[ad_1]

Earlier this year, a full-page color ad appeared in the press: “Who is Fatih Birol playing for?” he asked, representing the head of the International Energy Agency dressed in football suits.

He announcement, put by climate pressure group Avaaz, highlighted the awkward position of the IEA, a group founded to protect the interests of oil-consuming countries as it begins to plan a world without fossil fuels.

But this week marked a turning point for the world’s most influential energy body, as the IEA released a report on the bombs how to reach zero net emissions in 2050: a movement that followed years of campaigning by investors, climate activists and even their own member countries.

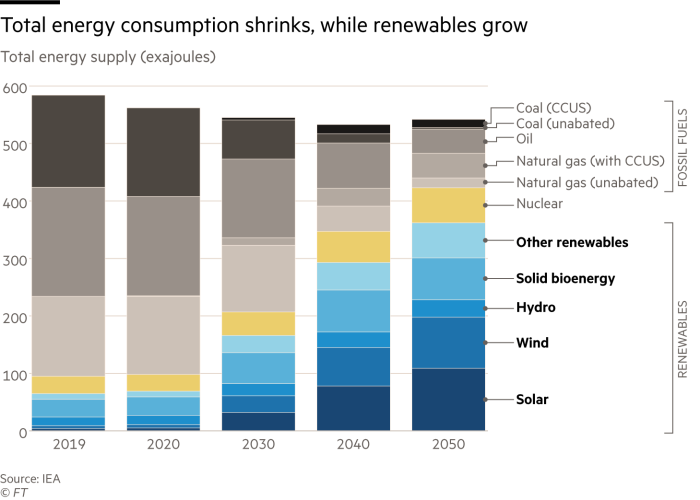

The Paris-based IEA calls for a halt to new oil, gas and coal exploration, but also for an end to the dominance of hydrocarbons. Energy investment is set to increase to $ 5 billion a year by 2030, mostly in clean energy, from the current $ 2 billion, he said.

“Indeed, they take time into the era of fossil fuels,” said Mark Lewis, BNP Paribas Asset Management’s chief sustainability strategist. “It’s like the owner of a pub ringing the bell for the last orders.”

It is a drastic change from the days of the Arab oil embargo and the formation of the group in the early 1970s. His mandate has been to make sure there is enough oil in the event of supply disruptions, such as the first Gulf War, after Hurricane Katrina and during the 2011 Libya crisis.

But just as governments and global companies are under pressure to tackle climate change, the IEA has also had to review itself.

“They have had to change because of how quickly policymakers have decided to do something about global warming and because of the rapidly declining costs of renewables,” Kingsmill Bond told Carbon Tracker. “They had to be reinvented”.

What the IEA says is important. Its forecasts are used by oil companies to shape investment strategies, governments to create energy policies, and stock market investors who want to understand the future.

Fatih Birol, IEA executive director, leads the agency’s response as governments plan for a world less dependent on fossil fuels © NTB Scanpix / AFP via Getty Images

Under Birol, the 63-year-old head of the IEA, the body has promoted energy security beyond oil, to gas and energy, expanded its relations with emerging countries and promoted efficiency. energy and low-carbon technologies.

Still, he has struggled to defend himself from criticism that he was too supportive of fossil fuels.

Birol himself worked on the Opec oil cartel, a revolving door sign between the oil and gas companies and the IEA.

“The industry has used IEA scenarios as a shield to justify its continued investment in oil and gas,” said Andrew Logan, senior director of oil and gas at Ceres, a non-profit organization. “This change is quite important.”

The IEA vehemently denies that it is obliged to speak for the oil and gas industry, saying that its mandate is energy security and, since 2015, to help governments move towards cleaner fuels.

Factions have emerged in the organization that advocate cleaner energies and lower carbon technologies. Investors, climate scientists, environmentalists and governments have also put a lot of pressure on the group.

Bruce Duguid, of the Hermes Investment Management investment group, said: “We went to Paris and met with Fatih in 2019 and argued that this [a net zero road map] it would be useful for both investors and the world. ”

A public letter in 2019 he called on the IEA to develop a clean zero scenario and immediately drew the attention of the leadership. A handful of IEA member countries, including the Netherlands, Germany, and Canada, made similar requests.

“The discussion started to get stronger over the last two years, but this coincided with political realignments: the UK, the EU, the US and others adopted clear net targets,” said Rachel Kyte, dean of the Fletcher School at Tufts University and former UN envoy to clean energy. “The logical consequences of hitting these targets are what you see in this report for the first time.”

The Biden administration in the US has only reinforced the need for change.

“The definition of energy security is changing,” Birol told the Financial Times after the report was released. “We have no goal to please anyone.”

For the IEA, this has meant a constant change of messaging. He went from warning about supply deficiencies and higher investment needs to saying that despite the Paris climate agreement, the status quo would be maintained. “Fossil fuels, particularly natural gas and oil, will continue to be the cornerstone of the global energy system for many decades,” IEA said in 2016.

Now, he not only calls for an end to the prominence of oil and gas, but his report says “the world has a viable path.”

In doing so, however, analysts say the group runs the risk of undermining its mission.

Oil prices rise – crude rose to $ 70 a barrel on Tuesday, the highest in more than a year – and drastic falls in investment in new production amid the coronavirus crisis mean the IEA is now preparing the world for supply shortages, says one investor.

An oil executive warned that the report would consolidate the narratives of rival camps rather than maintain a meaningful and necessary dialogue on changing global consumption patterns.

“Does the IEA really think its scenario is achievable or do they just demonstrate its impracticality?” Said Gordon Ballard, oil and gas industry advisor.

Another investor, who pushed the zero net report and did not want it to be criticized, said: “They show their conclusions in detail, but they are not enough in their calculations to get there.”

One of the results could be normal. Listed oil companies are not required to take further action and major producing countries continue to increase production capacity and market share.

Neil Atkinson, former head of the IEA’s oil markets division from 2016 to January this year, said: “For people outside the agency it seems like they’ve suddenly had religion, but no it’s definitely building a roadmap like this for a while. “

Follow @ftclimate on Instagram

Climate capital

Where climate change meets business, markets and politics. Explore FT coverage here

[ad_2]

Source link