[ad_1]

This post was originally published on TKer.co

Stocks rallied, with the S&P 500 climbing 2.5% last week. The index is now up 13.8% from its October 12 closing low of 3,577.03 and down 15.1% from its January 3, 2022 closing high of 4,796.56.

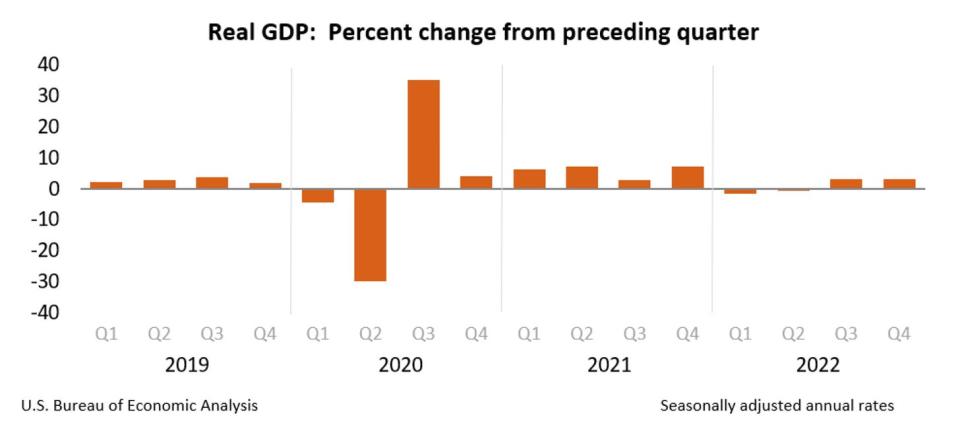

While the U.S. economy has been cooling off for months, the hard economic data shows growth has been pretty resilient. On Thursday, we learned GDP in Q4 rose at a 2.9% rate.

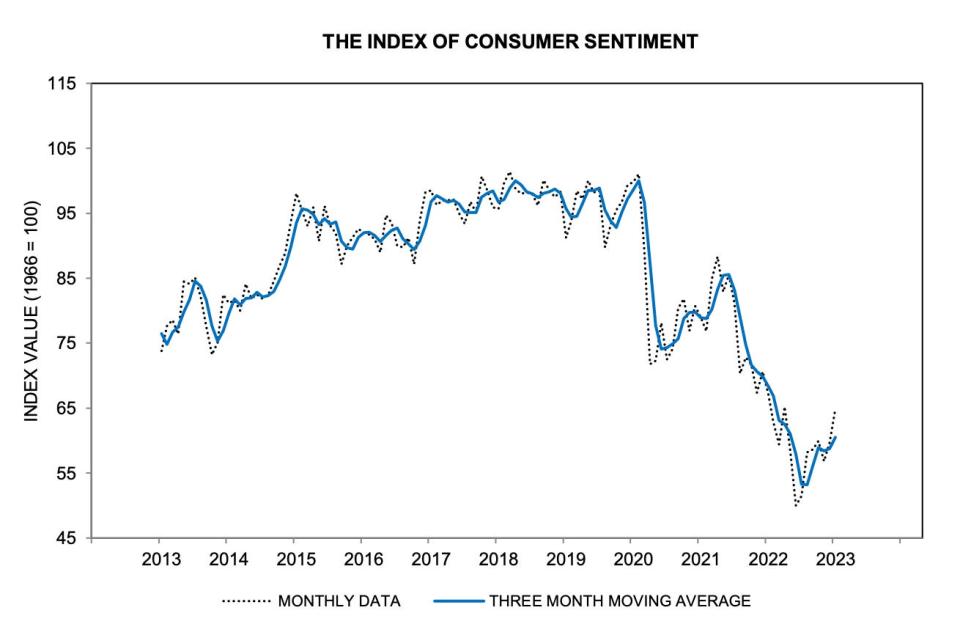

However, if you’ve only been reading sentiment-oriented business surveys (i.e., the soft data), you might think things are in much worse shape than they really are.

The ISM Manufacturing surveys have signaled contraction in November and December. The S&P Global U.S. Composite Output surveys have been signaling contraction since last July. Similarly, regional business surveys from the New York Fed, the Philly Fed, and the Dallas Fed have reflected ugly declines in activity.

