[ad_1]

Where will President Joe Biden and congressional Democrats get the money to extend their massive subsidies for green energy and Obamacare subsidies for the upper middle class?

The simple answer is “hard working taxpayers”.

Taxpayers across the income spectrum should expect to eventually pay for the “depreciation bill” of the left’s deviousness.

But the new taxes will fall heavily on certain industries and parts of the country. The largest tax in the bill, the new “book minimum tax,” would account for $222 billion of the more than half a trillion dollars expected in new tax collections. The book’s low tax rate hits disproportionate yield.

According to the latest government estimate from the Joint Committee on Taxation, manufacturing bears the lowest book tax at 49.7%, even though the economy accounts for only 11%.

Specifically, the nonpartisan committee estimated that 16.1 percent would fall on chemical manufacturers and 6.9 percent on transportation equipment (mostly automobile) manufacturers.

After the committee released these estimates, the Senate amendment to the bill reduced the manufacturing tax share somewhat. However, even using conservative estimates, manufacturing would still bear at least 2.5 times the tax burden as its share of the economy relative to the size of the sector.

Foreign manufacturers would not be subject to the new tax if they did not have significant US operations. Therefore, in order to remain globally competitive, American manufacturers face pressure to reduce labor costs or reduce their American operations. This means fewer jobs and lower wages in US manufacturing.

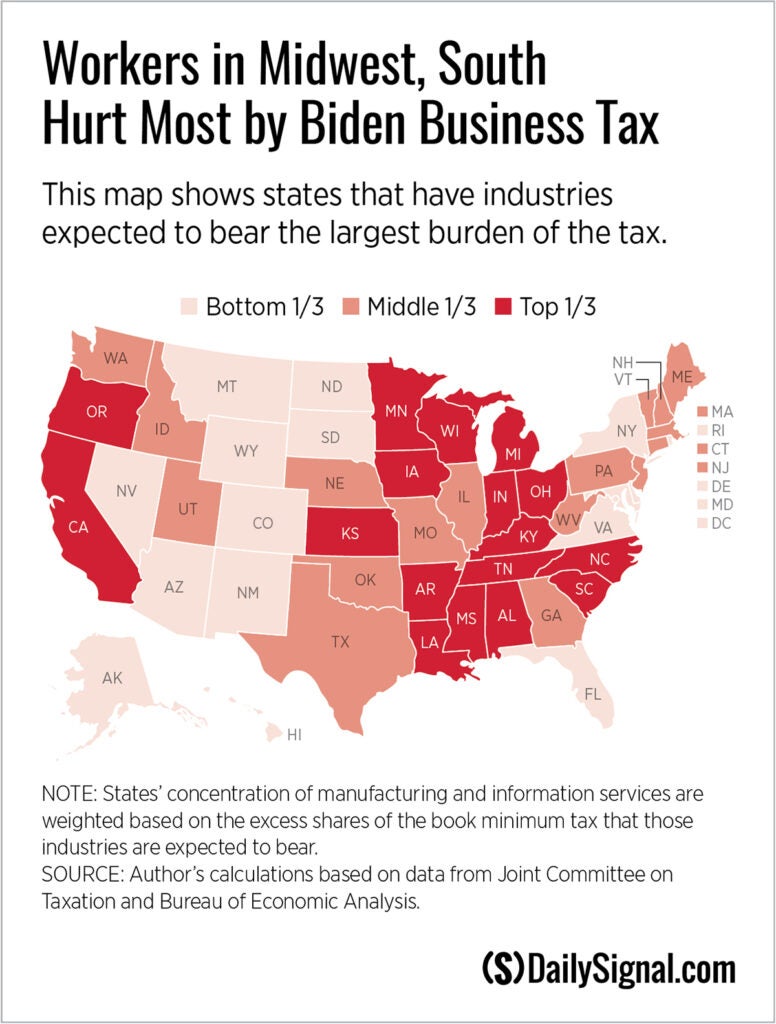

Workers in Indiana, Wisconsin, Michigan, North Carolina and Kentucky will bear the brunt of the economic hit from the new tax because of their states’ large manufacturing bases. Manufacturing accounts for 26.6%, 18.9%, 18%, 17.1% and 17.4% of the economy of these five regions.

Between 2000 and 2010, manufacturing employment in the U.S. fell by 33 percent. Since then, manufacturing’s steep decline has been slightly reversed, but manufacturing jobs are more than 25 percent below 2000 levels.

Indiana, Wisconsin, Michigan, North Carolina and Kentucky have lost more than 1 million manufacturing jobs since 2000. Largely due to large losses in manufacturing jobs, Indiana, Wisconsin and Michigan’s total private sector employment declined by 7.5% during this period.

A new tax won’t help America’s manufacturing states.

The proposed minimum book tax is a parallel tax system imposed on most large companies based on the “book income” of their financial statements.

Business taxpayers must calculate their tax liability not once, but twice. First, based on their regular taxable income and second, based on their financial statement income—and they pay the higher liability of the two.

The minimum book tax will be lower than the federal corporate tax rate (15%), but the minimum book tax does not allow businesses to claim certain business deductions allowed under normal corporate taxes.

Because of the income level, the lower tax disproportionately hits capital-intensive sectors such as manufacturing, where large-scale operations are necessary to achieve economies of scale needed to compete in the global economy.

The difference between financial accounting and regular tax accounting when income is “available” and when deductions are claimed can cause business taxpayers to pay arbitrarily lower book taxes in some years.

As just one example, under the income tax book, companies cannot use net operating losses before 2020. Indeed, there are many reasons why companies experience tax losses in a given year – including anything from high initial costs. Government lockdowns related to the pandemic. And the tax code allows taxpayers to carry forward losses from previous years and offset current taxable profits.

Consider a company whose purchase of expensive factory equipment in 2018 and 2019 included a taxable loss for those years. That company hopes to recoup the cost of the investment with higher profits in the coming years.

The Covid-19 shutdown may have delayed those future profits, and now under Biden’s book low taxes, the company must start paying taxes even if it is at a net loss starting in 2018-2019.

Many manufacturers have expanded investment in 2018 and 2019, particularly by removing barriers to business investment in the federal tax law. The full expensing provisions of the 2017 Tax Cuts and Jobs Act allowed businesses to fully deduct capital expenditures, such as machinery and equipment, when they were purchased and put into service, rather than over two decades.

Or at least these manufacturers thought they could cut those costs entirely.

In Biden’s book, the minimum tax would strip Uncle Sam of a portion of the deduction for capital expenditures by companies with unused net operating losses.

The timing of the new tax is sad. In the year A full phase-out between 2023 and 2027 would only worsen the U.S. tax environment for capital-intensive businesses like manufacturers and conventional energy companies. Rising interest rates and borrowing costs also make it harder for manufacturers and other businesses to invest and grow.

It’s not all bad news for manufacturers though. Although many manufacturers will be hit by new taxes under Biden’s legislation, companies that make solar panels, wind turbines, batteries and components for electric vehicles will receive a windfall of new tax subsidies and vastly expanded federal loan programs under the “Inflation Reduction Act,” the industry’s Washington lobbyists said. And finally, your wallet.

It’s long past time for the federal government to get out of the business of picking winners and losers. In the past two years, success or failure in America has depended heavily on what the government does for you or does to you.

Unfortunately, this latest law is more of the same. Additional government grants for some. More taxes, lost jobs, lower wages and more IRS audits for the rest.

This piece first appeared in The Daily Signal

[ad_2]

Source link