which he co-founded in 2018, turns carbon-rich biomass into sludge that can be safely buried underground. “We need to rebuild almost all the infrastructure around us to eliminate fossil fuel emissions and return the atmosphere to pre-industrial CO2 levels,” Reinhardt says. “That will require a tectonic shift.”

That’s why horizon-scanning investors are suddenly less interested in reseeding yesterday’s innovations (solar, wind and lithium-ion batteries) than doing deals that push forward the frontiers of climate tech. Decarbonized food, carbon-removing contraptions, futuristic materials and next-generation fuels are now portfolio targets for venture capitalists.

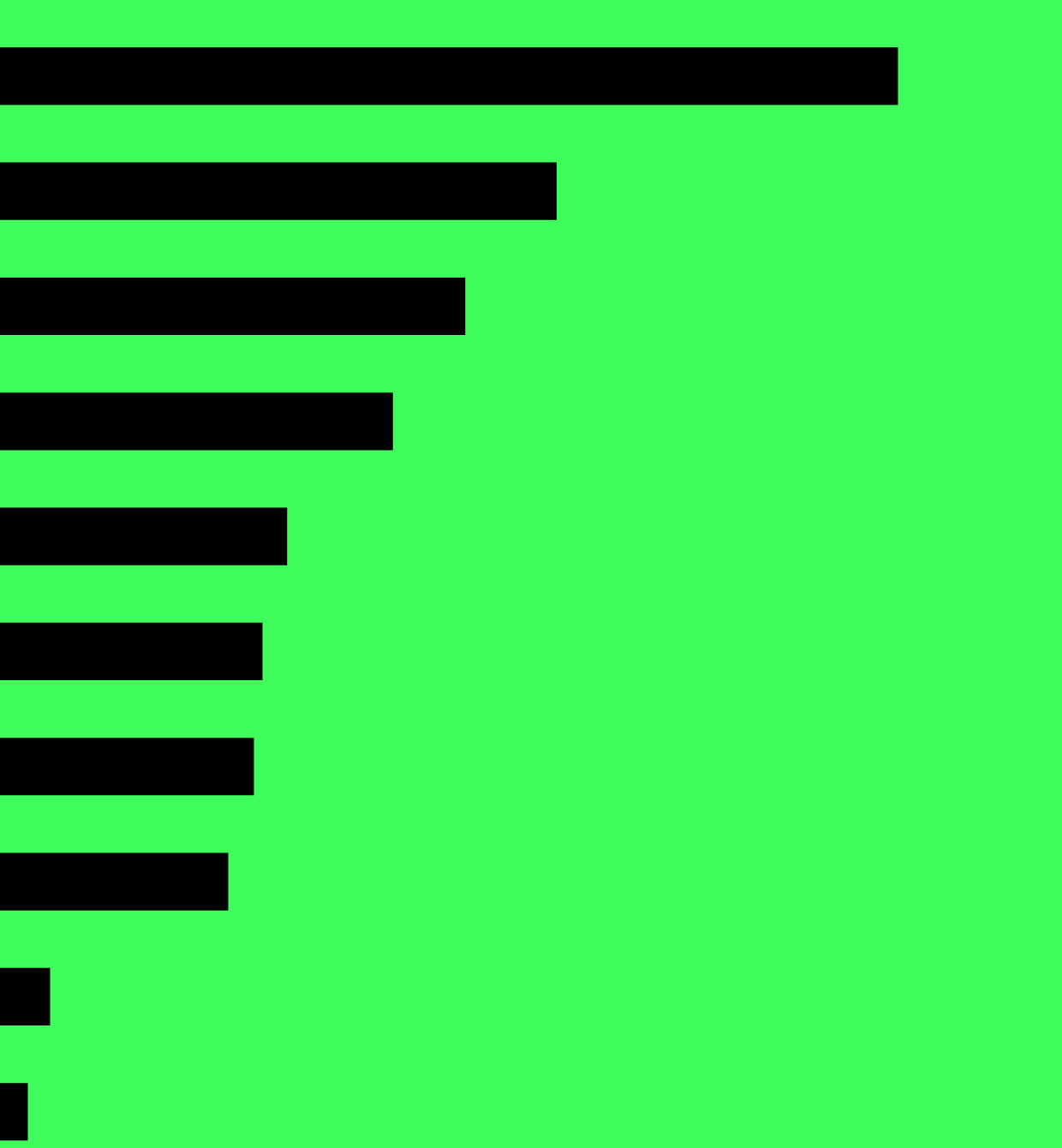

Venture Capitalists Are Moving Beyond Solar and EVs

Climate tech VC deals in 2022

Source: HolonIQ

For early-stage investors, solar panels and electric vehicles are so 2011. By now these are relatively mature products built on the work of previous decades. They’re doing the job they were built for: gradually replacing fossil fuels. In fact, solar and wind are cheaper than coal in most of the world today. That means market forces will turn power grids a deeper shade of green with each passing year, and VCs can focus on electrifying everything else.