This dynamic is not new to TKer’s paid subscribers. See: Perceptions on the economy have disconnected from reality 🔥

Goldman Sachs economists explored this conflict between the hard and soft data in a new research note titled: “Making Sense of Scary Survey Data.”

“While contractionary soft data in January represent a downside risk for Q1 growth, we believe gloomy sentiment is currently distorting the message from business surveys, and we place less weight than usual on this negative growth signal,“ Goldman Sachs’ Spencer Hill wrote in the report published Wednesday.

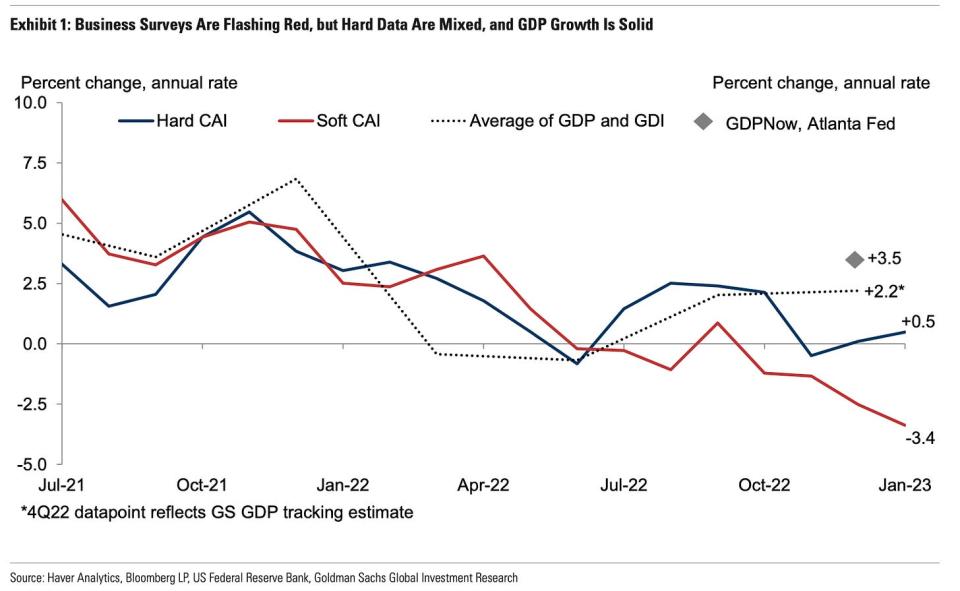

Hill compared the performance of soft data against hard data using Goldman Sachs’ current activity indicators (CAIs) composites.

“Since last June, GDP and other hard indicators of economic activity have consistently outperformed business surveys, with our Hard CAI outperforming our Soft CAI by 2.3pp annualized,“ he observed.

“Survey data do not provide a perfect read on growth, and they are particularly error-prone when business sentiment is euphoric or depressed,” Hill added. “Fears of imminent recession have been top of mind since the middle of last year, and as is visible in the gap between the blue and red lines in the previous exhibit, the economy outperformed the business surveys throughout the last two quarters.“

It gets even more interesting.

Hill dug into the soft survey data and separated objective findings (e.g., if orders are rising) from subjective ones (e.g., if general business conditions have improved).

“Business leaders broadly report deteriorating business conditions, but the breadth of decline reported for actual production, shipments, and employment is more modest — albeit still more negative than during most of the previous economic expansion,“ he found.

Consumers behave no differently. See: What consumers do > what consumers say 🙊 and A bullish contradiction 🛍.

This is not to say we should be totally dismissive of soft survey data. I often include this data in the weekly review of macro crosscurrents.

“The pessimism must be coming from somewhere, and to a certain extent should be self-fulfilling,” Bloomberg’s John Authers wrote regarding the same research note. “So maybe the recession is just behind schedule.”

“Or alternatively, after years of economic weirdness, people in business have lost their nerve and will soon snap out of it,” Authers added. “It would be nice to believe the second.“

The good news is the hard data on business finances and consumer finances look pretty strong. So the economy appears to have the capacity to keep growing.

But if the negative vibes persist, we could face an unfortunate economic downturn where businesses and consumers rein in activity when they don’t have to.

