[ad_1]

You’d better do all the things you like / get it through Getty Images

With the departure of the bear market territory, the vast stock market began in July and conditions could be ready for the summer rally, Bofe Securities reported.

S&P (SP500)NYSEARCA: Spy) Passed in the last four sessions, a series that has not been seen since the end of March. Nasdaq 100NASDAQ ፡ Q QQQ) Has increased by 6.5% in the last five days.

In a weekly flow show note, strategist Michael Hartnet indicated that the BofA Bull & Bear indicator was still at 0.0 “Max Bear” as of June 15.

In addition, in Treasuries (TLT) (SHT), the capital is shown, with the market now at 75 depreciation by 2023, DBC (COMT) (USCI). A.D. Since 1973 and BGD (BNDX) since 1931. They are in the process of having a bad year.

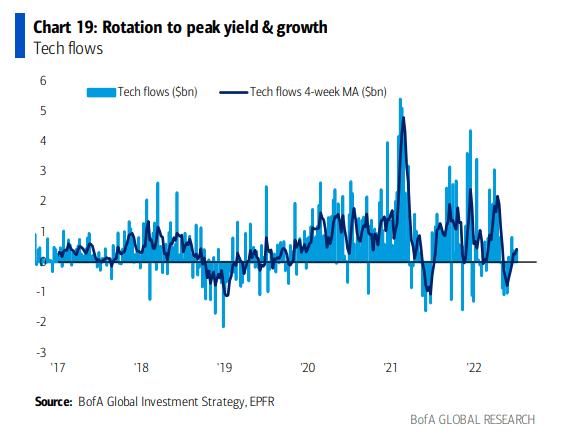

“It’s not surprising that technology lemons have been transformed into lemons in the last 12 months,” Hartnett said.

Technology Storage (NYSEARCA: XLK) The fourth-straight week saw revenue flow at $ 400M.

In preparation for the summer rally, Hartnet is greeting Good Pay Numbers, Nord Stream 1 Online, “Technical Decline” published on July 28, and EPS with “Price Resistance”.

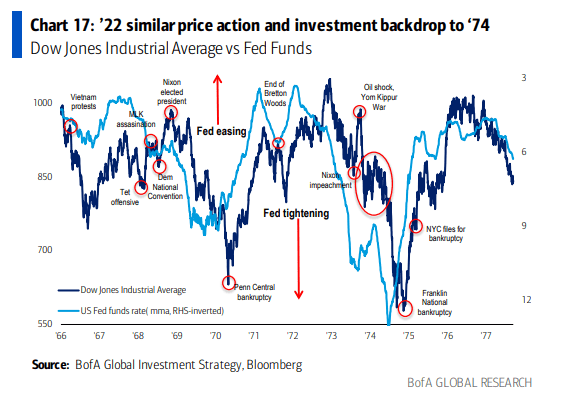

Looking down the line, Hartnet said it had reduced the federation’s credibility in 1975 and started major bull markets with small cap, value and real estate, but in 1965-73 it was not possible to return to the Nifty 50 leadership, and technology remained. A.D. The worst performing sector in the 1970s.

See why Oppenheimer cuts the road-high S&P target.

[ad_2]

Source link