[ad_1]

Luca, a startup building price planning and forecasting tools for retailers, today announced the closing of a $2.5 million seed round led by Melo Ventures with participation from Y Combinator (Luca was in Y Combinator’s Summer 2023 class), Soma Capital and angel investors.

Luca was founded by Tanvi Surti and Jonah Mann who worked together on Uber’s dynamic pricing team. Mann focused on Uber Eats pricing, while Certi led the UberPool pricing team.

“When I was at Pool Group in 2019, the business had bad unit economics,” Mann told TechCrunch in an email interview. “Uber was on the verge of an IPO, and I was responsible for setting up Uber’s pool pricing algorithm and making the unit economics work. In ten months, we managed to use pricing technology to put a big hole in Uber’s profit and loss. That got us thinking.

Mann describes Luca as a “price co-pilot for corporate retailers.” In plain English, it’s a platform that leverages AI to identify revenue and margin cores, make price adjustment recommendations, and measure results.

“Pricing strategy is one of the most powerful drivers for retailers to drive margin and revenue growth, but most retail pricing teams are often shooting in the dark,” Mann said. “Retail pricing teams must incorporate large amounts of data from multiple channels to build strategy – sales history, market trends, competitor price changes and inventory availability. They must do this across tens of thousands of SKUs and multiple stakeholders.”

The demand – and the huge addressable market – planted the seeds for a series of price revisions and plan launches. One of the most successful providers, Pricefx, has amassed tens of millions with its algorithmic pricing software for software-as-a-service businesses. Feature, which focuses on pricing optimization for the airline industry, recently landed a $12.5 million equity investment.

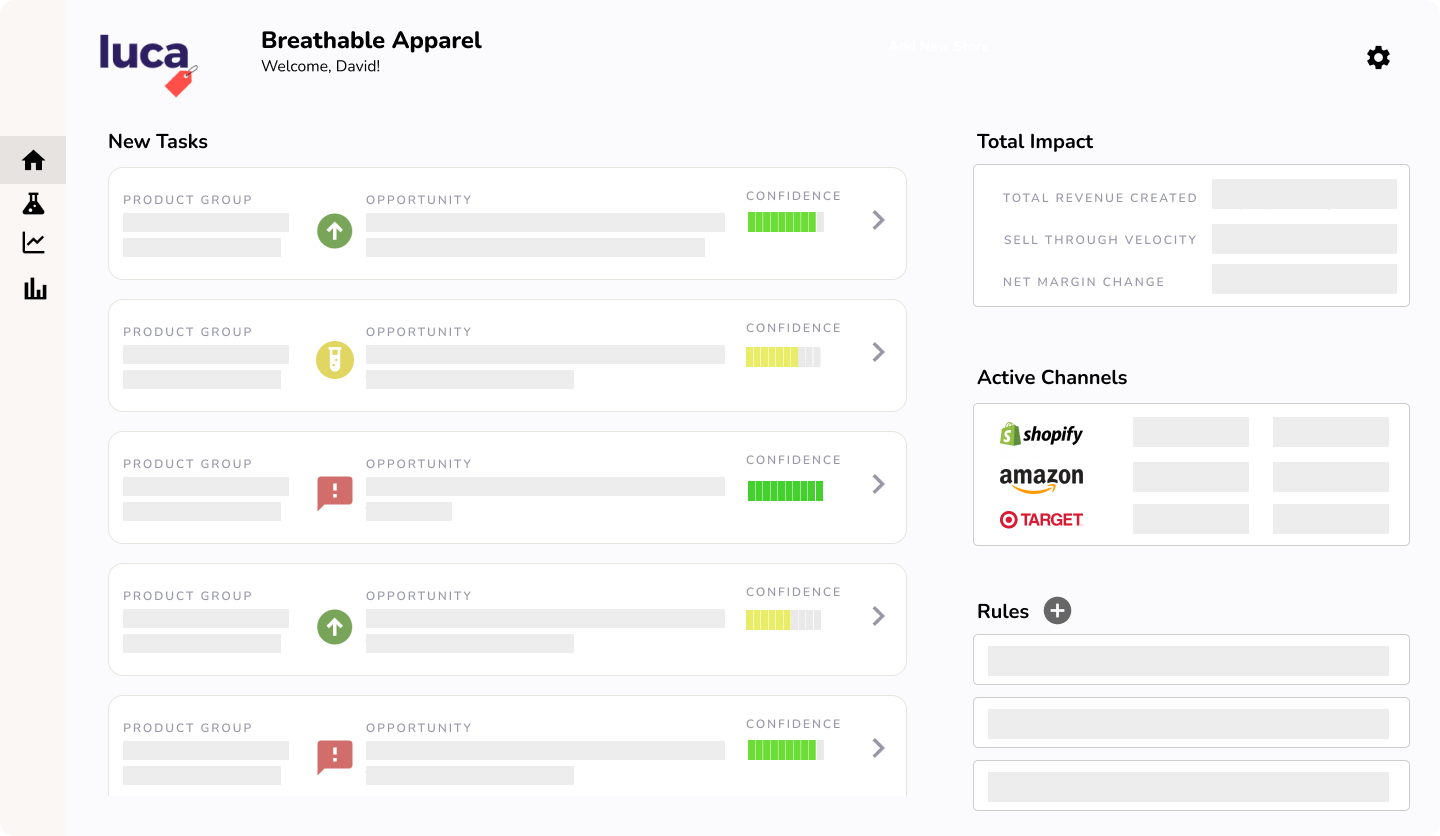

The Lucca platform attempts to optimize retail prices using historical data and other indicators. Image Credits: Luca

Lucca’s difference lies in its pricing engine, which uses retailers’ historical sales and inventory data, as well as competitor brands, to predict the sales performance of products at various price points. Once pricing recommendations are approved, Luca keeps tabs on sales volume, looking for undesirable trends.

“Unlike some players in this space, we’re not a dynamic pricing company. We don’t think that’s the right user experience for retail – who is.” It’s about presenting powerful people.”

It’s early days for Luca in terms of customer acquisition — the startup has only worked with eight brands so far. But who says two of these brands are Fortune 500 retailers?

“After the pandemic, most retailers will feel pressure on growth and margins due to higher customer acquisition costs, lower consumer spending and higher interest rates,” Mann said. “Most retail software-as-a-service tools don’t directly impact business metrics, but the retail executives we interviewed are actively looking for revenue improvement opportunities… That’s where we come in – our solution creates direct and measurable business value.”

He added that the seed money will be used to expand Lucca’s engineering and data science teams.

[ad_2]

Source link