That’s interesting! 💡

From a new NBER worker paper titled “Time Savings When Working From Home“:

… The average daily time savings when working from home is 72 minutes in our sample. We estimate that work from home saved about two hours per week per worker in 2021 and 2022, and that it will save about one hour per week per worker after the pandemic ends. Workers allocate 40 percent of their time savings to their jobs and about 11 percent to caregiving activities. People living with children allocate more of their time savings to caregiving.

Reviewing the macro crosscurrents 🔀

There were a few notable data points from last week to consider:

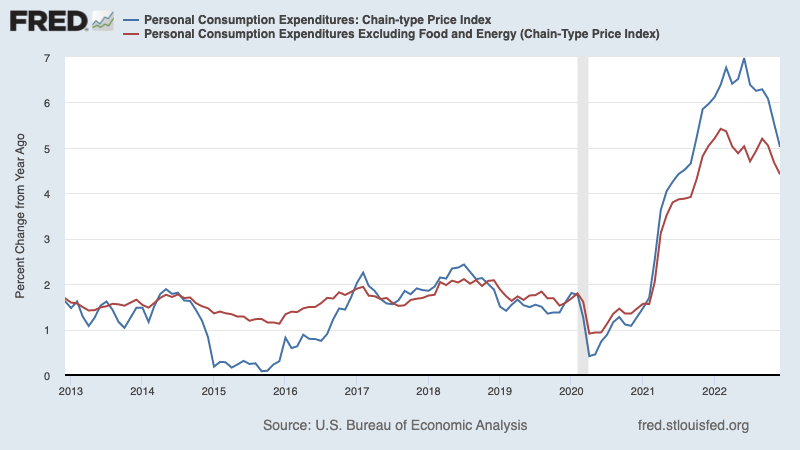

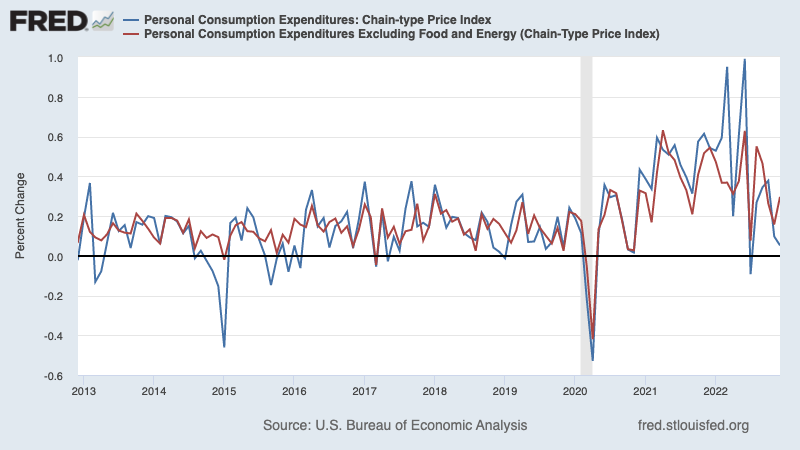

📉 Inflation is cooling. According to BEA data released Friday, the PCE price index in December was up 5.0% from a year ago, down from the 5.5% from in November. Excluding food and energy prices, the core PCE price index — the Fed’s preferred measure of inflation — was up 4.4%, down from 4.7% the month prior. While the improvement is welcome, the metric remains well above the Fed’s 2% target rate.

On a month-over-month basis in December, the PCE price index was up 0.1% and the core PCE price index was up 0.3%. Both metrics are down from their 2022 highs.

For more on inflation cooling, read: The bullish ‘goldilocks’ soft landing scenario that everyone wants 😀.