“There is capital available for great entrepreneurs — and good entrepreneurs — to tackle really hard problems in a way that wasn’t available in that first wave” of renewables investment, says Gabriel Kra, co-founder of Prelude Ventures. During the last 15 years, he adds, “the core technologies have changed, the participants have changed, the capital availability has changed, the building blocks have changed. And that’s what’s leading to this second, more successful wave of innovation.”

Global Investment in the Energy Transition by Sector

Source: BNEF

Investors won’t be working alone. Many of the most exciting startups combine private and public backing. Examples abound, despite a tech downturn that’s eliminated more than 120,000 jobs from the sector in the US and a banking crisis that’s taken down VC favorite Silicon Valley Bank.

Venture capital investment in climate tech reached a record $70.1 billion last year, according to HolonIQ Global Impact Intelligence. That was an enormous 89% rise over 2021 at a time when overall VC investment retreated, the tech sector shed jobs and Russia’s war in Ukraine spiked oil and gas prices and unleashed a scramble for fossil fuels.

Early-stage financiers are standing up against a backdrop of government, corporate and consumer spending on emissions reductions and adaptation measures. A balance of forces — investor enthusiasm backed by public-sector spending, facing off against global economic headwinds — will be a major topic of discussion during the two-day BloombergNEF Summit on the energy transition in New York this week.

While climate tech showed a surprising resilience compared to the broader VC landscape in 2022, this year so far suggests that the sector isn’t immune. Venture capital and private equity flows into the climate sector fell 12.8% in the first quarter compared to the rolling four-quarter average, according to new data from BloombergNEF. Higher borrowing costs and slowing growth tend to inhibit risk-taking, which is what backing early-stage ventures is all about.

“There are bound to be setbacks along the way but it’s clear that the market isn’t going to disappear,” says Mark Daly, head of technology and innovation research at BloombergNEF. That’s largely because climate change — and its costs in lives and property — isn’t going to disappear until fossil-fuel emissions do.

The US made a sizable investment in solutions in August, when President Joe Biden signed a climate bill containing at least $374 billion of incentives for carbon-free industrial development.

US Climate Bill Expected to Spark 4.5 Times More Investment Than Its Official Price Tag

Estimated additional US investment

Estimated private-sector investment

Estimated additional US investment

Estimated private-sector investment

Estimated additional US investment

Estimated private-sector investment

Source: Credit Suisse

Despite its name, the Inflation Reduction Act is dedicated in large part to accelerating the deployment of solar and wind power as the foundation of the future economy. But it also includes crucial provisions for carbon capture, low-carbon agriculture, green hydrogen, fusion and alternative chemistry batteries to help turn embryonic tech into companies that can eventually reach the immense scale of renewable power.

The US in the post-IRA period will double research-and-development tax credits for small businesses. The climate law is filled with provisions to help nurture early-stage technologies into companies fit for the climate economy.

The effect of these subsidies on investment has been almost immediate. Renewable power developers have invested more than $150 billion in large clean energy projects over the last eight months, surpassing the total over the five preceding years, as a wave of federal incentives propel construction.

There’s been a boom in battery tech too. Just look at the plans by Form Energy — backed by Bill Gates’s Breakthrough Energy Ventures and supercharged by the money on offer in the Inflation Reduction Act — to construct a $760 million factory in West Virginia. The project takes a novel approach to manufacturing dirt-cheap batteries, and it has both a marquee VC investor and owes no small debt to West Virginia Senator Joe Manchin’s decisive vote on the US climate legislation.

More Climate Tech Coverage From Bloomberg Green

Redwood Materials Inc., started by Tesla Inc. co-founder J.B. Straubel, has likewise landed a $2 billion government loan alongside private capital investment to expand its battery-recycling facility in Nevada. It’s part of the American attempt to counter China’s domination of battery materials. Even the longtime dream innovation of nuclear fusion is having a moment, thanks to a breakthrough at a government laboratory last year; the young company Commonwealth Fusion Systems, in Cambridge, Massachusetts, has raised more than $2 billion to try to take the next step forward.

US Climate Bill Is Already Making an Impact

$77B in investments announced since IRA

$15.3B

Hydrogen/

carbon capture

$15.3B

Hydrogen/

carbon

capture

$15.3B

Hydrogen/

carbon

capture

Source: Credit Suisse

The inventor and entrepreneur Saul Griffith says 85% of dealing with climate change, at least in a developed country like the US, is moving the energy system away from fossil fuels. After making strides there, “the smart and passionate people working on the other 15% will do their part, too,” he wrote in his book Electrify.

That process is playing out at the frontiers of climate tech. Money is flowing into previously unthinkable ways to fix the 15% of things that clean electrons can’t, such as agriculture, industrial processes and forestry. Today’s VC-backed companies are establishing new niches meant over the next decade to reach the immense scale that solar, wind and battery-powered cars attained over the previous decade.

In Venture Capital Funding, the US Is Ahead

Global VC investment in climate tech

Source: HolonIQ

The overwhelming majority of finance that finds its way into climate tech still goes into transport and energy startups. But looking at the deal count, it’s easy to pick out the pattern of rising interest in climate-tech startups that focus on green buildings, climate analytics, carbon capture and more. Those categories picked up steam even though VC and private-equity investments in climate-friendly agriculture and food startups thinned last year after a faddish boom in alternative proteins played itself out.

