[ad_1]

In normal times, car values are one-way.

The very act of leaving the dealership cleans up a piece of cash from the value of a vehicle, starting an unstoppable slide that will last until a decade later, when they will cease to be useless scrap.

Not anymore.

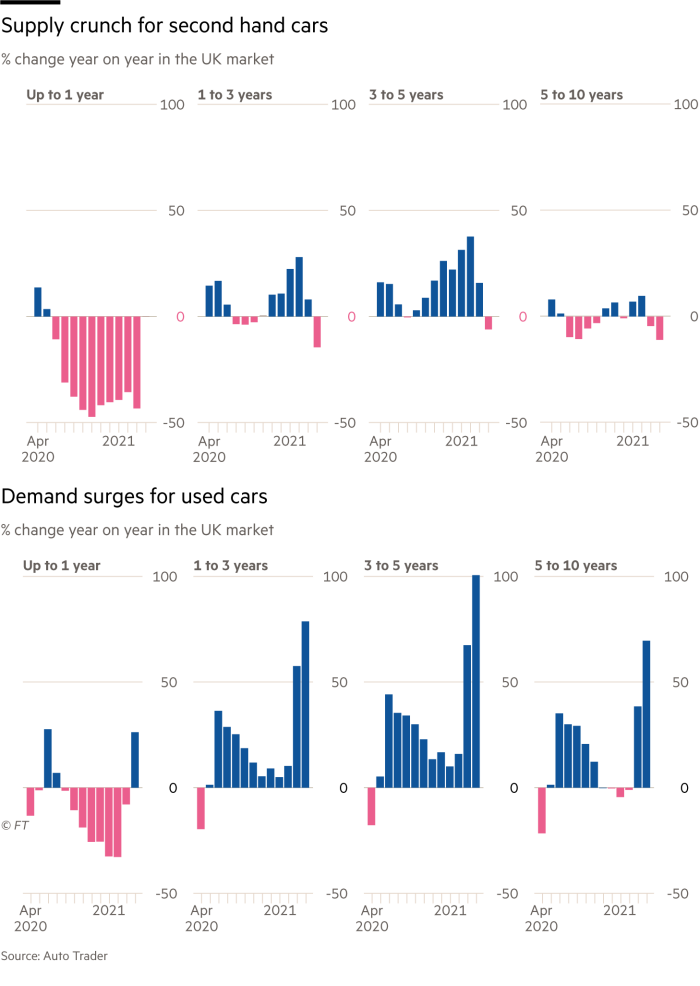

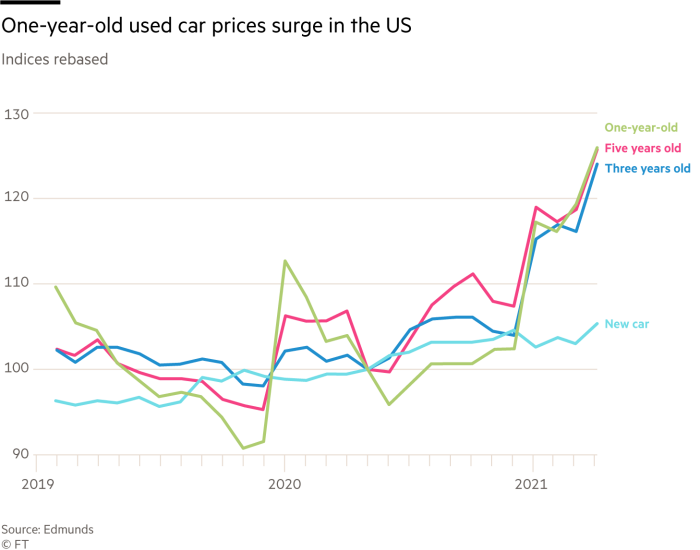

In the months most affected since the pandemic, used car prices have risen steadily, caused by an imbalance in supply and demand due to the coronavirus crisis and chip shortages.

Prior to this year, the largest increase ever recorded was 1% in February 2018. In May, they increased by 6.7%, according to data group Cap Hpi, which has tracked prices in lives since 2012.

“Cars usually depreciate, they don’t increase in value,” said Derren Martin, head of valuations for the data group. “But right now cars are an investment.”

The rise in prices is being felt in all courts in the UK, Germany and the US, with fears that it could add to inflationary pressures in other parts of the economy.

In Germany, used car prices hit an all-time high in April, according to AutoScout24, a leading sales site. The average price during this month was € 22,424, more than € 800 more than at the beginning of 2021.

In April 2020, the average price was € 20,858, having risen by around € 200 in one year.

“In the past, due to the season, the price curve would usually go down a bit in the early spring and summer months,” said the company, which has about 2 million cars in place.

The reason for the change in situation is “likely to be a predominantly scarce supply,” he added, “but the growing popularity of luxury cars and classic cars also causes average prices to rise relatively sharply.”

In the UK, a one-year Audi A3 is now worth £ 1,300 more than the equivalent model a year ago, up 7%, while Mazda MX5 sports cars have risen 50%.

“I’ve been doing this for 28 years and I’ve only seen this happen twice,” said Daksh Gupta, executive director of British retailer Marshall Motors.

The other time was after the financial crash of 2008, when prices rose in 2009, as demand recovered faster than the industry could sustain.

This time, there are two main factors at play.

Demand for vehicles has risen since late last year as money-saving consumers working from home and canceling foreign holidays splashed.

Sports cars and convertibles have had a particularly strong pace, but there have been climbs in all categories, and many motorists are still willing to avoid public transportation.

A survey in Germany of Deutsche Automobil Treuhand, which collects data on behalf of industry bodies, found that a third of used vehicle buyers bought a second vehicle to help other users in their home avoid public transport.

“This is the highest level of used car demand I’ve ever seen,” said Robert Forrester, CEO of Vertu Motors.

Visits to Auto Trader have increased as consumers search for used cars © Angus Mordant / Bloomberg

Visits to Auto Trader, an online car market specializing in used models, are 39% higher than in 2019 before the success of the pandemic.

“Everyone thought the accumulated demand would go away, but it has held up,” said Ian Plummer, commercial director of Auto Trader.

But the real slimming comes from supply.

The chip shortage caused by the pandemic has been exacerbated by storms in Texas and a fire at a Renesas plant in Japan, one of the world’s leading semiconductor manufacturers.

This has left the industry with millions of short vehicles, with little hope of regaining lost volumes until next year.

At the same time, stocks are low, as few motorists market new models and rental vehicle groups do not unload engines.

Dealers also make more money.

“If they have enough cars, dealers are in for a sweet spot right now,” said Mark Lavery, Cambria’s chief executive. “Demand is nonsense.”

But eventually the supply of new cars will end.

“Buyers of new cars can understand a vehicle one to two years old, but any older and make fun of it,” said Ivan Drury, head of used vehicles at U.S. data group Edmunds.

The imbalance between supply and demand will also get worse before it improves. Only the chip crisis and the return to normal production levels will be resolved.

“When does this end?” said Auto Trader’s Plummer. “It all depends on the balance of supply and demand and the time we keep as interested in cars as now. Of course it’s been months, but whether it’s years or not, we still don’t know. “

[ad_2]

Source link