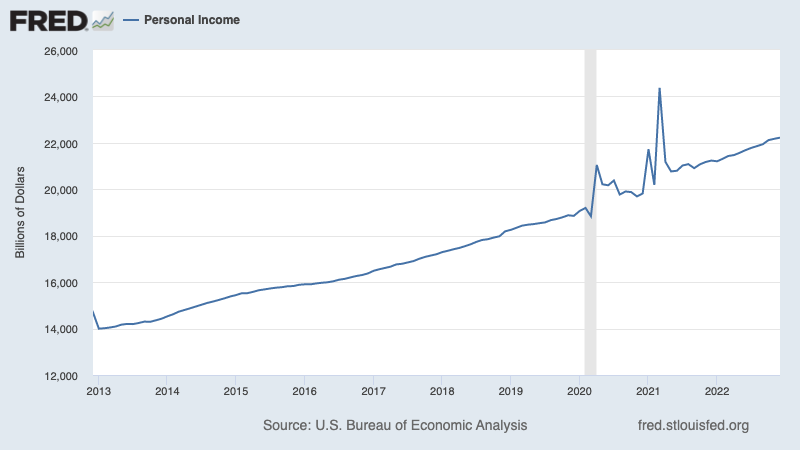

💰 Incomes are up. According to BEA data, personal incomes in December were up 0.2% from the prior month.

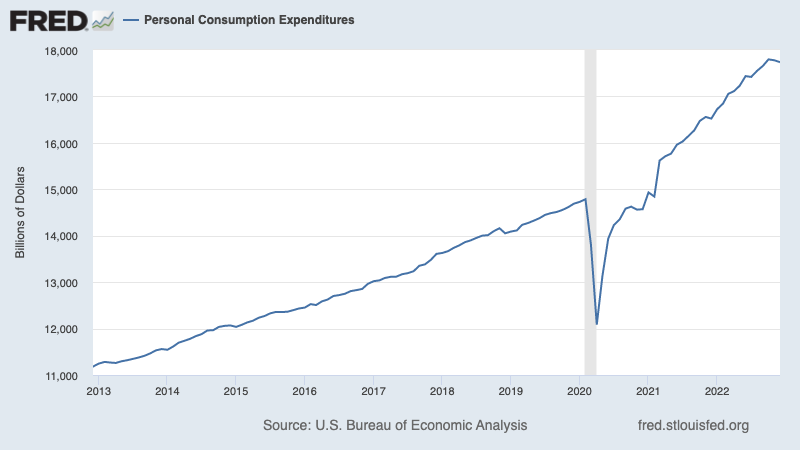

🛍️ Spending is down. According to BEA data, personal consumption expenditures in December declined by 0.2% from the prior month.

👍 Consumer sentiment improves. From the University of Michigan’s January Survey of Consumers: “Consumer sentiment confirmed the preliminary January reading, remaining low from a historical perspective but continuing to lift for the second consecutive month, rising 9% above December and reaching about 3% below a year ago… The current conditions index soared 15% above December, with improving assessments of both personal finances and buying conditions for durables, supported by strong incomes and easing price pressures.”

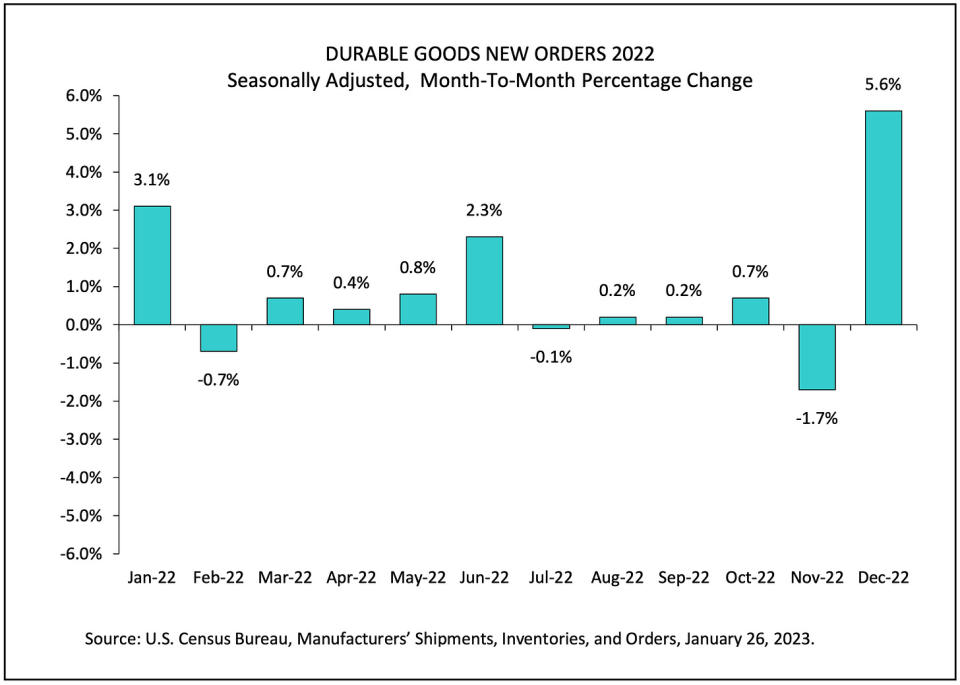

✈️ Durable goods orders climb. Orders for manufactured durable goods jumped 5.6% in December to $286.9 billion, driven by transportation equipment.