Excluding agriculture, large deals increased in size across the board, and 60 climate-tech funds closed in 2022, having raised $24 billion, according to BloombergNEF. These are not always the usual Silicon Valley stalwarts going after the latest thing. The largest fund to close at the end of 2022 was the $1.5 billion Aramco Sustainability Fund, the VC arm of Saudi Arabia’s national oil company. Oil and gas companies spent $32 billion last year on climate tech, a 27% jump over 2021.

Subsidies Will Make US Solar Cheaper Than China

Utility solar module cost per watt

Tax credits begin to phase out after 2029

Utility solar module cost per watt

Tax credits begin to phase out after 2029

Utility solar module cost per watt

Tax credits begin to phase out after 2029

Source: Credit Suisse

The IRA was only the most publicized signal that 2023 would be the year of climate tech. The last five years have brought cheaper computing and ever-more-powerful artificial intelligence, which is starting to reshape the potential for what problem companies can solve. There are climate-related AI applications in everything from how farmers spray pesticide to how satellites detect greenhouse gas pollution.

Of course, there’s still a long way to go. A report from the International Renewable Energy Agency published last month found that annual spending on climate would need to more than quadruple to $5 trillion a year, a cumulative $150 trillion by 2050, if we are to have any hope of limiting global warming to 1.5C. The current pledges and plans will leave the world with an emissions gap of 16 gigatonnes by 2050. The International Energy Agency reached a similar conclusion last week.

Zero-Carbon Technologies Need a Commodity in Short Supply: Time

Progress to peak deployment

Basic oxygen steelmaking

▼

Solar photo-

voltaics

▼

Progress to peak deployment

Basic oxygen steelmaking

▼

Solar photo-

voltaics

▼

Source: International Energy Agency

The past eight years have also brought the eight hottest years on record, with outlandish extreme events now an expectation instead of a remote possibility. Nothing motivates a certain class of investors quite like rising global temperatures potentially throwing modernity into a tailspin.

Hans Kobler, founder of Energy Impact Partners, has seen several attempted transitions come and go. He’s spent 25 years trying to budge energy systems using corporate-backed venture investing. “And I was very lonely for the first 20 years,” he says. His firm has $3 billion under management and a portfolio of more than 100 companies, including Form Energy and Electric Hydrogen Co., whose clean fuel is meant to decarbonize difficult industrial sectors such as steelmaking and fertilizer production.

If the US is open for climate-tech business in a much bigger way, that recent shift only underscores the intimidating head start enjoyed by China. After all, China today produces far more solar panels and EVs than any other country, even if the earliest technical innovations and initial government subsidies came from the US and Europe.

China Dominates Clean Energy Supply Chains

Clean energy manufacturing capacity

Clean energy manufacturing capacity

Clean energy manufacturing capacity

Source: BNEF

It would be a mistake to count American startups out, especially with access to the next wave of private and public climate capital. “The US is just really potent in coming up with creative ideas and scaling them fast,” Kobler says. “Probably 80% of the technologies we need for the energy transition are out there today.”

Don’t mistake “out there” for “available at scale.” The International Energy Agency estimates that 60% of the technologies needed for a net-zero pathway aren’t yet commercially viable. But investors are closely parsing the state of play. In fact, a “technology readiness level” tracker developed by IEA researchers for in-house purposes was released publicly in 2020 and has become a staple of pitch decks in the past two years. The uptake of a wonky tool for tracking technologies has become an index unto itself, showing the hunger for information on the climate-tech transition.

China Has a Head Start

Energy transition investment in 2022

Source: BNEF

There’s a snowball effect at work. A critical, soft-power feature of the IRA, for example, is its signal that climate tech isn’t a part of the economy — it is the economy, at the foundation of US economic competitiveness.

“It makes people pay attention,” says Saloni Multani, who is co-head of venture and growth at investment firm Galvanize Climate Solutions and was the chief financial officer for Biden’s 2020 campaign. High-level climate-tech investment makes it easier for people to see and internalize that the world is rapidly changing, throwing off a gazillion opportunities. Personal success will increasingly depend on finding a role in it.

There’s something to be said, too, for lower-level investment in the rickety wires meant to distribute the clean-energy future. “People aren’t that interested in their grid, except when it doesn’t work,” says Nancy Pfund, founder and managing partner of DBL Partners and an early Tesla investor. Maybe the need for a new and improved grid isn’t exciting or shocking. But contrast that with how shocked people are to hear something Pfund routinely shares with audiences: “Your morning cup of coffee is a cup of carbon.”

Ten-year-old Bellwether Coffee, in Berkeley, California, developed and sells an electric coffee roaster that eliminates the use of gas and vents nothing in the process. The company has raised $30 million and includes among its investors SolarCity co-founders (and brothers) Lyndon and Peter Rive.

“People that aren’t into climate, they feel guilty,” Pfund says. Reconsidering coffee as climate tech is “a gateway drug to understanding why carbon is embedded in everything you do and how to change that.”

[ad_2]

Source link