[ad_1]

Vaccitech, the company that owns the technology behind the Oxford / AstraZeneca coronavirus vaccine, raised $ 111 million through its initial public offering on Thursday, close to its original expectations, and demonstrated that investors were willing to examine recent concerns about the rare side effects of the spike.

The company set a share price of $ 17 ahead of its listing on the Nasdaq, the midpoint of its projected price range. At bid price, Vaccitech would be valued at $ 579 million, 36% above the price set by its latest private fundraiser In March.

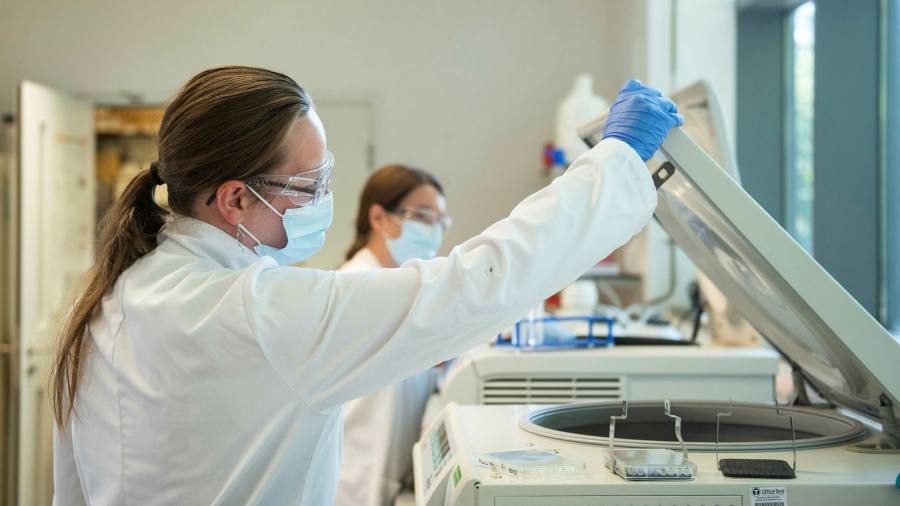

Vaccitech was co-founded by Oxford University scientists Sarah Gilbert and Adrian Hill in 2016 and has been supported by private investors, including Tencent, Google Ventures and California biotechnology Gilead Sciences.

The company owns the technology used to create the AstraZeneca vaccine and will receive 1.4% of net revenue if the vaccine is sold for profit after the pandemic. Work is also underway on another Covid-19 vaccine that could be used as a booster for people who received AstraZeneca shot.

The rapid expansion of the AstraZeneca vaccine has helped demonstrate the company’s adenovirus-based platform and has generated data on its use in millions of people. Vaccitech is developing technology for other vaccines, for diseases such as Mers coronavirus and shingles.

Vaccitech is also working on creating drugs for diseases such as human papilloma virus, chronic hepatitis and prostate cancer.

Shares of listed vaccine makers have risen during the pandemic. Novavax has increased by more than 1,300%, while Moderna and BioNTech have increased by approximately 380% in the last twelve months.

This has attracted several connected companies Covid-19 vaccine development to take advantage of public procurement. CureVac shares rose 249% on the first trading day in August. Valneva, a French-listed vaccine maker, also filed for a public IPO recently in the United States.

However, some investors have been cautious in the face of high valuations in the biotechnology sector. Nasdaq’s biotechnology index falls more than 10% from February high, after gaining more than 25% in 2020. Short sellers have also poured into the sector, with Novavax and Moderna among the 10 most deficient biotechnology companies, according to S3 data.

Coronavirus business update

How does coronavirus affect markets, businesses, and our daily lives and jobs? Stay informed with our coronavirus newsletter.

Vaccitech is made public after a period of intense exploration of the Oxford / AstraZeneca vaccine, culminating in concern over a very rare side effect of blood clotting. The company warned in its IPO that this could affect copyright and affect the reputation of its products.

Susannah Streeter, senior analyst at Hargreaves Lansdown, said the speed of vaccine innovation had been “impressive” and Vaccitech is one of the companies leading the charge.

“The crisis has shown that Vaccitech can effectively expand a successful project, which is quite unusual for a biotech start-up, which often launches into a stock market without such a proven track record,” he said.

Morgan Stanley, Jefferies, Barclays and William Blair led the bid.

[ad_2]

Source link