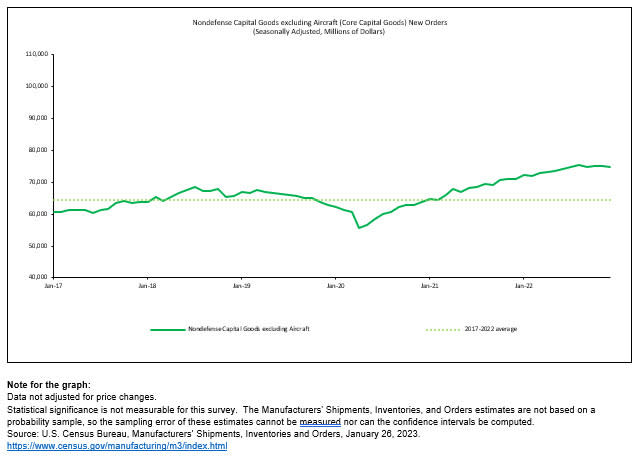

👎 But business investment cools. Orders for nondefense capital goods excluding aircraft — a.k.a. core capex or business investment — declined 0.2% to $74.9 billion. While this metric has declined in three of the last four months, it continues to hover near record levels. For more on core capex, read: 9 reasons to be optimistic about the economy and markets 💪.

👎 Layoffs hit some non-tech companies. On Monday, Newell Rubbermaid announced the “elimination of approximately 13% of office positions.“ On Tuesday, 3M announced it would “reduce approximately 2,500 global manufacturing roles.“ On Thursday morning, Dow Inc. announced “a global workforce reduction of approximately 2,000 roles.” On Thursday evening, Hasbro announced “the elimination of approximately 1,000 positions from its global workforce this year, or approximately 15% of global full-time employees.“ For more on this, read Making sense of conflicting news on the labor market 🤔.

👍 But non-tech companies are also hiring. On Wednesday, United announced it planned to “hire more than 2,500 pilots in 2023.“ On Thursday, Chipotle announced it “seeks to fill 15,000 jobs.” On Friday, Boeing announced it aimed to hire 10,000. I’ve started an informal thread on Twitter tracking anecdotes of companies hiring (Link). As always, Mind the anecdata 🤏 and Beware alarming business stories that get a lot of news coverage 🗞️.

