[ad_1]

Justin Sullivan/Getty Images News

Investment thesis

Technology Select Sector SPDR FundNYSEARCA: XLK) has returned more than 470% over the past ten years. While I don’t expect those gains to be repeated in an era of high interest rates, I still believe it will be long-term. Success. Powered by Apple (APL) and Microsoft (MSFT), this total ETF is cash flow positive, and only one stock with a significant weighting has reported a loss in the past year. With 20% expected earnings growth and forward earnings estimates three points lower than QQQ, XLK is my tech ETF pick, and this article compares its fundamentals to twelve peers to show why.

ETF overview and performance

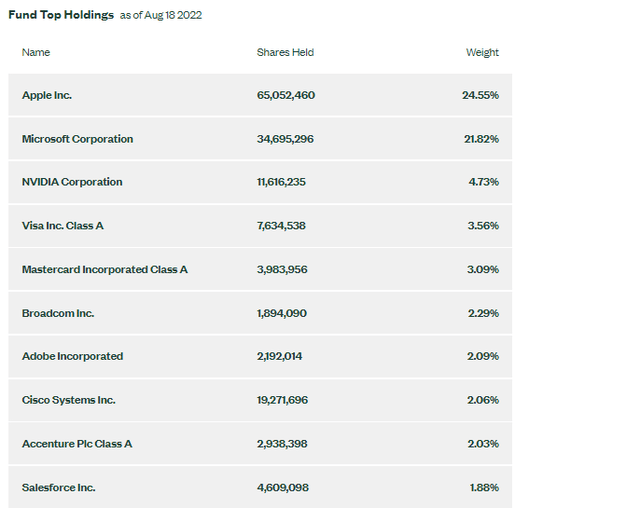

XLK holds 76 tech stocks in the S&P 500 and follows a market-cap weighting scheme. Like all SPDR Sector ETFs, fees are just 0.10%, and XLK currently has $43.32 billion in assets under management. It pays a small quarterly dividend (0.81% yield) that started 23 years ago, and currently has 68.10% of its assets in the top ten, as follows.

State Street

These companies combined for $850 billion in sales, $294 billion in operating cash flow, and $239 billion in net income over the past twelve months. They’ve grown sales by $379 billion (81%) over the past five years, and in the face of higher interest rates, analysts predict another $125 billion increase (15%) over the next twelve months. In short, they are money making machines.

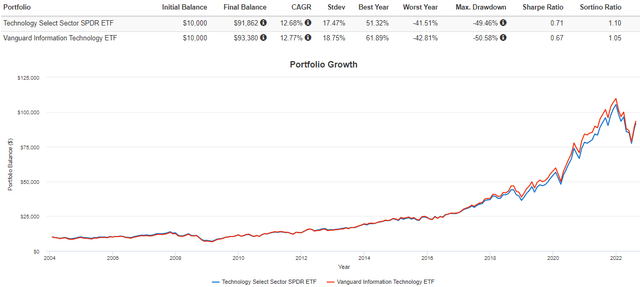

XLK isn’t the only broad-based tech ETF. There are 14 other passives to choose from if you focus on momentum, such as the Invesco DWA Technology Momentum ETF.PTFLike the SPDR NYSE Technology ETF (straight and equally weighted).XNTK). However, when it comes to popularity and low fees, it’s a two-horse race with the Vanguard Information Technology ETF (FBC).VGT). Below is a performance comparison of the two.

Portfolio Visual

Since the launch of VGT in 2004, the two have followed a similar path, with VGT having a slight edge in annual revenues (12.77% versus 12.68%). Still, XLK is the least dangerous, as indicated by the low deviation and better ‘worst year’ and ‘highest decline’ figures. As a result, the risk-adjusted returns (Sharpe and Sortino Ratios) were better. I prefer less speculation when discussing this type of buy-and-hold investment. Since 2004, XLK shareholders have lost money in only four years: 2005 (0.32%), 2008 (41.51%), 2018 (1.66%) and 2022 (12.86%).

XLK analysis

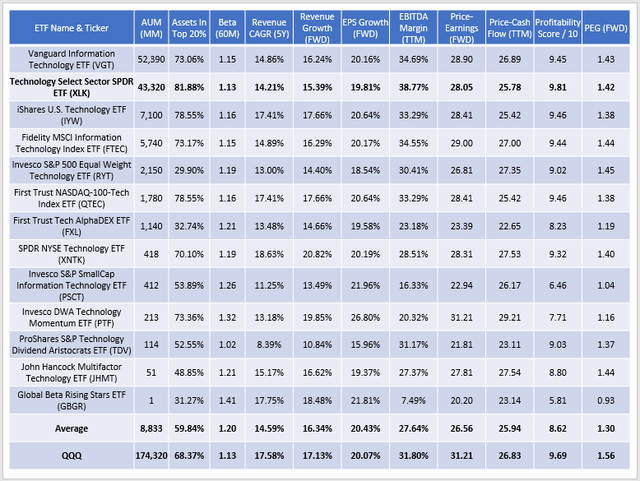

I compile statistics for all the broad-based passive technology ETFs I track. Pay particular attention to key metrics like volatility, growth, valuation and profitability and you’ll quickly see why I rate XLK highly.

