[ad_1]

We hear it often. Companies say, “We’ll step it up to our review starting in 2021.”

That statement indicates when they expect to fund their IPO, or their expectations regarding a future private round. They are saying that they will wait to go public until they charge more than or at least the same price as their last funding round for the IPO. This shows that the company is opposed to declining rounds or declining valuations.

Interestingly, these companies say they can do just that – growing to one’s 2021 estimates is easy and can happen in the near future.

Every time we hear a company make this statement, we always try to do the math (again, we hear it over and over again). In most cases, an IPO valuation at the company’s 2021 price is more than a few years away (assuming it’s ever implemented), and in some cases, we don’t think it will ever happen.

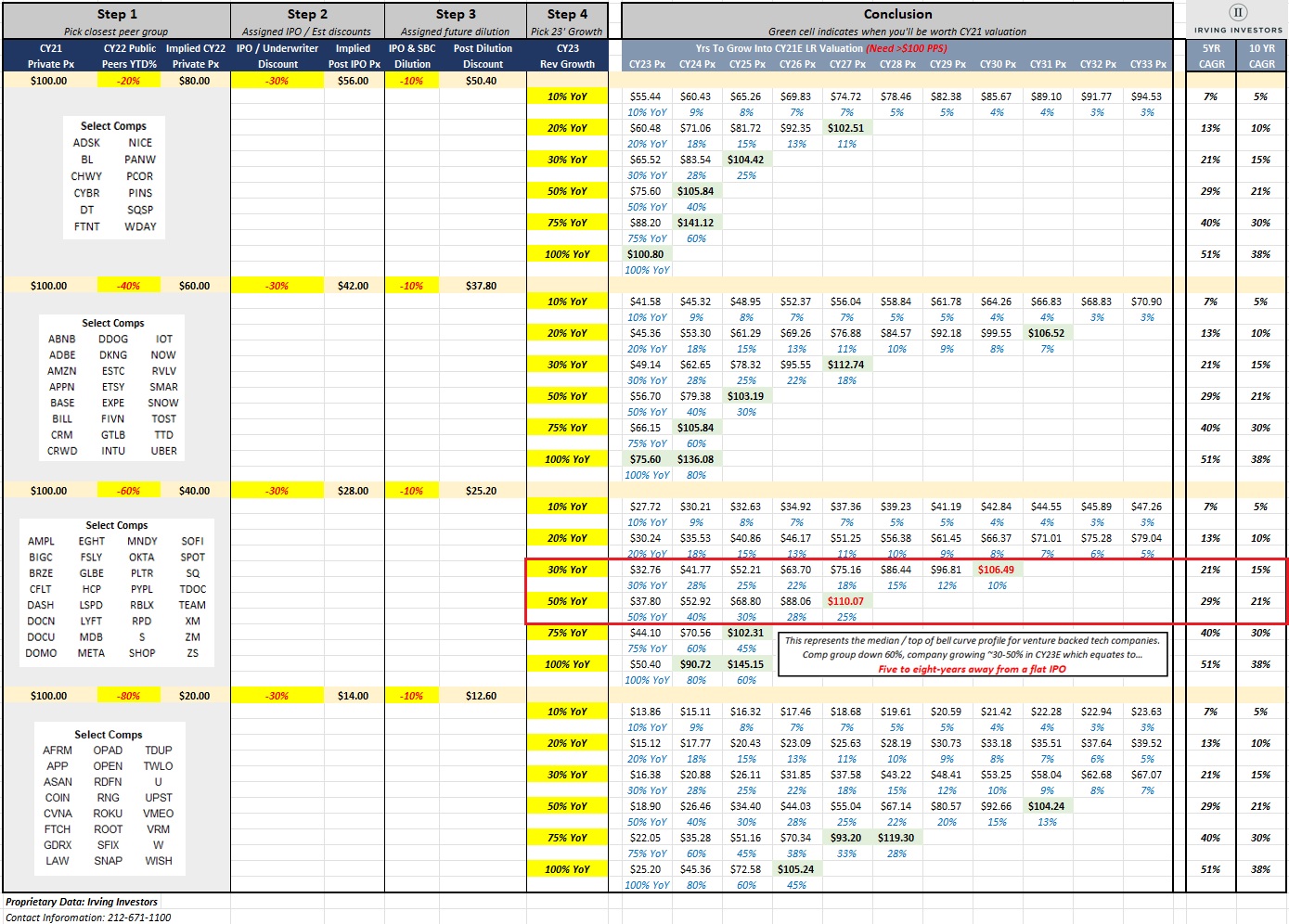

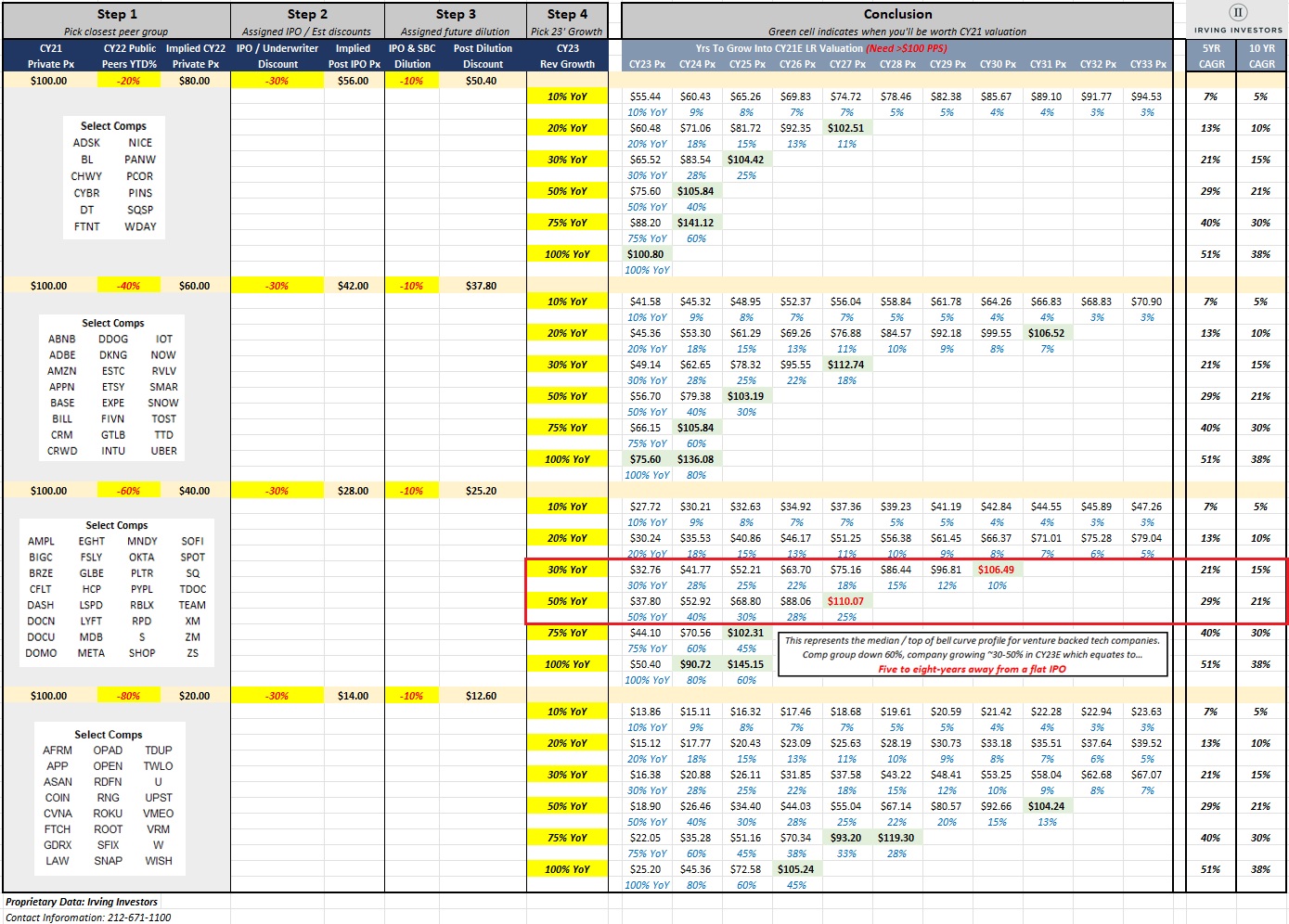

Our quarterly chart calculates how long it takes companies to buy their IPOs so that they match their previous valuations.

Image credits: Irving Investors

Using the table

If you’re growing slower than 30%, there’s a strong chance you’ll never match your 2021 valuation.

The layout of the chart is to give each company the ability to shape itself into a grid using a few parameters. The data tells you how long it will take for a company to reach the price needed for an IPO and compare it to estimates from 2021. The scope of the information is general, but broad enough to be applicable to almost any company.

To use the chart, companies need three resources:

- own public company comparison group (guidance provided below);

- How much that comparable group sold this year / CY2022 (guidance given below).

- Your growth rate forecast.

Step 1

- Start with your last round price (we’ll mark it as “$100.00”).

- Select the comparable group stock performance discount that is closest to your comparable group’s 2022 sales:

[ad_2]

Source link