Subscribed

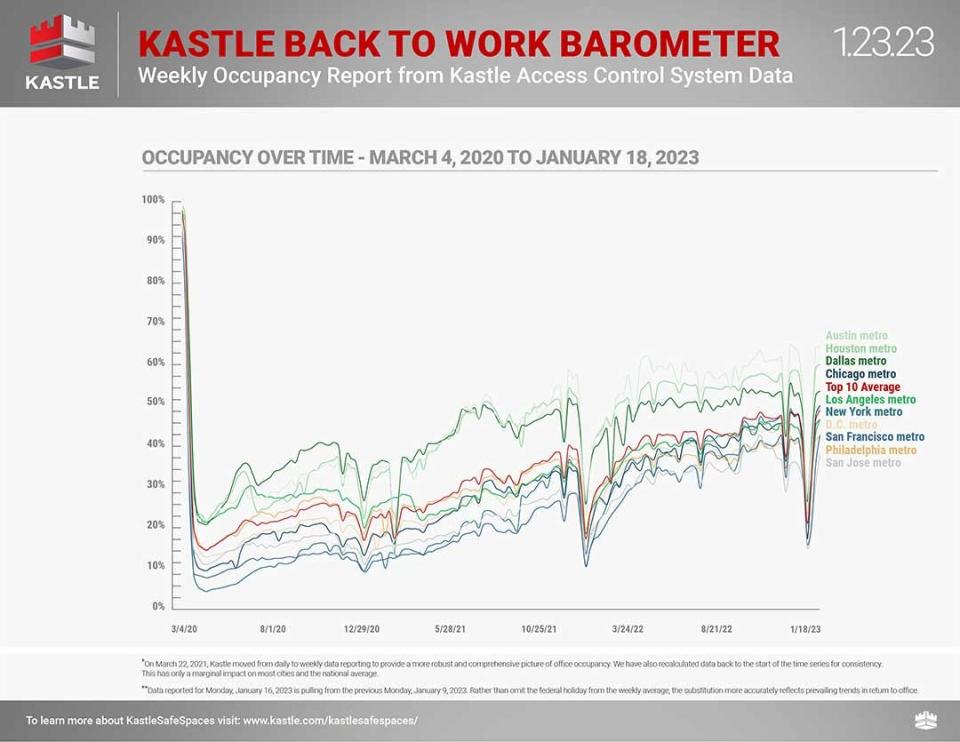

🏢 Workers are returning to the office. From Kastle Systems: “Occupancy hit a new pandemic record high last week, as workers continue to return to the office after the holidays. The 10-city Back to Work Barometer reached 49.5% occupancy, exceeding last year’s high of 49.0%. The highest day of the week for the 10-city average was Wednesday at 58.1% occupancy, and the low was Friday at 33.4%.“

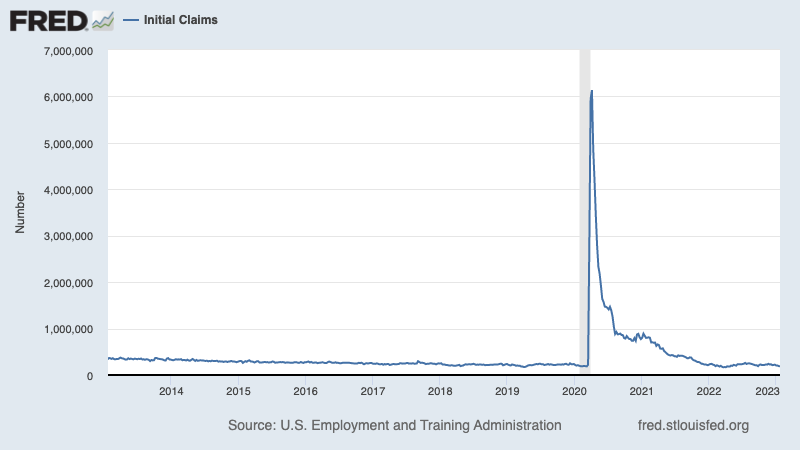

💼 Unemployment claims remain low. Initial claims for unemployment benefits fell to a nine-month low of 186,000 during the week ending Jan. 21, down from 192,000 the week prior. While the number is up from its six-decade low of 166,000 in March, it remains near levels seen during periods of economic expansion. For more on low unemployment, read: 9 reasons to be optimistic about the economy and markets 💪.