Sunday Investor

Overall, XLK has the best profitability score I’ve calculated using adjusted alpha grades on a scale of 1-10: 9.81. A weighted average EBITDA margin of 38.77% supported the result, which was more than 4% higher than the distributed Vanguard Information Technology ETF..

XLK is the second-lowest variable with a five-year beta of 1.13. Other options, including VGT, include small and medium technology stocks that are close but volatile. ProShares S&P Technology Dividend Aristocrats ETFTDV) is the least volatile, but not suitable for growth investors. The estimated sales growth of the components, for example, is only 10.84%, the lowest in the peer group.

On the other hand, XLK’s estimated sales and earnings growth rates are below the peer average of 16.34 percent and 20.43 percent, respectively, and on par with the other two major fundamental ETFs (VGT, FTEC). For growth-at-affordability fans, dividing XLK’s estimated earnings growth rate by its forward price-earnings ratio yields a figure of 1.42. That’s better than VGT (1.43) and FTEC (1.44), and you’re getting better leverage. For Invesco QQQ ETF (outperforms 1.56 figure)QQQ).

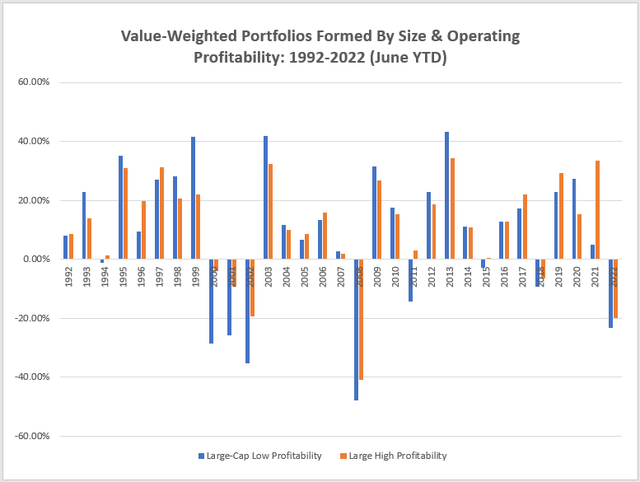

The deciding factor will always be valuation, but that shouldn’t be a significant concern if you plan to buy and own. To illustrate, consider the following two portfolios based on size and operating profitability: Kenneth French Data Library. The blue bars represent large stocks with low profitability, and the orange bars represent large stocks with high profitability. In this 30-year sample from 1992-2022, the high-return portfolio outperformed 18 times, with an average annual return of 2.18% per year over 30 years.

Chart: Sunday Investor; Info: Kenneth French Data Library

There are times when stocks with low profitability will lose, and this often happens after significant underperformance. From 2000-2002, the lowest-yielding portfolio underperformed by a cumulative 36%, only recovering by 13% from 2003-2004. In the year In 2008, they underperformed by 7% but the following year they outperformed by 4.5%.

The reverse is also true. Before the tech crash of the early 2000s, low-yield stocks outperformed by nearly 20 percent. Recently in 2020, they won by 12%, in 2021 they lost 28%: call it mean reversion theory or plain old evidence of market irrationality, but my message is the same. If long-term investors care more about valuation and more about profitability, they will ultimately be rewarded. As far as tech ETFs go, XLK is your best bet.

Investment advice

XLK is the most profitable Tech ETF due to its heavy exposure to megacaps Apple and Microsoft and exclusion of small and midcaps. Over the past 30 years, large-cap high-yield stocks have outperformed by an average of 2.18% per year. In the year For those who fear a repeat of 2008, know that dividend stocks outperformed that year by 7%. In my view, one of the best things you can do to manage risk is to evaluate your portfolio’s profitability.

One reason not to buy the XLK is if you hold Apple and Microsoft in high regard. Also, short-term investors may find low yield stocks attractive now, but as I explain in this article on ARK fintech Innovation ETF (ARKF), I find this argument compelling. Earnings surprises are below their long-term averages, and fundamentals do not support a return to a dire risk-environment. Therefore, I believe XLK is the safest and most valuable Tech ETF in the short and long term, and I look forward to discussing it further in the comments section below.

[ad_2]

Source link