[ad_1]

Tech stocks have been rallying for weeks.

But there are plenty of arguments that we’re in the middle of a bear-market rally and that there’s plenty of volatility ahead, especially for tech stocks that are fast-growing but have performed well as of late in the previous bull market. 2021.

Robert Stimpson, chief investment officer of Oak Associates Funds, argues that a “finance-first approach” for companies with staying power is best for the current environment if there are risks that include rising interest rates and a possible collapse.

Stimpson, who has been with the firm for 21 years and manages the $544 million Red Oak Technology Select Fund ROGSX, said in an interview.

He attributes the group’s approach to selecting large tech stocks to “attractive valuations, high profit margins and the ability or willingness to support and recognize shareholder value.”

That last part could include stock repurchases, which are expected to increase earnings per share, increase dividends, or increase earnings per share.

The fund has a low turnover method, currently holding 26 stocks and a four-star rating, the second highest, from Morningstar.

A company doesn’t necessarily have to pay a dividend to be in the fund’s holdings, Stimpson said, but it does have to “show respect for investors,” which includes a “non-intrusive approach to acquisitions.”

A closer look at the tech-stock rally

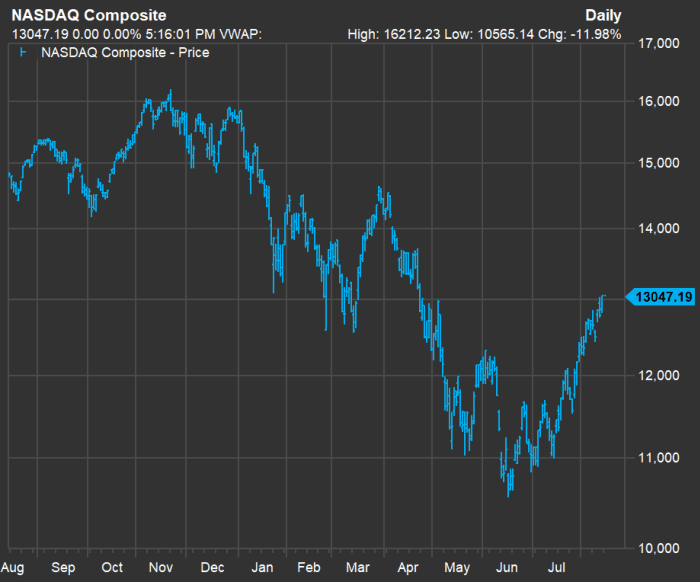

Here is a one-year chart showing the movement of the Nasdaq Composite Index COMP.

:

FactSet

The Nasdaq is up 23% from its June 16 2022 low and is now down 17% for the year. The Nasdaq-100 Index NDX;

– Includes 100 large non-financial stocks in the entire Nasdaq – also down 17% this year. But even after its own 22% rally since June 16, 23 of the Nasdaq-100 are still down between 30% and 59% for 2022.

To be sure, the Red Oak Technology Select Fund hasn’t escaped this year’s broad decline — it’s down 17 percent for 2022.

Despite higher-than-expected inflation for July, the Federal Reserve is expected to stay the course and raise interest rates to slow the economy. Rising interest rates always put pressure on stock prices — even more so for technology stocks. This is because their profits are driven by sales growth or emotional reactions to the possibility of “disruptive innovation” rather than increasing profits, cash flow and capital deployment to benefit shareholders.

“When we were in a zero-interest-rate environment, risk tolerance was very high. Capital was cheap and companies that weren’t expected to be profitable for a while were accepted,” Stimpson said.

Looking ahead, he advises investors to avoid investing in companies that will eventually grow to “high” current prices.

Fund performance

Stimpson is quick to agree that the Red Oak Technology Select Fund’s “high-quality blue-chip approach” to tech stocks underperformed during the last bull market.

Wish we had owned Nvidia for the last 20 years? Absolutely – it was a monster,” he said.

But Nvidia Corp. NVDA,

Tesla Inc. TSLA,

and Netflix Inc. NFLX,

They called them good companies that failed to meet the fund’s criteria, showing “shareholder returns.” Amazon.com Inc. He named it AMZN.

and Apple Inc. AMZN,

Examples of companies.

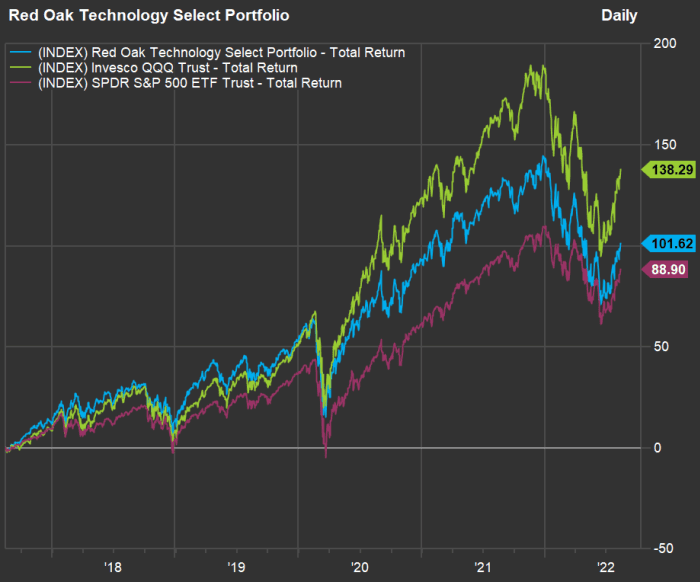

Here is the fund’s total return compared to the Invesco QQQ Trust QQQ:

(which tracks the Nasdaq-100) and the SPDR S&P 500 Trust SPY;

In the last five years:

FactSet

With central bank and fiscal policies doing much to support even the riskiest tech stocks, it’s no surprise that the Red Oak Technology Select Fund follows the QQQ. But the fund beat the S&P 500’s SPX;

Depending on five-year performance and how you feel about the direction of interest rates and the economy, a conservative approach to technology may be right for you.

Stimpson said last year the fund had been reducing holdings linked to consumer electronics, as the management team believed “there has been demand for gaming, housing, etc. during the pandemic.” They also said they “lightened up on semiconductors” and increased holdings in enterprise software companies.

High holdings

Here are the 10 largest holdings of the Red Oak Technology Select Fund as of June 30:

| Company | Ticker | Share of money | First purchased |

|

Alphabet Inc. Section C |

Gog |

7.9% |

March 2014 |

|

Apple Inc. |

AAPL, |

7.2% |

March 2006 |

|

Amazon.com Inc. |

AMZN, |

6.9% |

March 2016 |

|

Microsoft Corporation |

MSFT, |

6.0% |

March 2013 |

|

Cisco Systems Inc. |

Cisco, |

5.5% |

April 1999 |

|

Meta Platforms Inc. Section A |

META, |

4.9% |

March 2016 |

|

KLA Corp. |

KLAC, |

4.7% |

June 2006 |

|

Oracle Corp. |

ORCL, |

4.7% |

September 2013 |

|

Synopses Inc. |

SNPS, |

4.5% |

March 2010 |

|

Intel Corp. |

INTC, |

4.4% |

June 2010 |

|

Source: Morningstar |

|||

The percentage of Alphabet Inc. shares listed above is the Fund’s Company Class C GOOG;

and a division of GOOGL,

Shares.

Don’t miss it. Oil prices are down, but earnings estimates for energy companies are rising – these stocks are cheap.

Hear from Ray Dalio at MarketWatch’s Best New Ideas in Money Festival on September 21 and 22 in New York. The hedge fund pioneer has strong views on where the economy is headed.

[ad_2]

Source link