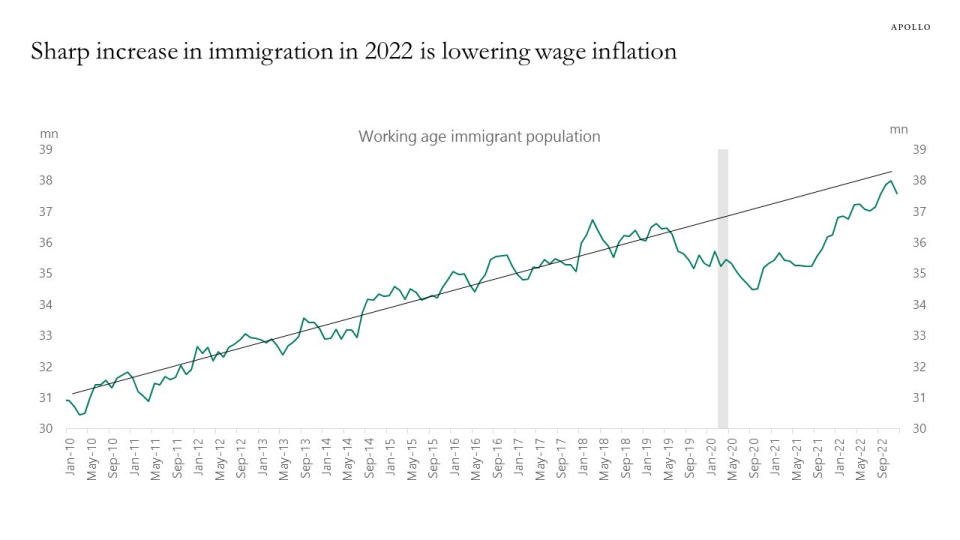

🇺🇸 Immigration is rebounding. From Apollo’s Torsten Slok: “Immigration declined during Covid, contributing to significant labor shortages and high wage inflation across many industries. But over the past 12 months, immigration has increased significantly, and the working age immigrant population is returning to its pre-pandemic trend, see chart below. This ongoing increase in immigration is the reason why wage inflation continues to come down from the significantly elevated levels we saw during the pandemic. This is good news for the Fed and markets because a less overheated labor market will accelerate inflation’s return to the Fed’s 2% target.“

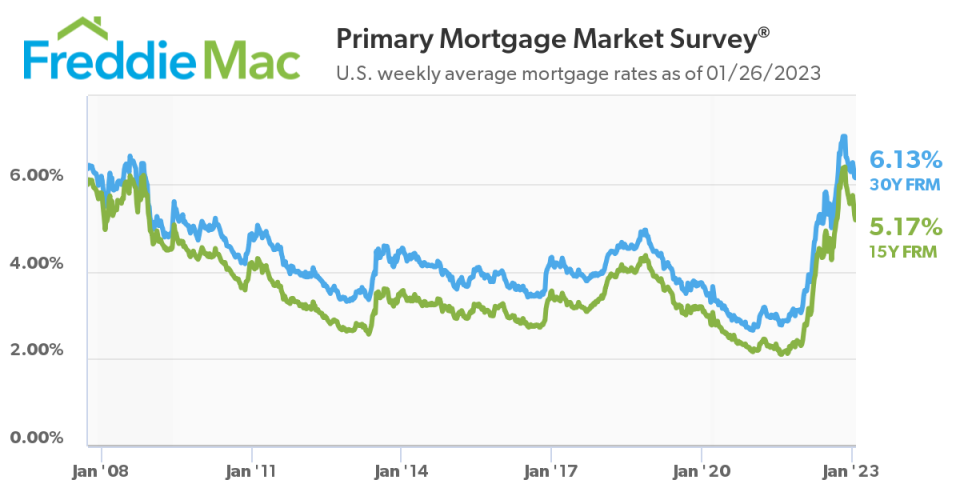

📉 Mortgage rates tick down. From Freddie Mac: “Mortgage rates continue to tick down and, as a result, home purchase demand is thawing from the months-long freeze that gripped the housing market. Potential homebuyers remain sensitive to changes in mortgage rates, but ample demand remains, fueled by first-time homebuyers.“

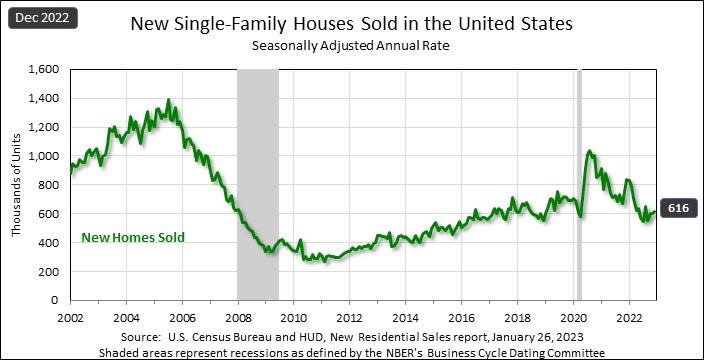

🏘️ New home sales tick up. Sales of newly built homes climbed 2.3% to an annualized rate of 616,000 units.

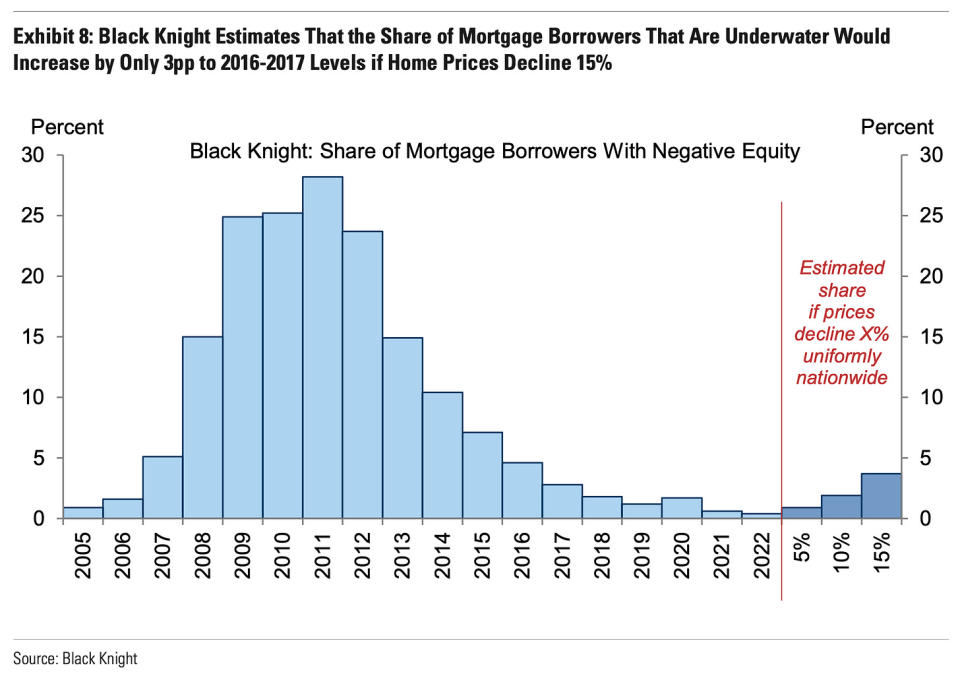

🏡 Few mortgage borrowers with negative equity. From Goldman Sachs: “Black Knight estimates that if prices uniformly declined 10-15% nationally, only 2-4% of mortgage borrowers would have negative equity, which is similar to levels seen in the latter half of the last expansion and well below the almost 30% seen in 2011.“

🇺🇸 GDP grew last year. According to the Bureau of Economic Analysis, GDP grew at a 2.9% annualized rate in Q4. For all of 2022, GDP was up 2.1%.

🇺🇸 A handful of states are contracting. From the Philly Fed’s State Coincident Indexes

3

report: “Over the past three months, the indexes increased in 30 states, decreased in 14 states, and remained stable in six, for a three-month diffusion index of 32. Additionally, in the past month, the indexes increased in 33 states, decreased in 11 states, and remained stable in six, for a one-month diffusion index of 44.”

Putting it all together 🤔

We’re getting a lot of evidence that we may get the bullish “Goldilocks” soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

But for now, inflation still has to come down more before the Federal Reserve is comfortable with price levels. So we should expect the central bank to continue to tighten monetary policy, which means tighter financial conditions (e.g. higher interest rates, tighter lending standards, and lower stock valuations). All of this means the market beatings are likely to continue and the risk the economy sinks into a recession will intensify.

However, we could soon see the Fed adopt a less hawkish tone if we continue to get evidence that inflation is easing.

It’s important to remember that while recession risks are elevated, consumers are coming from a very strong financial position. Unemployed people are getting jobs. Those with jobs are getting raises. And many still have excess savings to tap into. Indeed, strong spending data confirms this financial resilience. So it’s too early to sound the alarm from a consumption perspective.

At this point, any downturn is unlikely to turn into economic calamity given that the financial health of consumers and businesses remains very strong.

As always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have had a terrible year, the long-run outlook for stocks remains positive.

For more on how the macro story is evolving, check out the previous TKer macro crosscurrents »

For more on why this is an unusually unfavorable environment for the stock market, read: The market beatings will continue until inflation improves 🥊 »

For a closer look at where we are and how we got here, read: The complicated mess of the markets and economy, explained 🧩 »

This post was originally published on TKer.co

Sam Ro is the founder of TKer.co. Follow him on Twitter at @SamRo

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube

[ad_2]

Source link